Knowing which stocks to invest in can be a daunting and difficult task. If you're seriously committed to doing your homework rather than making your investment decision based on which company has the nicest logo it can be a labour-intensive and time-consuming task.

But that needn't put you off taking a plunge in the world's nerdiest game of chance. Fortunately someone else has done the hard work and like the sly but street smart slacker you can copy.

Credit Suisse asked its analysts to pick their three best US stock tips and came up with 140 candidates. That list was further whittled down until only 14 remained. Now take the knowledge and use it wisely. But remember, if it doesn't work out don't shoot the messenger, this one's on Credit Suisse.

14. Apple

- (NASDAQ: Apple [AAPL])

- The tech firm remains one of the most popular stocks in the world and with a number of seemingly ubiquitous gadgets it's not hard to see why. The stock is currently trading at around $138 but is tipped to climb all the way to $150.

13. Affiliated Managers Group

- (NYSE: Affiliated Managers Group [AMG])

- A US-based international investment management company that owns stakes in boutique asset management, hedge fund, and specialized private equity firms all over the world. It's currently trading around the $165 mark and is expected to climb as high as $194.

12. Blackstone

- (NYSE: The Blackstone Group [BX])

- Another New York-listed asset manager. Blackstone's $28 share price has slipped a bit recently but the boffins at Credit Suisse expect it to hit the $40.

11. Celgene

- (NASDAQ: Celgene [CELG])

- The NASDAQ-listed healthcare/biotech firm commercialises medicines for cancer and inflammatory disorders. Currently trading at $125, it could reach $148.

10. Facebook

- (NASDAQ: Facebook [FB])

- A single share in the social network firm will set you back around $138. Steep but it could look like a bargain if it reaches the $170 price that Credit Suisse are predicting.

9. Twenty-First Century Fox

- (NASDAQ: Twenty-First Century Fox [FOXA])

- Rupert Murdoch's mass media company boasts some of the biggest names in TV, film and news. Currently trading around the $30 mark and tipped to rise as high as $37.

8. Hormel Foods

- (NYSE: Hormel Foods Corporation [HRL])

- Hormel's brands are household names across North America and while the share price has taken a hit in recent times is expected to bounce back. At $34 a piece the stock could prove good value if it does what Suisse are forecasting and reaches $41.

7. JPMorgan Chase

- (NYSE: JPMorgan Chase & Co [JPM])

- The banking and financial services holding company needs no introduction. It's name has been synonymous with fat profits for decades and the immediate future is no different. A share today will cost around $91 and it's expected to edge its way up to $96.

6. KLA-Tencor Corp

- (NASDAQ: KLA-Tencor Corporation [KLAC])

- The California-based tech firm has its fingers in the semiconductor, LED, nanoelectrics industries just to name a few. The stock has surged to $91 recently but there will be more than a few people betting that it builds on those gains to reach $93.

5. Pioneer Natural Resources

- (NYSE: Pioneer Natural Resources Company [PXD])

- A share in the Texas-based oil and gas firm won't come cheap at $187 but could look like a steal if it hits the $221 that analysts are predicting.

4. Walgreens Boots Alliance

- (NASDAQ: Walgreens Boots Alliance [WBA])

- The healthcare and pharmaceutical and retail company has surged in recent months and is currently trading at around $85. It is tipped to reach $97.

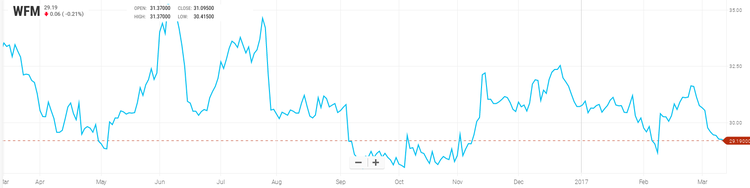

3. Whole Foods Market

- (NASDAQ: Whole Foods Market [WFM])

- You may think a supermarket chain that focuses on selling food promoted as healthy would struggle in one of the fattest nations in the world but that has not been the case for this Texas-based firm. Whole Foods stock is trading at $29 and forecast to hit $36.

2. Zoetis

- (NYSE: Zoetis [ZTS])

- The Pfizer spin-off is the world's largest producer of medicine and vaccinations for pets and livestock. It's unglamorous but the returns have been good with the stock on a gradually rising trajectory. Currently at $53, if the folks at Suisse are right it will get to $61.

1. Johnson Controls

- (NYSE: Johnson Controls [JCI])

- You may not have heard of them bu there's a good chance you own something that uses one of their products. A share in the automotive battery and electronics maker is worth around $41 today but could climb to $51.