A quick look at the asset tokenization market shows us that businesses, governments and ordinary users have recognized the scope of opportunities this new technology offers. That is why organizations such as World Economic Forum (WEF) and Deloitte predict that about 10% of global GDP will be tokenized using blockchain technology by 2025-27. This article states how such a young technology has become so significant and which direction it can develop over the next few years.

First Case of Tokenization

Tokenization on the blockchain is the process of issuing a token that symbolizes or provides ownership of an asset. Such an asset can be represented as gold, oil, real estate, cars, art objects, securities, fiat money and any other tangible and intangible assets.

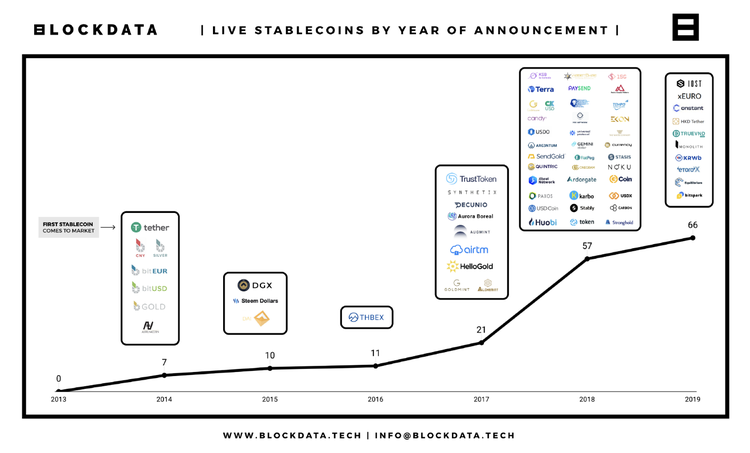

The concept of asset tokenization was first described in January 2012 by J.R. Willett in the article "The Second Bitcoin Whitepaper." The author described a protocol called Mastercoin. It is a Bitcoin add-on that allows creating tokens with a stable exchange rate by being linked to fiat or commodity. A year later, Willet held a token sale and raised 500,000 USD for the implementation of his project. In October 2014, Realcoin (currently known as Tether), based on Mastercoin, was released. This is the first stablecoin with an exchange rate pegged to the fiat currency — the US dollar.

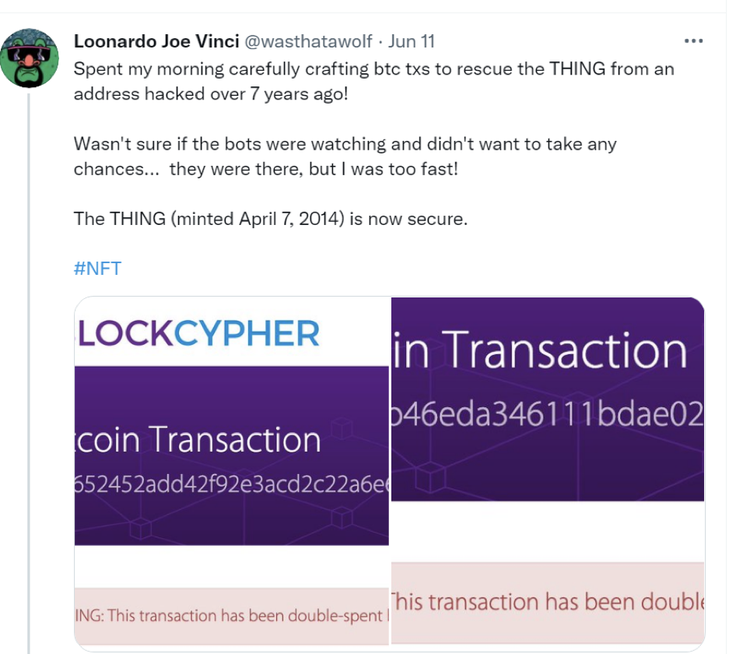

Although, it's not completely clear whether this was the first case of tokenization on the blockchain, since Realcoin was released in October 2014, while back in April that year, the non-fungible token (NFT) The Thing was minted on the Bitcoin side-chain. This NFT seemed to contain some kind of image. No one knows what the real image was or whether it existed at all, except for Twitter user @wasthatawolf.

Also, there was another NFT called OLGA, minted at Counterparty on June 12, 2014. Counterparty is a Bitcoin-based blockchain for issuing NFTs. It was created based on the Colored Coins protocol, which was first described on December 4, 2012. And even earlier, on May 3, 2014, a non-fungible Quantum token – a pixelized animated octagon image – was created.

Many people consider these NFTs to be the first tokenized assets. But this is controversial since Counterparty tokens technically are tokens with an image on the blockchain, and not tokens symbolizing those images. The blockchain community has not yet decided whether there is a difference between these definitions, so everyone decides for themselves which token is the first tokenized asset.

Current State of the Tokenization Market

In the past few years, the interest in asset tokenization on the blockchain has increased significantly. According to Forkast News report, the market surpassed 20 billion US dollars in Q4 2020. The main growth drivers were stablecoins (this market grew by 300% in 2020 alone), as well as energy (mainly companies such as PowerLedger, WePower, and Cenfura), gold, real estate and tangible goods markets.

Key Trends Determining the Market Development

The number of tokenization platforms has been growing exponentially. There are plenty of tokenization solutions in different jurisdictions, offering various business models for the various types of businesses. Among the most known are: Harbor, Tokensoft, Securitize and Polymath.

The top key trends in the current state of tokenization are developing working frameworks for compliance with regulations and creating ecosystems, offering customers to tokenize assets using all-in-one solutions, covering the entire tokenization cycle. For example, the recent Binaryx Invest marketplace, launched by digital asset exchange Binaryx, which offers businesses ways to create and manage a wide range of tokenized assets as well as engage private investors within the same platform. Moreover, the marketplace allows customers to buy assets from both, individuals and businesses as well as resell them.

In the next few years, the main trends in the blockchain-based asset tokenization market that will most affect its development will be the need to hedge risks from the volatility of traditional cryptocurrencies, as well as the gradual adoption of blockchain technology by businesses and users.

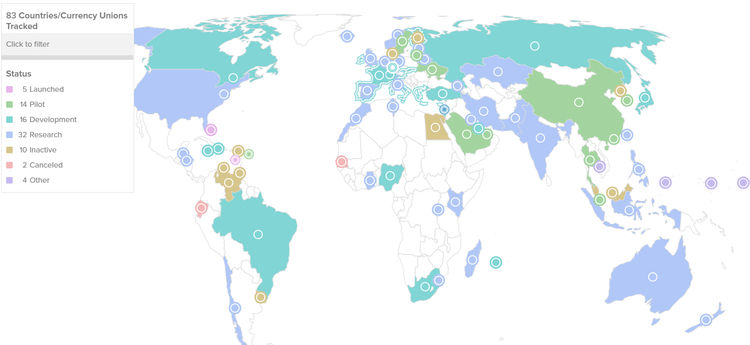

In addition, the market growth can also be greatly influenced by CBDC – Central Bank Digital Currencies. The USA, China, EU, England, Canada and many other countries have already announced their intention to launch their CBDCs in the coming years. If at least one such project gets finalized, then the tokenized assets market will ascend very quickly by ten, if not a hundred, folds.

Possible Development of the Tokenization Concept

Most likely, the concept of asset tokenization on the blockchain will develop linearly, without any significant changes. The development will go towards market growth and usability improvement. The market growth is driven by the increased number of Internet users and the adoption of blockchain. And what concerns usability, this is what businesses and investors need at the moment, since it is the complexity of the tokenization process that interferes with the mass distribution of this technology most of all.