In 2013, Indonesia was considered one of the most promising countries for the development of the cryptocurrency industry. The economic and demographic situation in the country catalyzed the growing interest of the public in Bitcoin and blockchain technologies. Subsequently, there was a reaction from the state and the central bank. What is happening in the country now and how has the attitude to cryptocurrencies changed over the past few years?

Indonesia ranks fourth in terms of population and fourteenth in terms of territory. Just under two million square kilometers are home to over 260 million Indonesians. Indonesia is among the Next Eleven group, as a country with a promising economy, which, in the future, can become a push factor in the international economic system. On average, the country's GDP grows by 5% annually, which is typical for developing countries.

However, the country is not developing evenly. The population has access to telecommunication services, but it is often deprived of the opportunity to use banking services. At the same time, banks in Indonesia are among the world leaders in terms of profitability, due to the cost of services for the population and various commissions. Together taken, these two factors result in the real interest of Indonesians in cryptocurrencies and blockchain technologies. As a result, in 2014, it became possible to buy Bitcoin in more than 1,000 stores across the country, owing to the local cryptocurrency exchange. In 2018, the country’s central bank criticized cryptocurrencies, banning them as a means of payment. However, a year later, the government considered cryptocurrencies as commodities and announced the plans for the release of a digital rupee to strengthen the national economy.

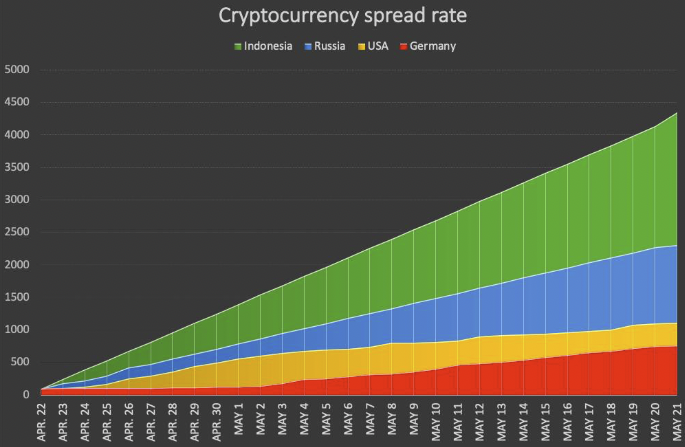

Meanwhile, interest in digital currencies among the population is still quite high. The ONFO blockchain project conducted an experiment aimed at identifying interest levels towards cryptocurrencies in different countries among the general public. The experiment was based on the “social mining” concept. Each participant received the project tokens for free and had the opportunity to get more free tokens for sharing the link to the cryptocurrency project among their friends and acquaintances. As a result, 4,350 people received information about the project from 100 initial users, that is, each user attracted 43 people unfamiliar with the project. In other countries, such as Germany, the USA and Russia, the results were 2-5 times more modest.

According to project founder J. R. Forsyth, such figures in Indonesia are the result of both the availability of banking services, as well as the number of cash transactions in the country as a whole, and the poverty rate among the population:

“Indonesia possesses the unique conditions that make it well-poised for Bitcoin adoption. As the world’s fourth most populous country, it’s home to a largely cash-based community, and huge swaths of the population — up to 80% — remain unbanked,” as stated by Forsyth, CEO of ONFO.

In 2013, the leadership of the largest Indonesian cryptocurrency exchange organized seminars and meetups to educate the population on cryptocurrencies. Seven years later, ONFO continues these educational activities under the new legislation in the country. According to J. R. Forsyth, training in practice without the need to invest can be more effective. This was the main, but not the only task of the experiment.

Today, amid the global crisis caused by the pandemic, Indonesia has high chances for a quick recovery, since the share of the services sector in the country's economy is relatively small - only about 40%, while the share of such services in European countries like Germany exceeds 70%. It is possible that these circumstances will also serve as a catalyst for the rapid development of a new digital economy in the country.