There are two sure things in life: death and taxes. Unfortunately, because of its meteoric rise in our recent culture, there are still misconceptions among some crypto traders; and chief among those may be the false assumption that crypto investments are anonymous - and therefore un-taxable. While that could not be further from the truth (if you are now nervous, please read on), the truth is more complex. A much safer assumption would be that tax laws regarding crypto are blazing to catch up, are quickly evolving, are potentially different for each country, and - thanks to growing regulation - your own country will be able to find and tax your crypto. If you are assuming that your accountant will be able to handle all this so it isn’t your problem, well… this ever-evolving field is new to nearly all accountants as well, and though they are working hard to stay on top of tax law for their clients, they also have to keep track of the rest of the tax law - which continues to change as well.

Some examples of how complex crypto tax can be:

- Many countries will implement the Financial Action Task Force "travel rule" guidance starting June 2021, which will, among other things, identify and track every wallet owner on a public chain. This information will be very useful to tax authorities, who will be able to pursue any unpaid crypto taxes.

- What exactly is taxable when it comes to crypto? That depends on the country. In the US, for example, cryptocurrency is mostly treated as property and taxed in a similar manner. You could be taxed when you sell crypto, when you trade it for another, or when you use it for a purchase.

- It also depends on how long you hold your investment, as there are different taxes for "short-term" and "long-term" investments.

- There are already lawsuits around how cryptocurrency is taxed. Joshua Jarrett, a cryptocurrency investor, is suing the IRS claiming illegal taxation. According to the suit, "The United States here seeks to use the federal income tax law to do something unprecedented, which is tax creative activity rather than income. Taxing newly created cakes, books, or tokens as income would have far-reaching and detrimental effects on taxpayers and the US economy." Essentially, the argument is centered around not trading crypto, but creating it, as the current tax law levies certain taxes around mining and staking. If crypto is treated as property, this tax direction no longer aligns with more traditional forms of property taxation.

- On the other side, some countries have either pledged not to tax crypto trading, or at least have not taxed it yet. Examples include Belarus, Germany, Malta, Malaysia, Switzerland and the Bahamas. That said, even some of these countries may tax certain aspects of crypto, or may tax businesses but not individuals.

While these are just a few examples, even they may be out of date within months depending on the tax law changes. It can be extraordinarily daunting to think about, and you may wonder if it is even possible to accurately calculate your crypto taxes.

Features

Given how complex the topic of cryptocurrency taxes are, it is somewhat shocking - and welcome - how simple the CryptoTaxCalculator system is. The UI design, the decision tree of options, the process flows and the time from problem to solution (a tax report) is incredibly fast. It is usually a sign of in-depth design, development, and testing when a complex problem has a solution that is--at least from the user’s perspective--intuitive and elegant.

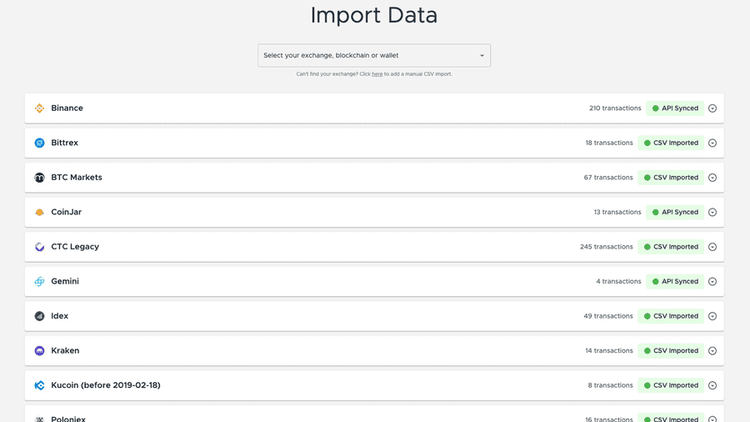

Import Data

Before you can calculate your taxes, you first need to capture your transactions. In order to make the product usable for the widest possible audience, the team works hard to include compatibility for all exchanges. The company supports over 100 different exchanges, and states that if you trade on an exchange so obscure that it isn’t already supported, you can let them know and they will create the functionality and add it to the list.

The data itself is flexible as well, with options ranging from simple CSV to more complex API integrations from the various exchanges. The tool can also import data from blockchains and wallets.

