Cryptocurrency trading is becoming a popular means of profiting from the emerging cryptocurrency industry - other means include crypto mining and buy-hold investing. You can trade legacy coins, altcoins, crypto funds and crypto futures by exploiting opportunities in the demand and supply dynamics of crypto assets.

For cryptocurrency traders, the cryptocurrency exchange that you use has a significant influence on the success of your trading activities. This piece provides a comparison review of Currency.com and BitMEX to help you make an informed decision in choosing a crypto exchange that is likely to give you the best trading experience.

Introduction

Currency.com was founded in 2018 by the leaders of VP Capital and Larnabel Ventures. It is the first regulated tokenized security exchange in the world. Currency.com provides its users with an innovative service for leveraging cryptocurrencies as an access point for trading in a variety of financial assets including commodities, stocks and bonds. Currency.com simply provides its users with an opportunity to conduct their crypto and stock trading activities on a single platform.

BitMEX was founded in 2014 by the trio of Arthur Hayes, Ben Delo and Samuel Reed. Ben Delo is reportedly considered to be United Kingdom's first billionaire who made his fortune from Bitcoin and he is regarded as the country’s youngest self-made billionaire. BitMEX provides a platform for cryptocurrency traders to make leveraged trades with their trading capital by allowing them to borrow funds to trade cryptocurrencies.

Currency.com VS BitMEX: Use Cases

BitMEX predominantly allows traders to place leveraged crypto trades to get exponential returns with minimal trading capital. Leveraged trading provides traders with exponential returns on their trading capital through multiplier contracts. Leverage on BitMEX is determined by the Initial Margin and Maintenance Margin levels, which specifies the minimum equity a trader must hold in their account to enter and maintain trading positions. The downside to leveraged trading is that you could lose all of your trading capital if the trade doesn’t go as expected, and you might be liable for covering the difference.

Currency.com exists to provide cryptocurrency holders with access to the regulated financial market without requiring them to first convert their crypto to fiat. Currency.com owns proprietary technology that integrates the crypto economy with the traditional financial market to provide crypto holders with access to stocks, bonds, commodities, forex and other assets. Currency.com’s tokenization of assets seeks to extend the appeal of cryptocurrencies to market participants who are interested in legacy assets. Interestingly, Currency.com also offers leveraged trading, and it allows users to use up to 500X leverage depending on the underlying asset being traded.

Currency.com VS BitMEX: Supported Assets

BitMEX doesn’t yet support trading on all the cryptocurrencies in the market - it currently only provides leveraged trade on Bitcoin, Bitcoin Cash, Ethereum, Cardano, EOS, Ripple and Litecoin.

Currency.com provides access to a long list of more than 1,500 top-traded tokenized assets and cryptos. Beyond the trading of crypto-crypto pairs and crypto-fiat pairs, Currency.com provides access to the trading of tokenized indices such as S&P 500, FTSE 100, EU 50, and FR40.

It also provides access to trade tokenized commodities such as crude Oil, Brent, Gold, Silver, Cocoa and Coffee. Users can also access tokenized stocks such as Boeing (BA), Apple (AAPL) and Tesla (TSLA). Currency.com also makes it easy to trade forex with currency pairs as well as government bonds without liquidating your crypto holdings.

Currency.com VS BitMEX: Mobile Apps

Currency.com offers on-the-go accessibility to its platform via mobile Android and iOS apps. Currency.com’s Android app has a rating of 4.5 stars out of 5 and you can read reviews from other users. The best part is that Currency.com has a responsive team with an active presence on the Play store to respond to any feedback on the users’ experiences with the app.

BitMEX offers mobile accessibility to users through a mobile-responsive version of its trading platform. However, we couldn’t seem to find any official iOS or Android BitMEX app that you can install directly from the iOS or Google Play stores. The only way to have a mobile version of the BitMEX trading platform is to visit the website on your mobile device and then add a shortcut to your home screen.

Currency.com VS BitMEX: Regulatory Oversight

BitMEX and its trading app and platform are wholly owned and operated by an incorporated entity in the Republic of Seychelles called HDR Global Trading Limited. However, it is not compliant with any known regulation in any jurisdiction. In fact, US customers specifically aren’t allowed to trade BitMEX contracts because the platform is not regulated in the US.

Currency.com is a fully regulated trading platform and it is compliant with extant AML and KYC laws, as well as data and customer protection laws. Currency.com Bel Company is regulated and authorized by the High Technologies Park of Belarus. It might interest you to know that Belarus has drafted its bespoke crypto regulations from scratch, and the country offers tax benefits for crypto activities to attract new business globally. Belarusian regulations award a legal status for tokens and smart contracts, and legalized operations related to mining, holding, buying, selling, distributing or exchanging cryptocurrencies.

