As the economy continues to struggle as a result of coronavirus-related lockdowns, mass unemployment and rapidly climbing government debt, savvy investors have begun looking for better ways to park their money — with the goal of avoiding the impacts of rampant inflation and protecting their finances during a time of economic uncertainty.

As a result, interest in Bitcoin (BTC) and gold — two assets largely considered to be uncorrelated from stock markets and forex — has increased dramatically, while both assets have shown impressive resistance to decline, despite the prevailing economic situation. Here’s why Bitcoin and gold have managed to buck the trend.

The Importance of an Uncorrelated Hedge

When it comes to investments, these can generally be split into two distinct categories: correlated and uncorrelated.

When discussing correlated assets, this usually refers to those that have their value closely tied to traditional financial markets, like the US stock market or currencies. As such, a negative change in traditional markets typically leads to a similarly negative change in any correlated assets, potentially sending the price plummeting when the market crashes. On the other hand, the price action of uncorrelated assets is independent of other markets and might increase, decrease, or stay the same if major traditional markets crash.

Because of this, uncorrelated hedges are widely considered to be an essential part of any diverse investment portfolio, since they can be used to preserve value when the market takes a turn for the worse — helping to minimize risk exposure.

Uncorrelated hedges are particularly important during times where major markets may be at risk of a sudden, dramatic sell-off, leading a dramatic reduction in value. These sudden cliff-edge dumps can occur after a period of rampant speculative activity, such as that seen since March this year. Most stock indices are at or close to their highest ever values, leading to speculate that a so-called "Minsky moment" may be on the way — potentially resulting in significant losses for those that are overexposed to affected markets.

However, finding uncorrelated hedges can be rather difficult, since most assets are at least partially correlated to the stock markets. A true uncorrelated hedge should be able to maintain its value irrespective of other major markets — and Bitcoin (and some other cryptocurrencies), as well as gold, are among the few assets that live up to the description.

Gold and Bitcoin as an Uncorrelated Hedge

For a long time, gold and other precious metals were among the only uncorrelated hedges available.

As a result, a large proportion of investors ensure they have at least some exposure to gold in their portfolio, as it has not only outperformed the US dollar by a wide margin, but has also outperformed many major stocks indices too — weathering all sorts of stock market crashes, sell-offs, and dumps to climb from $257/oz up to $1,971/oz in the last 20 years.

Bitcoin has also recently emerged as a popular hedge, since it is built around an entirely new economic system that draws no ties to traditional markets like the equities or currency markets. As a result, Bitcoin has appreciated in value for much of its existence, climbing from practically zero value in 2009, up to its current value of ~$11,000.

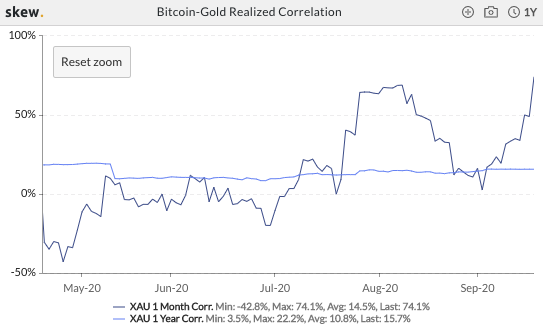

Although both gold and Bitcoin are uncorrelated with traditional markets, they are strongly correlated with one another. Since May, the correlation between the two alternative investment assets has increased dramatically, as both Bitcoin and gold defy the overall trends in traditional markets — gaining significant values since May. As a result, both Bitcoin and gold reached their highest value in 2020 just weeks ago, while gold reached its highest value ever, as an increasing number of investors look to hedge themselves against the potentially looming economic decline.

This has also seen modern gold-backed cryptocurrencies like CACHE Gold (CGT) appreciate in value in recent months, gaining 13% in the last three months alone. Since CACHE Gold can be redeemed for physical gold at any time, but can be transferred cheaply and easily just like a regular cryptocurrency, this makes it an attractive hedge for both traditional and cryptocurrency investors.