BitMEX is largely considered to be a tour-de-force in the cryptocurrency industry and has dominated the market since its launch in 2014.

However, in the last year, a number of new players have entered the market, promising to bring with them an improved trading experience, more variety, and better features. Among these, StormGain has emerged as one of the most promising, thanks to strong fundamentals and a host of partnerships that have seen its usage explode in recent months.

With that in mind, let’s see how StormGain stacks up with the current market leader—BitMEX.

The Fundamentals

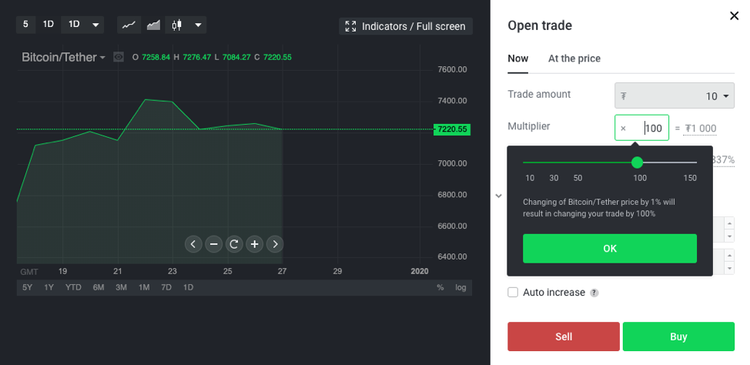

As margin exchange platforms, both StormGain and BitMEX allow users to trade on leverage to multiply their exposure to market movements. Fortunately, this is one area where both platforms excel, since BitMEX offers up to 100x leverage for its contracts, whereas StormGain offers a market-leading 150x maximum leverage.

BitMEX and StormGain both appear to understand the importance of keeping fees down to a fair level. As such, BitMEX customers can expect to pay a taker fee as low as 0.075% and receive a maker rebate of 0.025% for Bitcoin (XBT) traditional futures, whereas StormGain features a daily swap rate of between -0.04% (rebate) and 0.004%.

StormGain also offers conversion between cryptocurrencies through its instant trade feature, which is charged at 0.08% for most trade pairs.

Liquidity and Asset Selection

When it comes to selecting a cryptocurrency margin exchange, one of the most desirable features is a wide variety of assets to trade, since a large number of different derivatives contracts gives traders a good range of trading opportunities.

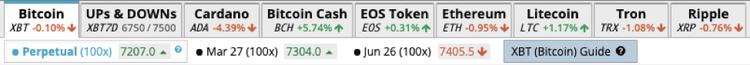

Fortunately, both BitMEX and StormGain have recognized this need for variety, and feature a wide range of different contracts available. In total, BitMEX offers contracts for eight different cryptocurrencies, including Bitcoin (BTC), EOS, Ethereum (ETH) and Tron (TRX). Most of these are offered as traditional futures with multiple expiry options, whereas Bitcoin also has Up, Down and Perpetual contract options.

On the flipside, StormGain more than holds its own in the asset selection department, by featuring a total of 23 different futures contracts to trade. This includes those for all the same cryptocurrencies offered by BitMEX, in addition to several others, such as Monero (XMR), Stellar (XLM) and OmiseGO (OMG).

Besides a strong asset selection, cryptocurrency exchanges need to provide users with ample liquidity, to ensure orders are executed quickly and without slippage.

This is one area where BitMEX really shines, since it offers arguably the highest liquidity of any Bitcoin derivatives exchanges on the market. Nonetheless, StormGain is close behind since it offers 100% liquidity for all of its trading instruments thanks to its partnerships with major liquidity providers and rapidly growing trade volume.

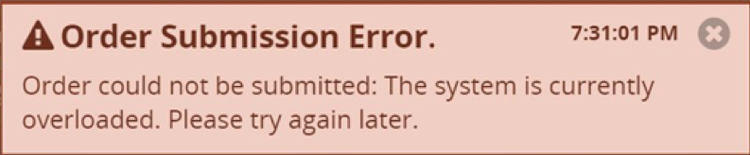

However, it should be noted that although BitMEX does have impressive liquidity, this popularity does bring with it an annoying compromise—system overload, which prevents orders from being executed due to excess server load. Fortunately, this is a rare issue, but it still occurs every now and then.

Usability and Security

As with any tool that deals with money, usability is a critical concern that must be considered by any platform that wants to provide a pleasant trading experience for its users.

With that said, many exchanges still have a long way to go in this department, and BitMEX is one of them. As it stands, BitMEX feels as though it was designed for experts, and could be difficult for newer traders looking to feel their way around. Nonetheless, its robust interface does contain a huge variety of tools that enable advanced trading strategies.

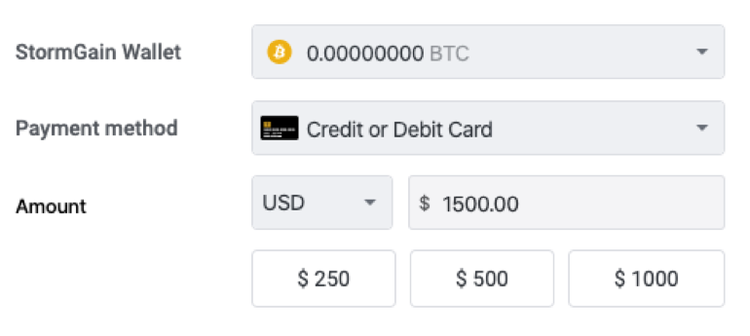

StormGain, on the other hand, appears to have been built with usability at the crux of its design, featuring a simple to navigate layout, in addition to flexible charting and order functionality. In line with this, StormGain also allows users to buy crypto with debit and credit cards, making it the more accessible of the two platforms.

In terms of customer side security options, both StormGain and BitMEX are roughly on par—featuring all the options you would expect from exchange platforms with a forward-thinking focus on security. Both platforms offer two-factor authentication (2FA) in the form of Google Authenticator, whereas StormGain also offers SMS verification. Likewise, BitMEX offers a security feature known as ‘IP pinning’, which essentially forces users to log out if their IP changes mid-session.

Aside from this, both platforms use state-of-the-art cold storage facilities to keep user funds safe while keeping only a nominal amount of funds in a hot wallet to facilitate fast withdrawals.

However, although neither BitMEX nor StormGain have ever been hacked in the past, BitMEX did recently suffer a data leak that saw the email address of thousands of users leaked after an employee mishap.

Tough Competition

As it stands, BitMEX is still considered by far the most popular margin trading exchange, whereas StormGain can be described as a promising upstart with the potential to shake up the industry.

As a newer exchange looking to penetrate the market, StormGain is really pulling out all the stops, including offering an up to 15% bonus on deposits and running regular promotions. Beyond this, the trading signals offered via StormGain’s mobile app and fiat deposit options make crypto derivatives trading more accessible than ever.

However, BitMEX still has the edge in terms of liquidity and the total number of trading contracts available, while its robust design aesthetic does have a certain appeal.

Nonetheless, the fact that StormGain was able to match and exceed BitMEX in some areas in such a short space of time indicates that it may not remain the number one platform for long, since newer platforms are now hot on its heels.