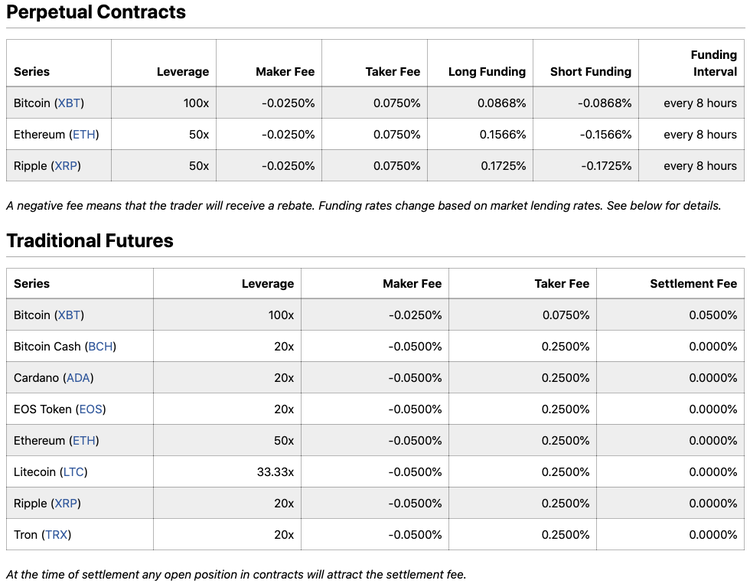

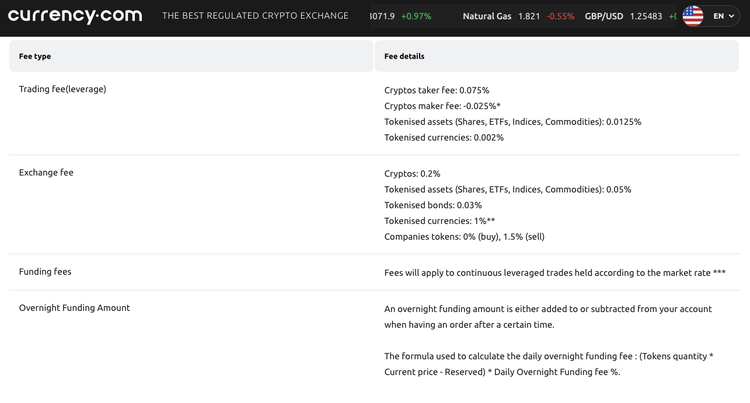

Currency.com VS BitMEX: Fee structure

BitMEX has a variable fee structure that is graduated based on the cryptocurrency, and the amount of leverage used. For instance, on Bitcoin (XBT) contracts with 100X leverage, BitMEX charges a maker fee of -0.0250% and a taker fee of 0.0750%. On Bitcoin Cash, BitMEX provides a 20X leverage with a maker fee of -0.0500% and a taker fee of 0.2500%.

Currency.com has a clear fee structure as it charges a taker fee of 0.075% and a crypto maker fee of -0.0025% on leveraged crypto trades. On leveraged tokenized assets and currencies trade, it charges a trading fee of 0.0125% and 0.002% respectively. On standard exchange trades, Currency.com charges a fee of 0.2% on crypto trades, it charges a fee of 0.05% on tokenized assets and it charges a 0.03% fee on tokenized bonds.

Currency.com VS BitMEX: Deposits and Withdrawals

BitMEX only accepts BTC deposits and its accounting model for profit or losses is represented in BTC numbers. Of course, BitMEX provides a USD price reference, but its main unit of accounting for deposits and withdrawals is in BTC.

Currency.com allows users to buy Bitcoin, Litecoin and Ethereum with credit or debit cards and you can make direct token deposits with BTC and ETH. The platform allows withdrawals in both crypto and fiat.

Currency.com VS BitMEX: Conclusion

The cryptocurrency exchange that you will choose will ultimately depend on the kind of features you want, the kind of assets you want to trade, the fees you are willing to pay, and other intangible factors such as the peace of mind from regulatory oversight.

If you want to choose an exchange based on longevity, it is obvious that BitMEX is the older of the two exchanges being compared. If you are predominantly interested in placing leveraged crypto trades, BitMEX is the obvious winner because it was intentionally built as an exchange for leveraged crypto trade.

If you want an exchange operating under clear regulatory oversight, Currency.com is the clear winner. If you want to buy cryptocurrencies with credit or debit cards or if you’ll love to make fiat withdrawals, Currency.com is the best exchange for you. If you also want to use your cryptocurrency holdings as a gateway to access other traditional assets such as stocks, commodities and bonds; you agree that Currency.com is the best exchange.