There are different ways to approach the DeFi industry. One option is to blindly throw money at projects hyped by influencers, youtubers and crypto groups. The other option is to do some research and only consider long-term investments in reputable projects with public team members.

A Quick Guide to DeFi Investing

Over the past few months, there has been a growing interest in decentralized finance. Concepts such as yield farming and earning interest allow cryptocurrency holders to make a lot of money. As is always the case when concepts like these arise, there is some cause for concern. Dozens of new DeFi projects are created every week, yet very few of them are effectively worth investing in. Even Vitalik Buterin, the co-founder of Ethereum, is alarmed and cautioned against people throwing money into yield farming.

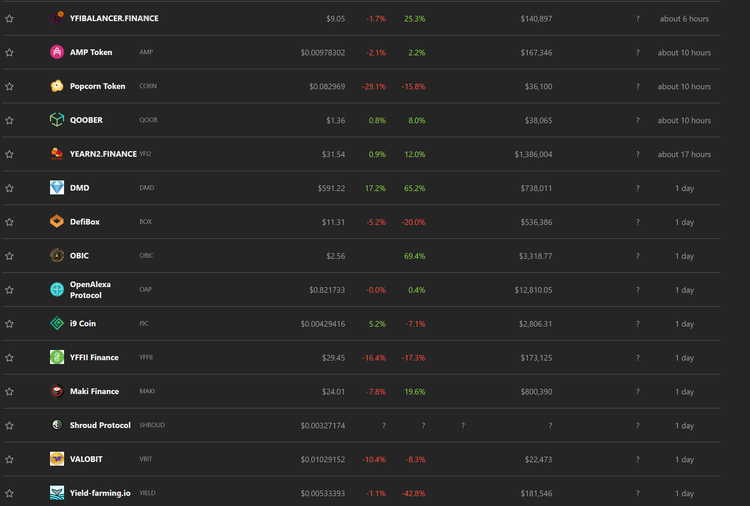

It is crucial to distinguish between projects in the decentralized finance space. The vast majority of projects have no public team members, smart contract code that may be buggy and unaudited, and tend to disappear very quickly. A growing number of projects fall into this category, as has become apparent in recent weeks. For investors - both newcomers and advanced cryptocurrency users, it is crucial to vet these investment ventures diligently first and foremost.

Legitimate projects are not that difficult to come by. They may not offer astronomical returns on investments within the first week, but that is only normal. Any project with high returns incurs high risks. In a lot of cases, it will result in investors losing part, if not all of their money in the process. Avoiding the obvious pitfalls simply requires conducting some basic research. Once money has been lost, there is no way of getting it back.

Avoiding DeFi Debacles like SushiSwap

Chasing quick profits is a natural aspect of human nature. Greed brings out the worst in people and tends to cloud their better judgment. The promise of earning annual returns of up to 5,000% would make anyone think twice. One such recent example is SushiSwap, a project that depicted potential but suffered from having an extremely greedy developer.

For those who missed the entire incident, a brief recap is in order. Eight days after launching this forked version of the Uniswap platform, the developer of SushiSwap decided to convert his portion of the SUSHI token supply to Ethereum. This decision was taken out of the blue, and allegedly as a way to "keep building and not having to worry about the token price." A greedy decision that caused the SUSHI token price to rapidly plunge to the bottom at $1.10, instead of $11.50 a few days prior.

While this incident was initially perceived as a potential exit scam, the outcome is very different. Under the huge crypto community pressure Chef Nomi has returned the 38,000 Ether to the SushISwap developer fund a few days ago. A community vote has determined the funds will be used to buy back SUSHI from the open market. With $14 million to spend, it remains to be seen if any real impact can be made in doing so.

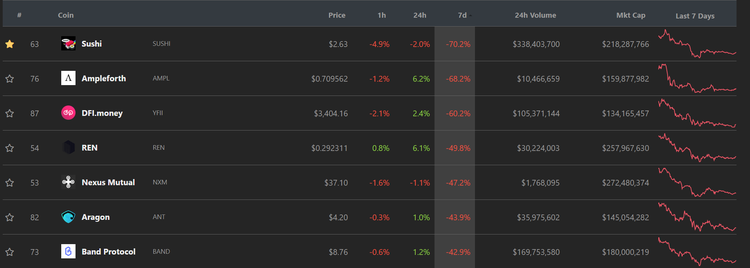

While the SushiSwap example is recent, there have been several projects that receive a lot of initial attention before petering out completely. Projects facing setbacks include ChainLink, Ampleforth, DFI.money, REN, Band Protocol and so forth. Some of these projects lost as much as 45%, indicating the momentum is shifting.

