Shares of the Japanese tech giant lost 20% overnight and hit the maximum one-day fall limit at Tokyo's exchange thanks to the yesterday's announcement that Toshiba may face a multi-billion dollar charge on its U.S. nuclear business.

Toshiba (TYO: 6502) executives said yesterday that the company planned to take emergency measures to cover heavy cost overruns related to its American nuclear power company Westinghouse Electric Co. The company was acquired last December by Toshiba's U.S. subsidiary, with the cost overruns adding up to “several billion U.S. dollars, resulting in a negative impact on Toshiba’s financial results”. The Wall Street Journal adds that the company's executives said they were looking at the possibility of borrowing funds from a number of banks while the chances that Westinghouse Electric Co. could reach a negative net value as a result of this write-down were also high.

The immediate stock market reaction to the announcement was a heavy 12% drop of the company's stock price. Overnight, the shares tumbled even lower, hitting the maximum allowed daily downward limit of the Tokyo stock exchange of 20%. The company also said that the potential write-down of "unconfirmed" amount would be much higher than the initially expected $87 million and would result in a considerably lower asset value, reported The Guardian. On top of that, Toshiba promised to revise its promising annual forecast predicting annual net profits at the level of $1.24 billion, which is more than 40% higher than last year, to reflect the influence of the upcoming write-down.

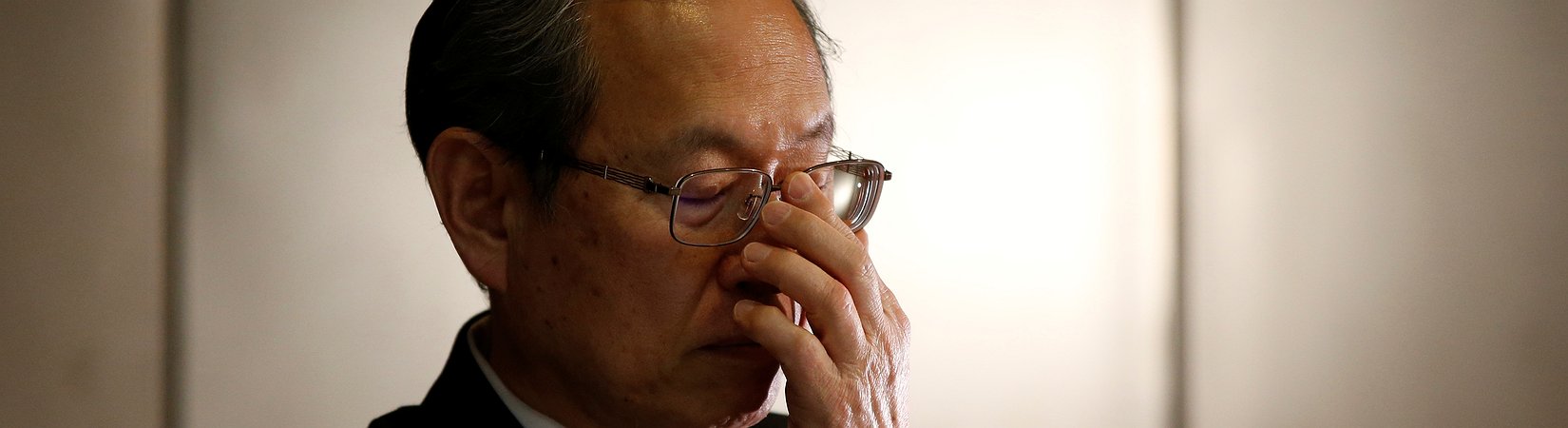

The experts quickly connected such a dramatic stock market reaction to the growing disappointment that comes from the company lowering the profits forecast for this year as well as fresh memories of Toshiba's financial scandal ending in the resignation of its previous CEO in 2015. With that in mind, yesterday's news of a problematic acquisition of its American nuclear business feels like another slap in the face.

"This will come as an additional shock to Toshiba's institutional investors that may further undermine confidence in company management, as well as significantly weakening its international nuclear credentials," a consultant Tom O'Sullivan told Reuters.

Trust issues

Last year, Toshiba admitted to misreporting on its financial results as it was revealed that the company's managers continuously forced subordinates to hide weaker than expected financial results. In July 2015, an independent panel of investigators found out that Toshiba had wrongly "overstated" its operating profits for a total amount of $1.22 billion, which was three times higher Toshiba's own estimate.

"It has been revealed that there has been inappropriate accounting going on for a long time, and we deeply apologise for causing this serious trouble for shareholders and other stakeholders. Because of this Hisao Tanaka, our company president, and Norio Sasaki, our company's vice chairman will resign today," the company said in a statement, as reported by BBC.

Toshiba business empire that covers everything from home electronics to elevators and nuclear power plants, had to shed a number of its smaller businesses to cover the losses in that period. However, the company's overhaul following the devastating investigations coupled with an appointment of a new CEO Satoshi Tsunakawa were welcomed by the investors, what allowed Toshiba shares to climb 77% this year prior to yesterday's drop, said BBC.

When addressing reporters yesterday, Toshiba officials declined to provide any details on the sum of the write-down and said that the definitive figure would be announced by mid-February. Considering a previous history of financial scandals, the unconfirmed statement of a multi-billion charge was enough to cause panic among investors and drag the stock down more than 12%. As the losses reached 20% by the market opening today, it was clear that uncertainty around the amount of the write-down makes the situation only worse.

Reuters adds that as it turned out that the cost overruns would be much higher than first estimated a couple of months ago, there was a big disagreement between Toshiba's Westinghouse subsidiary and Chicago Bridge & Iron Company (NYSE: CBI) that stands behind the CB&I Stone & Webster Inc business acquired by Toshiba last December. The company said that Toshiba's nuclear station operating unit had some previously undiscovered inefficiencies resulting in significant cost overruns that laid on Toshiba's shoulders.