Technical market analysis from cryptobroker AMarkets, Insider.pro partner

Bitcoin

As resulted trading session Tuesday, Bitcoin (Bitcoin) succeeded in the peg above $8215. As there was no correction below this bar we continue to work with the previously opened purchase order.

The technical picture is kind to byers once again. MACD climbed to positive territory and the Alligator waves turned up, indicating bullish maintenance. An additional point is that bitcoin could overcome bottom-up sliding averages EMA50 and EMA25. The long-term sliding average EMA200 ($8830) remains the last serious barrier. If this line falls we will increase the purchase from the level of $8900.

Dash

Dash (DASH/USD) reacts to market conducts much harder than other altcoins. A day ago the rates of DSH/USD decline got ahead of similar BTC/USD correction. Today it is leading in growth. The buyers obviously took the lead after the peg of $360. By 11:00 (Moscow time) Dash claimed to take a peg of$415. There are no obstacles for further boost.

As the bulls managed to get over the asset above the long-term sliding average EMA200 it is time to think of increasing the working volumes. We recommend buying more due to the break of EMA200. It is possible by placing a Buy Limit at the level of $390.

Ethereum

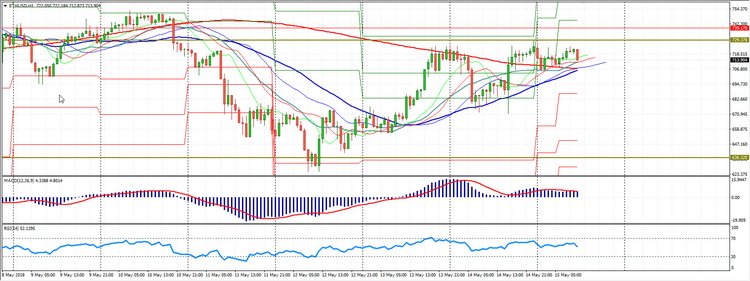

Ethereum (ETH/USD) is also developing bullish dynamics. As in case of Dash the technical picture has strongly changed by completely removing all the hints at possible correction. Since the ETH/USD quotes have recovered up to $715, all opened long orders are benefit.

Further struggle is likely to turn at the level of $730. A large number of sales orders are gathered here. We hope that the initiative will stay behind the buyers. If this resistance falls the growth impact may be enough for movement above $750. We will fix the profit closer to $800.