The cryptocurrency market has been on a bumpy road since 2011 as the whole industry suffered 120 security attacks and over 70 attacks on decentralized finance (DeFi) protocols, according to new research conducted by Crystal Blockchain, a blockchain forensics company.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.

In particular, the Amsterdam-based company found that the DeFi area of the cryptocurrency market lost over $1.7 billion over the past few years. The company's experts claim the scale is due to the novelty of the technology. The biggest DeFi hack up to date remains to be the one associated with Poly Network, when a hacker, or hackers, stole over $614 million in tokens (later the majority of the funds have been returned).

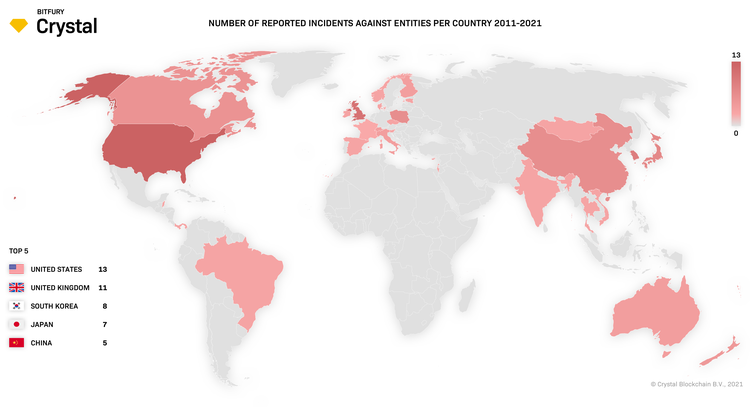

The company notes the most common locations for exchange security breaches are the United States, the United Kingdom, South Korea, Japan, and China. The order can be explained by the fact that the United States and other countries are more loyal to the cryptocurrency market than China.

Moreover, scams focused on non-fungible tokens (NFTs) are also trending as the market capitalization for NFTs jumped by 1785% in 2021. Growing adoption inevitably leads to more bad actors in the space, the analysts emphasize.

As iHodl earlier reported, the Royal United Services Institute (RUSI), the world's oldest defense and security think tank, warned that NFTs are actively exploited by money launderers the same way the bad actors exploit physical art. The RUSI found that most NFTs are purchased with cryptocurrencies exploited for malicious means. The organization called for stricter regulatory measures for NFT-focused marketplaces similarly used by financial institutions like KYC/AML.

Access more than 50 of the world's financial markets directly from your EXANTE account – including NASDAQ, London Stock Exchange and Tokyo Stock Exchange.