While innovation is known to be the main ingredient to success, many projects are simply copying existing concepts and luring greedy investors in with high returns that will never sustain in the long term.

Keeping all of the information above in mind, it's easy to figure what type of DeFi investments people should be looking for. Let’s compare the above to a project with solid fundamentals for us to see the differences.

Level01 - Working Product, Transparency, and Expertise

First of all, there needs to be a working product. Level01 has verifiable technology that can be accessed through the mobile application, which is available for download on the Google Play Store. Through the Android application, users can immediately begin to engage in peer-to-peer trading. All funds are tokenized and collateralized during a trade before profits are auto-disbursed by the smart contracts.

Second, any reputable project is transparent where its team members are concerned. For Level01, the founders are out in the open, and have a more than solid track record. Level01’s founder, Jonathan Loi has successfully founded AdvanceTC Limited Pro, a company that is publicly traded on Australia’s national stock exchange. The founders and team are often present at events to answer people’s questions and take suggestions.

Speaking of team members, Level01 differentiates itself by leveraging innovative technologies. Multiple experts in the field of quant analysis, big data, artificial intelligence, neural networks, derivatives pricing and risk analysis are contributing expertise and knowledge. All of these individuals have played crucial roles in major projects during their lifetime, making them invaluable for a project of this magnitude.

Groundbreaking innovation - FairSense AI

Powering the Level01 decentralized finance platform is the FairSense AI. At its core, this revolutionary artificial intelligence is developed to overcome discrepancies that can occur when achieving fair value. The AI provides valuation analytics through a variety of methods to form a never-before-seen derivative fair pricing instrument.

Observing and sequencing real-time cross-market variables in liquid financial markets provides Level01 with a very unique offering. This tool is used to provide consistent pricing analytics to all users of the Derivatives Exchange, eliminating slippage - a common problem in derivatives trading. On the other side of the spectrum, it grants retail investors a chance to submit offer prices for tradable contracts around the clock, improving liquidity and price discovery.

By taking this particular approach, Level01 affirms its focus on building durable solutions. This artificial intelligence-driven approach is designed to remain relevant decades from today, and FairSense AI has all the necessary aspects to make this vision come true. Combining years of research and development with speed, accuracy and transparency paves for future improvements.

The Long-term Game

It is not just the development side of Level01 that is based on a long-term vision. Everyone who invested in the project or its native LVX token is in it for the long term ROI. This is evident when nobody panic sells during the recent market crash because they know this is a solid project poised for success, similar to those achieved by Amazon, Facebook and Ali Baba, which took years if not decades to be where they are today.

In the cryptocurrency industry, or even in the technology space, it is crucial to put everything in its right perspective. Crucial developments are always long-term investments, both in terms of money and ongoing contributions. Seeing the platform grow and evolve in a steady pace highlights its potential that will not last just months or years, but rather decades.

Key Partners and Legitimacy

Many blockchain projects have no real partnerships with reputable companies. Level01 is a different creature. Their key partners include Thomson Reuters, Bloomberg and AG Delta, to name a few. These are giants and leaders in their respective industries.

Despite the transparent and borderless nature of blockchain, there needs to be some degree of legitimacy and credibility for projects that deal with money. Level01 has taken care of that aspect by obtaining the necessary accreditation from the Estonian government. As such, the platform is licensed for virtual currency and wallet operations globally. With proper licensing, Level01 can engage any party, including governments without any barriers, giving it a competitive edge.

Conclusion

Engaging with cryptocurrencies can trigger a wide variety of emotions. Both FOMO and greed are all too real, and will take over one's mind more often than not. Not giving in to these impulses may seem difficult at first, but losing money is anything but a fun experience. There is no point in chasing profits on paper that will vanish in a snap when hyped-up projects crash, whether by design or when the music stops. Distinguishing between viable products and everything else is crucial, especially when there's money on the line.

By comparing Level01 with SushiSwap, we can see the differences are obvious. One has a working product, strong and public team, serious investors and several key partners in place. The other has suffered a massive liquidity problem and is now in the hands of someone else entirely, with no real future ahead. For those who are serious about investing in this industry, separating the wheat from the chaff is mandatory.