There was a Black Thursday Bitcoin crash and everyone remembers how it swept through the market on March 12. And though the events of a few months ago may well be history, they still left a serious imprint on the market as a whole. Altcoin prices that have been on the rise ever since, frantically climbing up the capitalization ladder in recent weeks. And all of these events are inextricably tied in the wake of the global economy’s collapse.

Bitcoin is no longer king of the hill of price dynamics charts. Many altcoins that had been overshadowed by it over the past few months of even years are now outperforming it badly. The crypto media is having a ball on the matter, as channels of all kinds have picked up the buzz and are now plunging into the pits of juicy economic details regarding the decentralized finance market tokens that are hitting price surge percent bars by the day.

Yield farming is one of the resurgent factors contributing to the massive rise in prices. Along with it is the new-fangled total protocol value. Closing the trio of influencing factors are the mind-boggling interest rates being offered by various projects on their digital assets. Such considerable and previously disregarded price hike catalysts are contributing to the rally in the DeFi sector. Analysts note that the hyping interest in DeFi tokens is more palpable than even the advent of blockchain itself at the dawn of the underlying market.

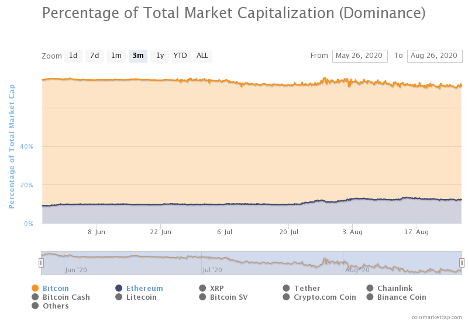

Bitcoin is feeling the heat more than any other asset as the price hikes of its competitors are breathing down its neck. The dethroned king of crypto is losing its dominance in the face of stiffening competition. But while low capitalization altcoins are pummeling through price barriers and reaching previously unfathomable caps, more prominent altcoins are still struggling with their former demons. Many are being left behind Bitcoin as wayward stragglers and that is giving investors new reasons to keep pumping cash into them.

The main altcoins that have stood the test of stability and have not succumbed against the backdrop of the DeFi frenzy are Ethereum and Cardano. At the same time, such “dark swans” of the past as Chainlink are climbing up the ranking. Dash is also in the lead and is toppling former competitors off their pedestals, as investors are expressing firm belief in its ability to keep rising.

On-chain analysis firm Santiment has been serving the market with its statistical data. The firm recently released an interesting prediction that has given investors and traders goosebumps. The market forecast states that a protracted correction is expected on the market. Once the hype around DeFi deflates, the market will start to return to normal, just as it had in the past with the ICO craze. The analysts are certain that the funds the DeFi market has detracted into its maw will eventually be disgorged back into the likes of Bitcoin and its long-time rivals, which are still seen as reliable old-timers. Such confidence on the part of investors is expected, considering that hype rallies have occurred in the recent past with inflating tokens that gradually crashed and burned like Phaeton.

Dash is seen as one of the main benefactors of the tribulations sweeping across the market. The daily charts show that the asset has recently made a full cycle of the golden cross. The phenomenon can be clearly observed in between the 50 and 200-day moving averages. The milestone threshold was breached on August 19.

Investors are known for their cautious approach to trading and often heed the advice of market experts. Mati Greenspan, founder and CEO of Quantum Economics, is one of the gurus of market dynamics who believes that a golden cross is a sure signal for an upcoming bull start based on technical analysis. He also noted that historical data is a clear indicator of potential opportunities that investors and traders should keep an eye out for.

One of the signals heralding the arrival of a powerful upward move for the altcoin market is the convergence of the 100 and 200-day moving averages. Dash is one of the leading digital assets that is set to benefit from such a conjunction.

Another expert, Florian Grummes, founder of Midas Touch Consulting, believes that Dash is one of the most promising assets on the market at the moment. The asset has recovered over 61.8% of its sell-off point value from the month of February. Back then, Dash took a nosedive from $130 to $33 over a course of four weeks. Then August came about and gave Dash a 220% boost to around $100, which, as Florian Grummes notes, is a typical Fibonacci retracement. He also believes that Bitcoin will continue to perform poorly while Dash will rise on par with the bigger players and become a low-risk asset.

Clear Sailing Ahead

The DASH/USDT pair may be looking forward with glee and expectations of more meteoric price rises, but some factors should be considered before investors decide to take the plunge and go all in.

The lower highs and lower lows have yet to be breached. Dash has yet to set them on the daily 4-hour timeframes and investors are eagerly waiting. In addition, the charts show a declining trend line taking root from the $105 local high mark. Even more interesting is that it is pushing over the 20-MA level and giving plenty of food for thought regarding the asset’s further movement.

The presence of a golden cross is not a proverbial “be all and end all”, and neither is it incontestable proof of Dash’s impending bullish near future or a rising trend. Traders should heed Grummes’ advice and never merely trust dynamics when making bets and placing trades on the open market, especially one as volatile as the DeFi digital assets market.

Had the 20-MA and descending trend line been breached, then the presence of a bullish run for Dash would have been more apparent. But the visible range indicator of the volume profile is still hovering on a high mark around the $90.90-$92.25 region. It is also aligning with the 20-MA and the descending trend line, thus giving clear signs that can be read like the writing on a wall.

The 4-hour Stoch RSI is moving away from the oversold field as well. In addition, it is doing so along with the moving average convergence divergence. But those indicators alone are not enough grounds to make any sudden moves or derive any conclusions. The sell volume is yet to be exceeded and investors and traders should think twice before deciding that the bullish run has already begun.

The convergence of the signal line and the MACD on the 4-hour or daily moving average convergence divergence are the signs that are being most expected. Those relying on technical analysis instruments in their trades may still have the chance of seeing the long-awaited phenomenon, and are likely waiting for it. The signs of the commencement of a bullish run for Dash are starting to form as the RSI has dived below the midline and breakout has skipped the 50 mark.

The best strategy under the given circumstances is to wait for support to be achieved at the 38.20%. The 38.20% corresponds to $91.03 and 50% $93.68 respectively at the Fibonacci retracement levels. The price of Dash is a volatile one and it has good chances of offering pleasant surprises to its followers.