The crypto industry is risky, no matter what you do. If you enter trades, there is always a risk of losing money. If you buy new tokens in token offerings, it can always turn out that the project is a scam, or too weak to survive the extremely competitive crypto industry. Even if you simply hold your coins locked up in your wallet, or stake them, lend them and alike — you are exposed to the risk of their price dropping in a bear market, thus reducing the amount you hold in cryptocurrency.

Because of these issues, the crypto sector has always sought some sort of insurance, and over the last few years, insurance companies started developing an interest in them, as well.

However, the crypto industry has gotten really invested into the DeFi sector, causing its members to want decentralized everything, even insurance. This opened up the space for decentralized insurance firms, and a few stood up to the challenge, including one firm called InsurAce.

What is InsurAce?

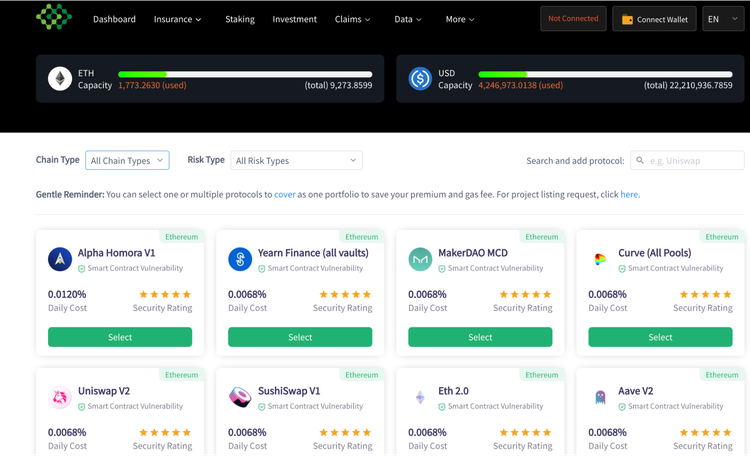

InsurAce is a leading decentralized insurance protocol that offers its clients reliable, robust, and secure insurance services. It focuses on DeFi users, and it guarantees unbeatable portfolio premiums, according to its website. However, it also claims to offer sustainable investment returns.

Essentially, the project offers to insure smart contracts against hacks, and allow users to secure their investments against risk. And, given the amount of risk that the crypto industry has, this is likely to be welcomed by a lot of users of the DeFi sector.

The project recently also announced the launch of a full-spectrum, multi-chain insurance service on its Ethereum-based dApp, which will provide insurance coverages to various protocols on a wide range of public chains.

Why Multi-Chain Insurance?

Over the last 12 months, the DeFi sector has expanded to numerous chains. Even though it was born on Ethereum, a lot of other projects and companies recognized its potential, thus creating their own DeFi-oriented chains, or modifying the existing ones to support DeFi. Some examples include Binance Smart Chain — Binance’s second chain, made specifically for DeFi — or Huobi Eco Chain, also known as HECO.

InsurAce will cover both of these, but also Polygon (formerly Matic) Network, Solana and Fantom. So, as the DeFi grows and expands, so must insurance services in order to not exclude users and projects just because they operate on a different chain.

But, despite the fact that this is a great necessity, InsurAce will be the first decentralized insurance service to actually offer multi-chain support, thus gaining a lead in this sector of DeFi.

So far, it has already launched InsurAce Multi-chain v1.0, which went live just before the weekend, on May 21. As for the Multi-chain v2.0, it is currently still in development, and the project expects that it will be able to launch it soon, likely at some point in June.

InsurAce Also Insures IDOs

With the growth of DeFi and decentralized exchanges (DEXes), a new token launch model has emerged — IDOs. Essentially, this is simply DeFi’s version of initial exchange offerings (IEOs), and it stands for Initial DEX Offering. As many have likely assumed, it allows users to launch new DeFi tokens on DEX launchpads, which are tailored specifically for DeFi projects.

Well, as of last Wednesday, InsurAce also has a product that allows it to offer the industry’s first IDO insurance, and as such, it offers pretty much the widest coverage of possible risks in the DeFi sector. Currently, the project is unmatched, as none of its competitors managed to cover IDOs, or go multi-chain, which makes InsurAce the leader of DeFi insurance sector.