Crypterium, a global fintech startup focused on providing transparent and efficient digital asset services, has announced that it intends to burn up to 30% of its total native token ‘CRPT’ supply. The firm issued a press release on July 1 confirming that the burning process will commence this month. Before this development, Crypterium only burnt CRPT tokens used to pay the platform’s 0.5% gas fee on transactions.

Like most native digital assets, CRPT is built on the Ethereum blockchain and plays a fundamental role in powering Crypterium’s ecosystem. This ERC-20 token ensures that Crypterium’s services are scalable and stable; some of the services offered by Crypterium include crypto-to-fiat on ramping, a contactless visa card and B2B solutions which are among the latest innovations by the firm.

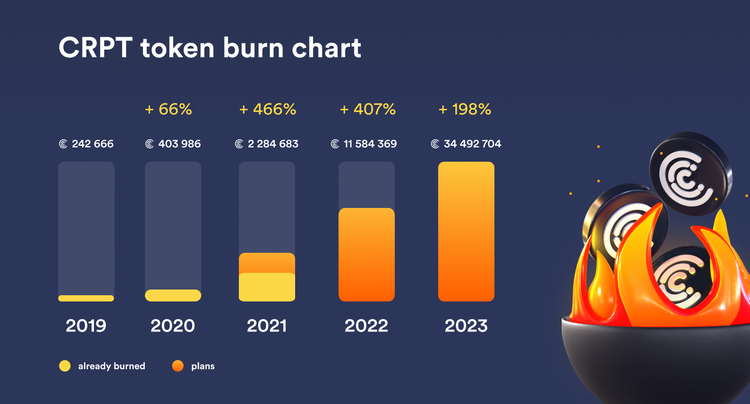

Notably, Crypterium’s digital asset services have gained traction, with the company serving more than 500,000 people through its wallet and card services. This growth can be attributed to the platform’s ease of buying, sending, exchanging and making crypto payments. As a result of the upward trajectory, the amount of CRPT tokens burnt every year has been increasing since 2018 and will likely be accelerated following the latest developments.

Deflationary Tokenomics in Play

The most common crypto tokenomic models include inflationary or deflationary tokenomics. An inflationary model allows market participants to add more tokens into circulation through activities like mining. In contrast, a deflationary model removes tokens from circulation by burning on transactions or buying back the tokens in market circulation to burn them.

Crypterium’s tokenomic model follows a deflationary approach with the total supply capped at 98 million tokens. Currently, 84 million of these tokens are in circulation, which is set to decrease in the coming years. In 2020 alone, this platform burned 400,000 CRPT through its burn-on-transaction model. The figure has increased to 800,000 CRPT in 2021, with six months still left before the year ends. It is noteworthy that this increment was fueled by the adoption of Crypterium’s services over the past three years.

Despite burning over 1.6 million CRPT tokens to date, Crypterium now wants to speed up the process to burn over 30% of its total token supply within the next two years. The firm’s COO, Austin Kimm, noted that the move to start burning tokens in market circulation would have a positive impact on their ecosystem:

"Until now, our burning rate exclusively depended on transactions. However, looking ahead we’re planning to redeem tokens from the market for burning purposes. We are confident that increasing CRPT burning speed will have a positive impact on our ecosystem."

Crypterium is also welcoming all crypto communities to take part in the burning process. The project has launched an initiative that allows CRPT token holders to burn their tokens by sending them to a dedicated address. However, this initiative runs only up to July 10.

With the number of CRPT tokens burnt increasing every month, the supply continues to dwindle. Should the demand for Crypterium’s services increase or remain constant, the value of the CRPT token will likely increase. This is because of the fundamental law of demand and supply, which applies in most financial markets.

Conclusion

The burning of crypto tokens to reduce supply has played out well for most crypto projects, although it is a bit early to measure success conclusively. Crypterium’s decision to redeem and burn some of the tokens in circulation will ultimately reduce its supply by as much as 30% if the company hits its targets. This will be a big boost to CRPTs fundamentals and Crypterium’s business, whose monthly gross profit grew by 10x in 2020.