2020 had a decentralized finance (DeFi) summer, but 2021 seems to be the year of DeFi. The rapidly growing sub-sector of the crypto economy is gaining phenomenal traction this year. According to data from DappRadar, the total value locked (TVL) in DeFi protocols has grown over sevenfold this year from nearly $22 billion at the start of the year to hit an all-time high of $165.29 billion on Oct. 27. Currently, the TVL stands at $157.18 billion as of Nov. 1.

Even though Ethereum is the most utilized blockchain for DeFi applications, there are several other blockchain networks with the smart contract functionality that have been gaining prominence and spurring the growth of DeFi further.

There are many DeFi protocols and networks that are leading the charge to support this multiple style growth and are creating an inclusive ecosystem where all categories of investors can be involved in an efficient manner. Some of these are listed below:

Avalanche

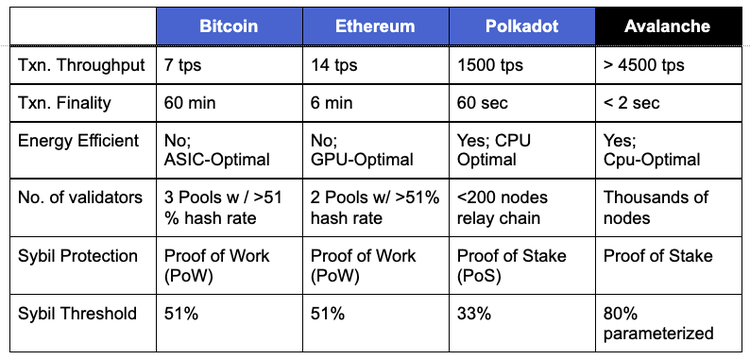

Avalanche is one of the fastest-growing layer 1 blockchain networks that houses a thriving ecosystem of decentralized finance (DeFi), non-fungible tokens (NFTs) and other cryptocurrency projects. Given the rising popularity of Ethereum alternatives due to high gas fees issues, scalability factors and the delay of the PoS Eth 2.0 network supposedly incoming 2022, Avalanche has grown to become one of the top contenders for that stop as it resolves many of these issues along with adding its other user’s propositions and innovative technology infrastructure to the mix. It evens outperforms other "Ethereum Killers" like Polkadot in many ways.

The native token of the network, AVAX, has posted impressive gains this year. According to data from CoinGecko, the token has posted 1,662.2% gains on a yearly basis and currently trades $64.06 with a market capitalization of $46 million and a circulating supply of 220.2 million tokens. It has quickly risen to become the 16th most prominent cryptocurrency by market capitalization.

In comparison to Ethereum, Avalanche allows developers to deploy smart contracts just at a tenth of the cost on the Ethereum network. The network’s Virtual Machines (VMs) allow developers to easily launch blockchains with a wide array of application-specific features, its also entirely compatible with the Ethereum Virtual Machine (EVM) with additional compatibility incoming in the future.

Additionally, the Avalanche Bridge (AB) is providing interoperability to the network and enables the easy transfers of Avalanche and Ethereum assets between blockchains. The network offers several DeFi protocols like Automated Market Makers (AMMs), Decentralized Exchanges (DEXs), Borrowing & Lending protocols, and asset issuance projects. For institutions, the network facilitates debt financing, digital identity, asset issuance & trading, and document tracking services.

BENQi

BENQi is a decentralized, non-custodial and algorithmic liquidity market protocol built on the Avalanche network. It facilitates users to effortlessly lend, borrow and earn interest with digital assets where depositors provide liquidity to the protocol to earn passive income while borrowers are able to borrow these funds in an over collateralized fashion.

The protocol aims to give a push to financial inclusion by providing democratizing access to DeFi products through permissionless lending and borrowing. Users can utilize the platform for the three main outcomes:

- Supply and Access liquidity instantly from a shared liquidity market.

- Use supplied assets as collateral to borrow instantly from a liquidity market.

- View interest rated in a real-time manner that is transparent around the clock depending on the underlying assets market supply and demand.

The network has raised over $6 million from various eminent investors and venture capital (VC) funds like Ascensive Assets, Arrington XRP Capital, Woodstock Fund, GBV Capital, Ava Labs, Spartan Block and Skynet Trading, amongst others. It has also partnered with various giants in the cryptocurrency and blockchain industry like Avalanche, Chainlink Labs, Immunefi and Halborn. One of the main objectives of the protocol is to serve as a cross-chain hub between various blockchain networks like Ethereum, Polkadot and Binance Smart Chain (BSC) enabled through the Avalanche subnets.

