In the last decade, the blockchain industry has seen an explosion in innovation and adoption, and has grown to become one of the most promising new developments in recent years — due to the huge range of applications of the technology.

But it’s not perfect. Though there have been striking developments in terms of blockchain capabilities and versatility thanks to the advent of Proof of Stake (PoS) consensus systems, even these suffered from several significant limitations — until now.

Here, we take a look at how a next-generation cross-chain financial hub known as KIRA looks set to tackle some of the biggest problems facing Proof of Stake networks today.

Liquidity

Right now, the vast majority of Proof of Stake (PoS) blockchains require individuals to lock up their tokens for a fixed period of time in order to be eligible to receive staking rewards, while some incentivize staking increasing larger sums to unlock additional rewards.

The economic theory behind this goes something like this. The greater the proportion of the network that is staked, the higher the chance that nodes will act honestly and in the best interests of the network, or risk being slashed. While those that put more at stake — either by committing to a longer lock-in period or by staking more — arguably contribute more to the security of the network and hence deserve greater rewards.

But this solution has a serious limitation, which can undermine the integrity of the blockchain. By staking tokens, users are no longer able to access them and hence gain utility from them. These tokens become a simple vehicle used for generating profit, rather than being used for their intended use case.

This has the knock-on effect of damaging the utility of the underlying blockchain, since more people will be incentivized to simply lock their tokens, rather than use them. Over time, this takes its tole on the community and user base, and the project can struggle to grow.

KIRA resolves this issue by introducing the concept of ‘liquid staking’ — that is, by allowing individuals to continue using their tokens even while they’re staked. It achieved this through the use of derivatives tokens, which are provided to users at a 1:1 ratio to their staked cross-chain tokens.

What’s so special about #KIRA?

— KIRA Network (@kira_core) January 28, 2021

💎stake any asset and earn rewards

💎 trade at the same time as you stake

💎 use other #DeFi at the same time

While their native tokens remain staked and earn rewards, users are free to use, trade, and stake their derivatives within the KIRA ecosystem — including its decentralized exchange (Interchain Exchange Protocol) and in Initial Validator Offerings (IVOs).

Security

Security is one of the biggest concerns for many blockchain-based projects, and the security of blockchain technology in general is widely considered to be one of its primary advantages over legacy financial applications.

As we previously touched on, for Proof of Stake blockchains, this security is derived from the stake that users must put up to either participate in the block validation process, or delegate to another node to do so instead.

Though this is somewhat successful in securing the blockchain, it does suffer from a major limitation — it’s too homogenous. This is because the only tokens that can be staked are ones that are native to a single blockchain, which ultimately leads to a single point or weakness, while limiting the absolute value that can be put up at stake.

In order to maximize the security of a blockchain system, users need to be able to not just its stake native assets, but also a range of cross-chain assets derived from a diverse array of other platforms. This not only removes the single point of failure, but also makes the system more inclusive.

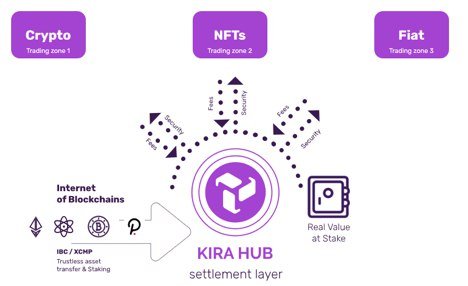

This is exactly what KIRA achieves with its novel Multi-Bonded Proof of Stake (MBPoS) consensus protocol, which allows users to stake practically any tokenized asset and contribute to the security of the KIRA ecosystem — while earning staking rewards at the same time.

Like most blockchains, the security of the KIRA Network increases as the total value of assets staked on the network increases. But unlike other blockchains, the absolute limit of this security is maximized due to the diverse range of assets that can be staked — which can include other cryptocurrencies, non-fungible tokens (NFTs), and even tokenized physical assets.