Welcome to our crypto currency outlook 2022. This provides a thorough review of the cryptocurrency world in a series of articles. In this first part of our cryptocurrency review, we present some suggestions as to what may affect the cryptocurrency market in 2022 and present some of the key facts behind what moves cryptocurrencies.

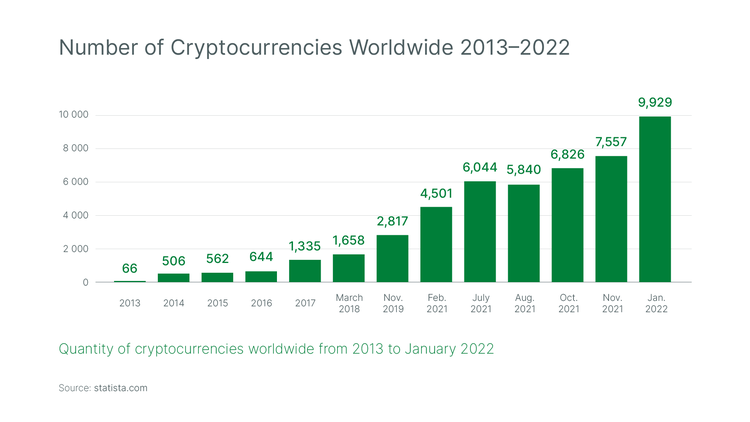

Cryptocurrencies and associated products are a market in transition. What was once a very niche market has grown substantially: cryptocurrencies market valuation has grown 210% over the past year alone. In this notoriously volatile market there are a number of events likely to take place in 2022 that may affect both the value of individual cryptocurrencies as well as overall market demand for specific cryptocurrency products.

- Cryptocurrencies use and valuation may, at least initially, be affected by the introduction of new regulation in different jurisdictions, including the US, Hong Kong and the EU in 2022.

- Global interest rate changes, particularly rate rises by the US Fed, may alter the overall risk tolerance levels of investors, making cryptos less attractive to investors with lower risk tolerances.

- The introduction of central bank digital currencies in 2022, will likely cause a greater degree of volatility around cryptocurrencies.

Why crypto now?

Cryptocurrencies are gaining traction as a legitimate alternative asset class. The size of the crypto market, as of 29 December 2021, was $2.25 trillion compared to only $10.2 billion on 29 December 2013. Over an 8 year period the total market value of crypto has grown over 22,000%. In 2021, Wall Street finally embraced cryptocurrencies as a full-fledged investment asset e.g. JPMorgan gave its clients access to a half-dozen cryptocurrency funds and in May 2021 Goldman Sachs launched a new Bitcoin-based financial product. The latter's non-deliverable forwards allow clients to place bets on changes in cryptocurrency prices and receive settlements in fiat money.

What affects the price of cryptos?

There are multiple factors that will affect the price of cryptocurrencies and associated products into 2022. These include, but are not limited to:

- the availability of new products

- the increased/decreased adoption as a means of payment

- statements made by celebrity investors

- statements made by governments and/or central banks regarding their support of these products

- the change in value of other investment products

- hacker attacks

- geo-political events

What moves the cryptocurrency market is not always clear; volatility can be attributed to multiple correlated factors and real world situations that combined, may suddenly affect sentiment. The price of cryptocurrencies can change as a result of events in the crypto world itself. Cryptocurrencies are reliant on a network effect, i.e. a crypto product or cryptocurrency becomes more valuable as more people want to own that product or currency. Therefore, every additional Bitcoin adopter makes Bitcoin more valuable for everyone else who owns Bitcoin. This is because, unlike fiat currency, there is a limited supply. And, as cryptocurrencies have become more established as legitimate investment products, the introduction of a new listing can further generate demand from investors already exposed to the asset as well as new investors not wanting to miss out, e.g. in April 2021, the crypto market experienced a healthy growth, possibly in anticipation of Coinbase’s listing.

A key driver of the price of cryptocurrencies is the availability of products. If there are multiple ways investors can gain exposure to a product, e.g, through derivative instruments, that can help investors better balance the overall risk level of their portfolios, this may have a positive impact on the valuation of cryptos in the longer term. This means that the more products become available for investors to gain exposure to cryptocurrencies, for instance, new ETFs, ETFs or crypto-centered indices, the more likely the price of such assets is to increase in the longer term.

Adoption as a payment method will influence the value of that cryptocurrency. Several global corporations now accept cryptocurrencies as a payment method, e.g. US electric car maker Tesla accepts meme crypto Dogecoin as payment for some of its merchandise, the American movie theater chain AMC has added Bitcoin and other cryptocurrencies as online payment options, and even payment players like Paypal are accepting cryptos. The increasing adoption of cryptocurrencies as a means of payment for everyday transactions means that overall demand for cryptos will increase, positively affecting the price of that crypto. However, the decision to remove or suspend the acceptance of cryptocurrency payments can negatively impact the value of that cryptocurrency. For instance, when Tesla suspended Bitcoin payments on the basis of environmental concerns, the price of the cryptocurrency was negatively affected. The acceptance or rejection of cryptocurrencies at national level may also affect the valuation of some cryptocurrencies in the future. All eyes are on how well the Central American country El Salvador’s economy performs following its legalisation of Bitcoin. If it is readily accepted by its population and has no negative economic impact on domestic businesses, then it may lead to the global strengthening of the cryptocurrency.

