Let’s face it. The vast majority of cryptocurrency exchanges don’t go far enough to ensure their traders stand the best chance of turning a positive return on investment. After all, they still get their trading fee whether their traders make a winning or losing order.

With that said, a growing number of exchanges are introducing tools and features designed to help traders grow their profits in more ways that one. Here, we take a look at four of the features we think traders should look out for when choosing a new cryptocurrency exchange.

Leverage Options

Since cryptocurrency exchanges first appeared in 2010, the variety of tools and features they offer have evolved considerably. Nowadays, modern exchanges offer a huge number of features that traders can use to boost their success and maximize their profitability.

Among these, the capacity to trade on leverage is arguably the most significant upgrade to the cryptocurrency trading space, since this allows traders to amplify their exposure to already volatile markets, turning what would otherwise be modest gains into colossal profits.

However, the feature is typically only available on a particular type of cryptocurrency trading platform, known as a derivatives exchange. These platforms allow users to go long or short on the market, ensuring they can profit regardless of how the market moves—which when combined with leveraged trading can lead to some staggering gains.

There are currently dozens of different platforms available for leveraged trading. StormGain stands apart from most due to its industry-leading maximum 200x leverage, whereas Deribit is also a popular choice for those that prefer to trade Bitcoin options.

Excellent Customer Support

Cryptocurrency trading can be a challenging experience—and not just for inexperienced traders. Since most cryptocurrency exchanges support a huge number of cryptocurrencies, offer a wide variety of tools, and cater to multiple demographics, it’s only natural that issues will occur every now and then.

Despite this, most cryptocurrency exchanges struggle when it comes to customer support. They often host a huge number of clients, but have far too few or improperly trained support staff on hand to deal with customer complaints and concerns. This can leave traders in limbo, struggling to get the help they need, while potentially suffering financial losses in the meanwhile.

Fortunately, it isn’t all bleak when it comes to customer support on cryptocurrency trading platforms. Some exchanges, including the likes of Coinbase and Gemini are bucking the trend, offering excellent, easily accessible customer support on-demand through a variety of mediums.

Never underestimate the importance of prompt customer support, it can be a lifesaver under the right circumstances.

Savings Products

Although cryptocurrency exchanges are primarily used for trading, customers generally only use them because they plan to turn a profit using the platform.

However, the vast majority of cryptocurrency traders leave their funds idle in their exchange accounts most of the time. Unless these funds are locked up in open orders, they are not being used for any potentially profit-generating positions—at least this was the case until fairly recently.

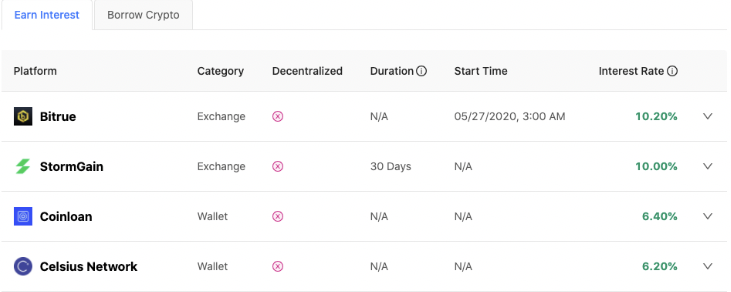

Now, several cryptocurrency trading platforms are beginning to provide users the opportunity to turn a safe profit on their crypto balances, without losing access to their funds through simple savings plans.

StormGain currently stands out among the platforms that offer this feature, since it provides a fixed return of 10% APR on any of the cryptocurrencies supported by the platform. Likewise, Binance offers a range of savings products for a huge array of cryptocurrencies, but these tend to offer a lower APR.

Overall, savings products represent an excellent way to maximize your returns by ensuring your deposits turn a profit even when they are not being used.

Staking Rewards

Similar to savings products, staking rewards are an excellent way to turn a profit on your cryptocurrency exchange balances while they are not being used for trading.

In short, these are the rewards that some blockchains provide to cryptocurrency holders that lock up their assets in order to help benefit the overall health of the network. The returns each blockchain provides varies based on a variety of factors, but tends to be in the single-digit range for most assets.

Why should you stake your #crypto on Kraken?

— Kraken Exchange (@krakenfx) April 26, 2020

We offer:

⚡ Instant rewards — no waiting or lockup periods

🏋️ The highest fixed returns in the industry

💕 Payouts twice a week

Find easy answers to common #staking questions in our new FAQ 👇https://t.co/OhJadFRHmn pic.twitter.com/PtsMkn16TD

As it stands, the vast majority of cryptocurrency exchanges still don’t offer staking functionality. That said, the feature is becoming increasingly popular, and a handful of exchanges, including Binance, Coinbase, and Kraken, have begun offering limited support for some coins.

Staking rewards can be an excellent way to supplement your trading income, but it’s important to be aware that staked coins often locked for a fixed period, during which the funds will be inaccessible.