Bitcoin (EXANTE: Bitcoin) will perform worse than stocks in the coming months, Capital Economics, London-based macroeconomic research firm predicts in a recent study.

“Bitcoin’s correlation with equity prices has strengthened recently, but we think that this will be just temporary. We still think that bitcoin is essentially worthless, meaning that it is likely to fare much worse than other assets in the coming months,” Capital Economics' research reads.

According to the study, the main reason of expecting bad performance is the fact that cryptocurrency has "no fundamental worth." Although Bitcoin has been correlated to the S&P 500 (LSE: PLUS) index, since the price started to fall from its record high at the end of last year, but this correlation has been coincidental and related to specific factors, researchers explained.

They mentioned rising concern over regulation, a ban on cryptocurrency advertising from major internet platforms and some banks banning customers from buying it via credit cards.

“In other words, the factors driving Bitcoin prices are still rather different to those driving the prices of other assets,” Capital Economics added. “Bitcoin’s correlation with equity prices has strengthened recently, but we think that this will be just temporary. We still think that Bitcoin is essentially worthless, meaning that it is likely to fare much worse than other assets in the coming months“.

"We expect equity markets to fall as investors cotton on to the fact that rising U.S. interest rates will slow economic growth. But the main factor driving down the price of bitcoin is likely to be a realization that it is simply not a credible long-run alternative to conventional currencies," the study paper added.

Bitcoin’s market value by the end of the year should be no more than $77 billion, professors at ETH Zurich Spencer Wheatley and Didier Sornette claimed in another recent research.

That’s $41 billion less than cryptocurrency’s market capitalization as of Monday 2 April.

The Swiss researchers applied Metcalfe’s law showing that the value of a network is proportional to the square of its users. By applying this principle, professors at ETH Zurich calculated that Bitcoin’s market value by the end of 2017 should be $77 billion maximum. Bitcoin’s market capitalization Monday is $118 billion which is almost 35% more than their estimate.

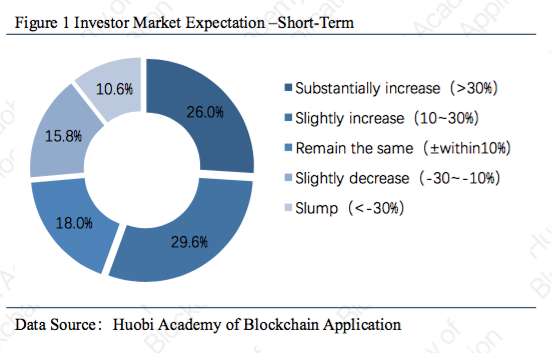

Nevertheless, another recently published research shows that cryptocurrency investors are still bullish. A Cryptocurrency Sentiment Index-Survey by Huobi Research was taken from 1,797 people stemming from 23 different countries in various regions worldwide.

Huobi’s report details that 77.9% of voters believe cryptocurrencies will rise by more than 30% in the next three years. Even in the short term more than half of those polled believe that the total market value of cryptocurrencies will increase in the next month.

Bitcoin rose to a record high of above $19000 mid-December 2017. However, already this year the digital currency has lost more than half of its value.

According to our Bitcoin (BTC/USD) Chart, it is now traded just a little over $6,600.

It raised the issue of how much the digital currency is really worth even among the academia.

By Ksenia Batanova