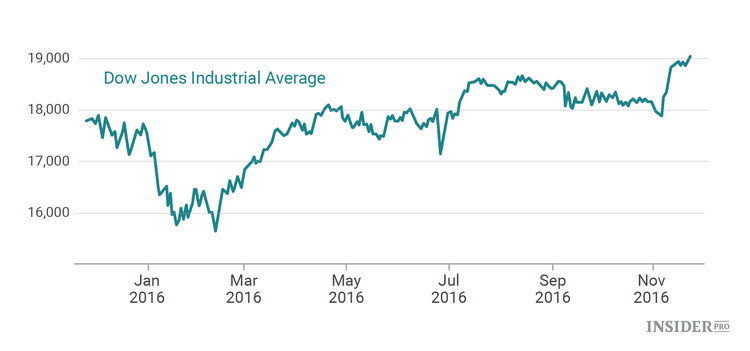

For the first time in its 120-year history, the Dow Jones industrial average surpasses 19,000 point, as part of the Wall Street post-election rally.

The post-election craze sent the stock market higher than ever, with all major stock indexes reaching new record-highs. The Dow Jones industrial average (INDEX: DJI), one of the main stock market gauges, has jumped the highest. Before the close yesterday, the Dow grew by 0.35% or 67.18 points and finally reached the new historic milestone of 19,000. At the same time, S&P 500 (INDEX: US500) also closed higher by adding 4.76 points at 2,202.94 whereas Nasdaq Composite (NASDAQ: NDAQ) jumped 17.49 points to end the day at 5,386.35, reported CNBC.

The experts add that yesterday's record trading day came right after all three major stock indexes together with the small-caps index Russell 2000 (RSU: RUT) hit their all-time highs on Monday.

"From a time standpoint, this may be just the beginning. Don't forget, we spend about three months consolidating before this breakout after the election. We are in a transition period on a number of fronts. First, we're moving from an interest-rate driven market into an earnings-driven market. Also, something most people are missing, is we're getting a more business-friendly administration," Baird's chief investment strategist Bruce Bittles told CNBC.

Generally, the Dow Jones, the index that lists 30 big brand stocks like Coca-Cola (NYSE: KO), Walmart (XETRA: WMT), Disney (NYSE: DIS) and GE (Milan Stock Exchange: GE), has grown almost 4% since the big elections day on November 8. However, we all remember the decline of the major stock indexes, including the Dow, a few days before the election when the market feared Trump's lead over Clinton in the election race because of the re-opened FBI case against the Democrat candidate. So, what can explain the stock rally now?

According to CNN Money, the market participants were mostly shocked by Trump's surprise win, what sent the market in a huge Brexit-like turmoil right after the results were announced. However, as the initial shock wore off, the market seems to realize that Trump's presidency together with Republican-dominated House of Representatives and Senate could mean more market-friendly policies to come. Among those could be Trump's promise to boost the country's infrastructure and, in turn, industrial stocks like U.S. Steel (NYSE: X) as well as looser control of the health industry and financials, benefitting such stocks as Pfizer (NYSE: PFE) and Goldman Sachs (TOCOM: GS).

The Wall Street Journal adds that since Trump's election, the demand for stocks of the sectors tied to economic growth has significantly increased. In the banking sector, almost all banks out of 24 included in the KBW Nasdaq Bank Index (IND: BKX) have reached their 52-week highs in the post-election days on hopes of softer industry regulations and higher interest rates.

“There’s always the danger that you jump to conclusions way too fast because a lot of these expected benefits will take time to pan out,” an analyst Jimmy Chang told the Wall Street Journal.

This sceptical view on the unprecedented stock market rally is shared by several other analysts claiming that this market behaviour is just a form of an aftershock. Interestingly, MarketWatch expert Michael Sincere says that the Dow's peak value is not a cause to celebrate but rather a big warning sign. According to the expert, such a high and fast rally of the index, accompanied by spiking yields and a high chance of interest rates hike next month, points at the underlying stock market problems that are not so easy to spot while being in a festive mood.

Even though the market seems to be uplifted, veteran analysts are extremely cautious. A senior trader Mark Cook said that one of the most worrying signs in this situation was that the Dow Jones reached its all-time high level today again but Nasdaq Composite and S&P 500 didn't follow with the same performance.

“The DJIA is notoriously a laggard, not a leader, so therefore this top that we are putting in could be a top that won’t be eclipsed for years, if not decades,” Cook told MarketWatch.

From here, the market could still reach higher but not that much, he says. Cook also warns about the possibility of inflation emerging from Trump's presidency that will negatively affect the stock market. Another red flag we shouldn't neglect is the possibility of the interest rates raise coming in December, as the stock market "can't stand higher interest rates", says Cook.

In this situation, all we can do is keep our eyes open and try not to be blinded by the record-high indexes that can prevent us from seeing the hidden problems. One thing is clear: the market rally of the last days is still coming from the shock induced by Trump's surprise election win that is unlikely to settle down until the president-elect finally moves into the Oval Office.