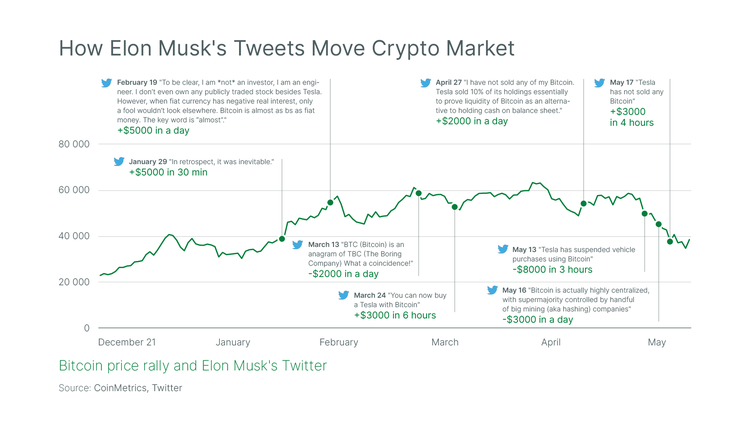

Statements made by well-known celebrities like Elon Musk can have an impact on a cryptocurrency's price, although this will usually only be temporary with the price of the asset returning to its initial value.

Statements made by governments and central banks can also affect the value of cryptocurrencies. According to the Bitcoin whitepaper, the first cryptocurrency was designed to allow users to make payments “without going through a financial institution.” Governments and central banks have several concerns related to cryptocurrencies and are looking towards regulation as a tool to control the impact on domestic and global markets. Some countries, like China, may seek to impose a total ban, while others, like the US, have recognised the growing importance of cryptos and seek to regulate them as they would any investment instrument. Experience shows that the prohibition and the regulation of cryptocurrencies impacts the prices of these assets and may be likely to have a similar effect in the future. Although state involvement is generally viewed as a negative for the market, for example, China has recently banned crypto mining, while Iran temporarily bans this activity in periods of high consumption of electricity in order to avoid power outages, the protection that regulation may bring to investors; may also have a positive effect on the market.

The change in the value of other asset classes. Cryptocurrencies are part of the asset class mix; there may be correlations with other asset classes that impact demand, price and the level of volatility. When financial markets are affected by external shocks, e.g. a widespread fall in stock prices caused by new strains of covid-19 or a sector dominating company like China-based Evergrande experiences severe financial distress, the cryptocurrency market may also, at least to some undetermined degree, be affected as global investors re-evaluate overall market risks and rebalance their portfolios.

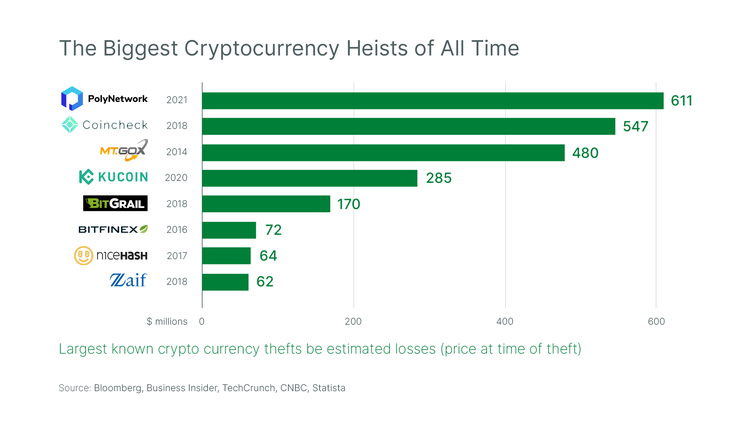

Holding cryptocurrencies and crypto products does open investors to an unusual risk: hacking. Owners of crypto products have previously been targeted by multiple hacker attacks, and despite all the security measures put in place, bad actors may keep attacking them. As a result, crypto projects lose millions of dollars. When a crypto project is targeted by bad actors, the price of the native token of the project that has been hacked is likely to fall. Despite the efforts of the developers of hacked projects to compensate for the stolen funds and mitigate risks, the reputation of the project is usually affected. The continuous attacks on the crypto industry can affect its reputation, and the price of a particular cryptocurrency can crash in a few minutes if it falls victim to a hacker attack.

Geopolitics: the risk is real. As we saw in 2021 with the sudden banning of crypto products by China and in early January of 2022 with the civil unrest in Kazakhstan, actions that may affect the ability of cryptocurrencies to be mined or created and those events that infer serious legal harm to owners or users of cryptocurrency products, will impact the value of cryptocurrencies.

In summary, there are a number of things that can move the market; we’ve listed our top three for this year. However, there are even more things for investors to consider including how we got to this level to begin with. Read our next installment to learn more about what was behind the major movements that affected the crypto market, whether they can or will happen again, and what other possible actions we anticipate may move the market in 2022.