BENQi has been incredibly successful ever since its launch in mid-2021. The liquidity market protocol reached $2 billion in TVL even less than a week after its launch on Avalanche, which is a landmark moment both for the protocol and the network itself. In comparison, the biggest player in the DeFi market currently that dominated 8.82% of the market’s TVL, Aave, took several months to hit $1 billion in TVL. Currently, the TVL on BENQi is $2.6 billion

BenQi rolled out the $4 million second phase of its ongoing Avalanche Rush incentive program on Oct. 4, which will last for 45 days. The Avalanche Rush is a $180 million liquidity-generating incentive program that aims to get the best DeFi protocol to the AVAX network. The program brought in top DeFi projects like Curve, Aave and BENQi in its first phase.

Pangolin

Pangolin is a community-based decentralized exchange based on the Avalanche blockchain network. It uses the same AMM model as the highly successful protocol, UniSwap, which is based on the Ethereum blockchain. Its native governance token, PNG, is fully community distributed and is fully compatible with both Ethereum and the Avalanche blockchain.

What’s unique about Pangolin’s token supply and distribution is that it is a 100% community-driven token and protocol. There are no PNG tokens are allocated to the team, investors, advisors, or any type of insiders. Its supply is capped at 538 million tokens out of 95%, i.e. 512 million tokens are reserved for the community treasury where they will initially be used to fund liquidity mining. The remaining 5%, i.e., 26 million tokens, are allocated to a community airdrop.

The chain-agnostic blockchain project, AllianceBlock, partnered with the DEX in August this year to help the latter grow in line with DeFi regulatory developments and make institutional access to the DEX easier. Pangolin’s users can also use AllianceBlock’s compliance framework to choose their level of identity verification.

Pangolin has also entered a collaboration with Markr.io in an attempt at improving the efficiency of the Avalanche network. Markr is a tool for portfolio management and tracking for the users of decentralized applications based on the Avalanche network. For the Avalanche network, it enables dApp comparison, portfolio tracking, token tracking and swap comparison. The DEX currently has a TVL of over $260 million, with an all-time high of nearly $394 million that it hit on Sep. 16, as per data from DefLlama.

Serum

Serum is a leading DEX on Solana’s rapidly growing ecosystem that attempts to bring unprecedented speed and low transaction costs to the DeFi markets. In a nutshell, the DEX attempts to bring the experience and efficiency of centralized exchanges to DeFi. It was created by the Serum Foundation, which is a consortium of partners including FTX Exchange, Alameda Research and the Solana Foundation itself. It uses a central limit order book (CLOB) mechanism to facilitate transactions on the exchange.

SRM is the native governance and utility system of the ecosystem. It is an SPL token, Solana’s token standard, but is also cross-listed as an ERC-20 asset on the Ethereum network. The DEX uses 80% of the revenue generated to buy back and burn SRM tokens every week, and the remaining 20% gets distributed to SRM stakers that have their SRM tokens in Serum’s staking contract. It uses a two token model, SRM and MegaSeum (MSRM), to give holders proportional governance rights over the protocol and reduce trading fees on the DEX.

The DEX has grown quickly to go past the $1 billion mark in TVL. This metric hit an all-time high of $1.85 billion on Oct. 14; it currently stands at $1.62 billion as per data from DefiLlama.

Manta

The Manta Network is a privacy preservation layer on Polkadot that also enables interoperability. The network is being built as a layer-1 solution that entails that privacy will exist in the core architecture rather than sitting on top of another blockchain network. The network uses Substrate to take advantage of the interoperable ecosystem that Polkadot brings, aimed at making the DeFi markets truly private.

The network recently completed a $5.5 million funding round on Oct. 19 that had participation from more than 30 venture capital (VC) funds, including the cryptocurrency hedge fund, CoinFund and alternative investment firm ParaFi Capital, CMS Holdings, LongHash Ventures, Global Coin Ventures and SkyVision Capital amongst others. Angel investors even included SushiSwap’s core contributor 0xMaki, Dragonfly Capital’s Kevin Hu and Parafi general partner Santiago Santos.

Earlier in the year, the network raised $1.1 million in a funding round led by Polychain Capital and was joined by major industry players like Alameda Research and DeFiance Capital. The protocol uses zk-SNARKS with Groth16 proofs, which is the same piece of cryptographic technology that backs the privacy-oriented digital asset ZCash (ZEC).

The network is aiming towards getting a parachain slot upon its launch. Their roadmap also holds the plan to launch its "private" UniSwap called MantaSwap, which will be a privacy AMM-based decentralized anonymous exchange in addition to MantaPay, a multi-asset decentralized privacy payment scheme.

Conclusion

These protocols and blockchain networks are taking DeFi to new highs as the entire ecosystem expands to cater to the growing needs of retail investors and institutional investors alike. Considering the ongoing bull run, it won’t be long before the TVL on DeFi protocols passes $500 billion in 2022, all due to the exponential growth of alternate blockchains like Avalanche and Solana that are spurring the growth of this ecosystem in an efficient manner.