You think you are young. You think you’ve got plenty of time to save for your retirement. But is it really so? Many studies show that millennials (also known as Generation Y, people born in the period of early 1980s and early 2000) are less active than their parents in terms of savings and finances in general. Born into an era of computerization and digitalization, millennials’ mindset differs from the older generations’ greatly.

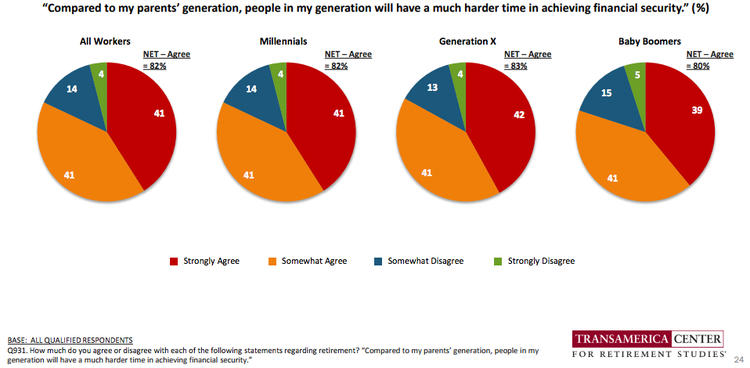

In a 2016 report about Perspectives on Retirement: Baby Boomers, Generation X, and Millennials conducted by Transamerica Center for Retirement Studies it shows that the majority of millennials agree that they will have a much harder time in achieving financial security than their parents.

Forbes suggests that the representatives of Generation Y make five major mistakes when dealing with their money. Unfortunately many millennials don’t always know if what they are doing is right and if others at the same age do the same. Forbes refers to this phenomenon as FOMO- Fear of Missing Out or simply a peer pressure.

According to the Generation Research report by Financial Finesse, Millennials need help in two main areas:

Maintaining and strengthening their money management skills to avoid the same fate as Generation X. Fortunately, they will have access to technologies and financial wellness programs that the previous generations didn’t have.

Giving greater priority to the importance of longer term goals like retirement planning and investing. Once they do so, they’re likely to take advantage of a host of technologies like retirement calculators and robo-advisors that can help them just as they do with their credit.

Mistakes young people do according to Forbes:

Prioritizing paying student loans over saving for retirement

Yes, we all agree that student loans is a serious thing, but If your interest rates are 6% or less, you are still likely better off investing that money aggressively for the long-term rather than paying off your loans earlier. Even just eking out $50 per paycheck to save for retirement can make a six-figure difference in your ending balance down the road.

Investing too conservatively

Millennials are less likely to have general investment knowledge compared to older generations. That’s mostly due to the fact that they witnessed the largest market meltdown in decades during their formative years, perhaps even watching parents lose jobs and wealth due to the declining market and economy.

Turning to credit cards to afford luxuries

It comes down to prioritizing. If you’re unable to pay cash for your manicure or grocery delivery order, you need to find an alternate solution like doing your own nails or taking yourself to the store to bargain shop for your food. Decide which of these things you really want in your life right now and which can wait until later when you’ve paid off some debt and grown your income a bit.

Living in a fancy place with no financial foundation

Of course it is hard to argue against getting a comfortable personal apartment, but jumping straight to the nicest or most expensive community in town is definitely a mistake. When looking for a place to live, decide which things you can and can’t live without in order to meet other financial goals in the meantime. If housing costs are eating up more than 50% of your income, it’s too expensive. Build up your emergency fund before you choose housing that may be a financial stretch for you.

Feeling bad about delaying “adulting”

Statistics show that Millennials in general are delaying some of the more typical milestones associated with “adulting,” such as marriage, having kids or purchasing a first home. The antidote to this extends far beyond your personal finances, but as it relates to your money and avoiding making doozie mistakes, here is an offer: when making financial decisions for yourself, from something as small as buying that Starbucks on the way to work to as big as booking a trip to the other side of the world, stop and ask yourself if you would be making this choice if you couldn’t share it on social media.

Let’s now look at the more practical side and see how a millennial can ensure his or her proper retirement.

CNN Money suggests the following steps to make your-future-self rich.

Max out employer matches

Most employers who offer a 401(k) plan will match at least some of your contributions. In other words, they'll contribute free money into your retirement account if you make contributions of your own. Different employers offer different levels of matching; check with your HR representative to find out what your own company offers.

Consider a Roth account

Traditional 401(k)s and IRAs allow you to contribute money tax-free. With a 401(k), the contributions come out of your paycheck before they're taxed, and with an IRA, you get to deduct your contributions, which means you don't have to pay taxes on that amount. However, you do have to pay taxes when you eventually withdraw the money to pay for expenses in retirement.

Choose volatile investments

When it comes to investing, high risk and high returns usually go hand in hand. Riskier, more volatile investments -- those that tend to bounce up and down in value -- will generally earn greater profits over the long haul than investments that slowly but steadily gain in value.

If you've wisely begun investing well before you will need the money, you can take advantage of this rule by investing in more volatile assets and getting a higher return on your money.

Make a plan

You need to figure out how much money you'll need to have saved by the time you retire. There are tons of retirement calculators that can help you determine this number; try using two or three different calculators to get a ballpark figure of how much you'll need, then adjust your savings to make sure you'll reach it.

Have some non-retirement savings

Don't make retirement accounts the be-all and end-all of your savings plan. Between now and retirement, you'll hit some rough patches. You'll probably experience medical emergencies, family crises, car breakdowns, job losses, and so on.

Now that you have some ideas on how to secure your finances and not panic, let’s find out why are millennials less confident in the first place. According to Kristi Mitchem, Wells Fargo Asset Management CEO “If they (millennials) continue at this rate, they will never have enough savings for retirement. Ever," CNBC reports.

"Helping them think through these issues and really understand how important it is to not just to save, but invest I think is critical,"

she said. Wells Fargo came up with a Positive Financial Indicator (PFI) to test how well an individual is doing financially. It consists of five attributes of an individual in good financial standing:

- I have enough money to be able to save for future needs.

- I am saving enough for retirement.

- I feel in control of my financial life.

- I take an active role in setting and achieving goals.

- I am able to pay for monthly expenses.

"So really, really important — engagement actually drives happiness. And that's a connection, that millennials don't understand. They would tell you that happiness is all about relationships, they assume materiality, but actually, finances do matter to them," said Mitchem.

Activism actually creates more confidence. Grandparents who have millennial grandchildren, parents who have millennial children, talk to your millennials about money and finance. Don't give them fish, don't teach them how to fish, fish with them."