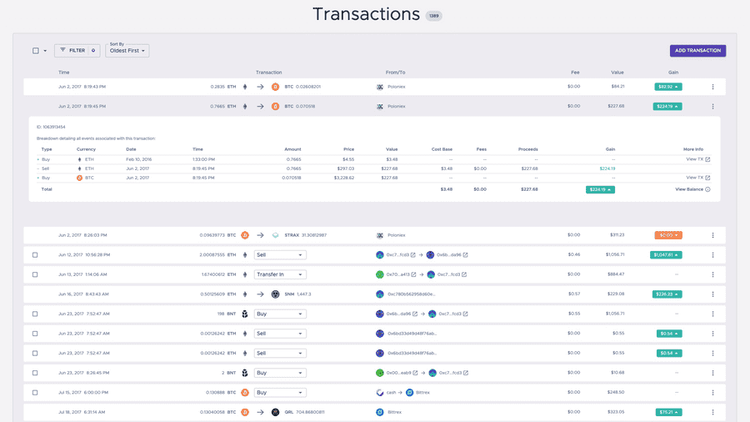

Transaction Review and Categorization

Once the transactions have been uploaded and organized, they need to be labelled based on what type of activity they are. You may have transactions that include buying, selling, ICOs, crypto to crypto trading, staking, losses, mining and more. All transactions must be categorized before they can be calculated, but here is where the founding team’s AI backgrounds come into play: transactions are automatically labelled based on certain context and clues. It is important to look through and make any corrections (as sometimes the transactions don’t offer enough context for precise labelling), but having the majority of transactions labelled is sure to save the time and - let’s face it - the grief it would otherwise involve to manually label the hundreds or thousands of transactions you’ve made over the year.

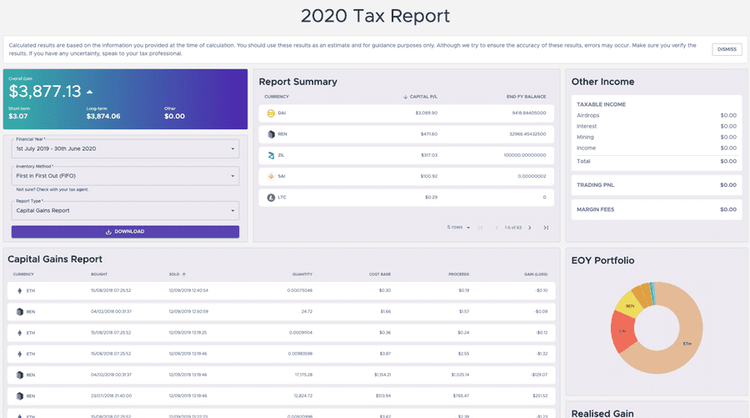

Tax Reports

Once the data has been imported and labelled, it is ready for export into an easy to read report. And frankly, this is where the magic happens. As you may remember from the beginning of this review, there are a LOT of factors that go into crypto taxes. Where you live, the various transactions you’ve made, the current set of laws… and not to mention, your crypto taxes are only a portion of your overall taxes, and everything has to be combined in order for you to fully complete the process. To manage this massive effort, the tool takes into account where you live, your many transactions, and creates a report that supplies the key pieces of information needed to flow into your overall tax filing. The tool doesn’t make assumptions on how you do your taxes; the report can be used by you, or can be given directly to your accountant and is presented in a way that they do not have to be a crypto tax expert.

Pricing

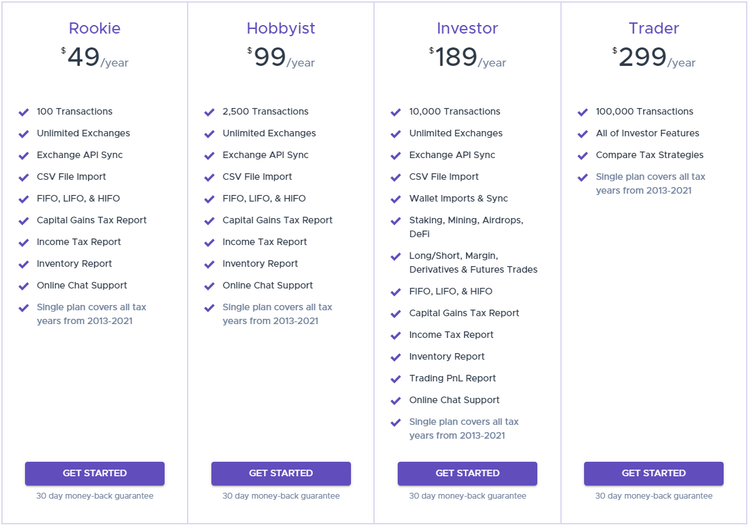

There are a wide range of pricing tiers depending on what is needed. Helping to ensure happy customers, the company offers a free trial and a 30 day money-back guarantee. The pricing tiers and their yearly costs include: Rookie at $49, Hobbyist at $99, Investor at $189 and Trader at $299. The price differences are due to elements such as the number of transactions (100 - 100k), and the types of reports.

All levels feature:

- Use of unlimited exchanges

- API sync

- CSV import

- FIFO/LIFO/HIFO

- Capital Gains Tax Report

- Income Tax Report

- Inventory Report

- Support (via online chat)

- Tax year reporting from 2013-2021, depending on what data is pulled and imported

The Hobbyist offers more transactions than the Rookie, and the Investor and Trader include additional reports, wallet imports and sync capability, and significantly more transactions.

Conclusion

Taxes can be very confusing. With crypto, the levels of confusion and complexity are multiplied exponentially. However, dealing with crypto taxes should not be an undue cause of stress, and shouldn’t discourage you from being active in the world of mining, staking, trading and profiting. Solutions such as CryptoTaxCalculator are an enticing option to bring a much needed dose of simplicity to the complex, ever-evolving, and at times intimidating process of calculating your cryptocurrency taxes.