If you had invested $100,000 in Bitcoin (BTC) on November 13, 2016 ($702.03,) it would have appreciated to $1,255,423 ($8,813.80) by November 13, 2019. That translates into a 12-fold return on investment, hardly shabby by any stretch of the imagination. Bitcoin’s breakout year was 2017. It started trading at $998.33 per unit BTC on January 1, 2017 and closed the year on $14,156.40 on December 31, 2017. Savvy traders and investors would have cashed out just in time for Christmas on December 16, 2017 when the price topped out at $19,497.40 per unit BTC.

Of course, trading is hardly a perfect science, with speculation driving market prices in every which direction. The demand for cryptocurrency, it seems, is a function of many factors, not least of which is the public's perception of this contrarian asset category, and its applications in the real world. As one might expect, the greater the degree of integration between cryptocurrency and everyday technology, the greater the adoption. Crypto ATMs allow for quick and easy purchases of these treasured assets, but the mainstream appeal of such is limited. Therefore, it stands to reason that demand is directly correlated to speculator sentiment. When the mass market sets its sights on an asset class, demand increases and prices follow.

Experts routinely cite the ‘network effect’ as the primary reason for increasing demand. In a sense, it mirrors the traction of viral posts in social media circles. When so much energy is focused on a new asset class like crypto, merchants invariably want to cash in on it by facilitating its use on their platforms. Hence, we have seen a virtual explosion of interest in crypto-supported e-commerce platforms all over the world.

Increased publicity invariably leads to increased adoption, and this is precisely what is needed to drive up demand. True to form, the ICO market has an outsized effect on demand for cryptocurrency. Initial coin offerings, much like their stock market siblings, initial purchase offers, are hugely popular. Available through crypto exchanges, these ICOs accept investments in BTC or ETH, thereby driving up demand and prices for these cryptocurrencies.

Factors That Impact Pricing of Crypto

The greater the utility value of an asset, the higher its price. Of course, this doesn't apply to resources like water and air – both absolutely essential for survival. However, in the currency realm, digital currencies must serve a purpose to justify their price. Bitcoin is a P2P digital currency which has real-world applications. It can be traded, exchanged for fiat, used for investment purposes, or to facilitate value propositions.

Bitcoin can be used in place of traditional currency (fiduciary currency), while Ethereum is used for dApps (decentralized applications). Mining for crypto is also a factor to consider, since the more difficult it is to mine the cryptocurrency, the greater its cost. Not only is crypto extremely time-consuming to mine, it is increasingly difficult to mine. The costs are so steep that they are actually prohibitive.

By far the most important factor to consider vis-a-vis the pricing of crypto, is supply and demand. Given the scarcity of digital currencies like Bitcoin (capped at 21 million BTC), it stands to reason that investors and traders will eagerly get involved in this market given its finite nature. The rationale behind it is similar to the reason why people invest in gold and crude oil.

Demand Factors in Cryptocurrency Markets

If supply remains fixed and demand is increasing, it makes sense that prices will rise. Digital currencies with high limits face the opposite problem – supply exceeds demand and prices stagnate. Throughout it all, social media, news, and print media have a part to play in driving up demand for cryptocurrency. Regulatory constraints, or increasing liberalization of digital currencies can have an outsized impact on performance.

One of the great challenges facing digital currency operations is safety. Over the years, bugs in the code, hacks, and security breaches have had a big effect on the public's perception of cryptocurrency. Sometimes the security issues are so severe that the blockchain splits into multiple versions. This happened with Bitcoin and Ethereum.

When this occurs, it is known as a fork in the blockchain. This has a significant impact on the price of cryptocurrency. Anytime there is a scandal about a particular digital asset, this will be reflected in the price. These contrarian investment options are particularly sensitive to negative press, such as the sentiments of business leaders, government officials, central bank governors, and talking heads.

Inflationary pressures also impact cryptocurrency demand in a big way. If the Bank of England, the Bank of Japan, the Fed, or the European Central Bank decide to cut interest rates, this reduces the buying power of the money by flooding the market with more money. Since there is no benefit to holding money in a bank account, businesses and individuals pull their money out of fixed-interest-bearing accounts. Access to cheap money means that more loans are facilitated and this invariably weakens a currency. This has an effect on crypto too. As the USD decreases in value, so the price per unit BTC increases.

Cryptocurrency is a Nascent Market with Plenty of Growth Potential

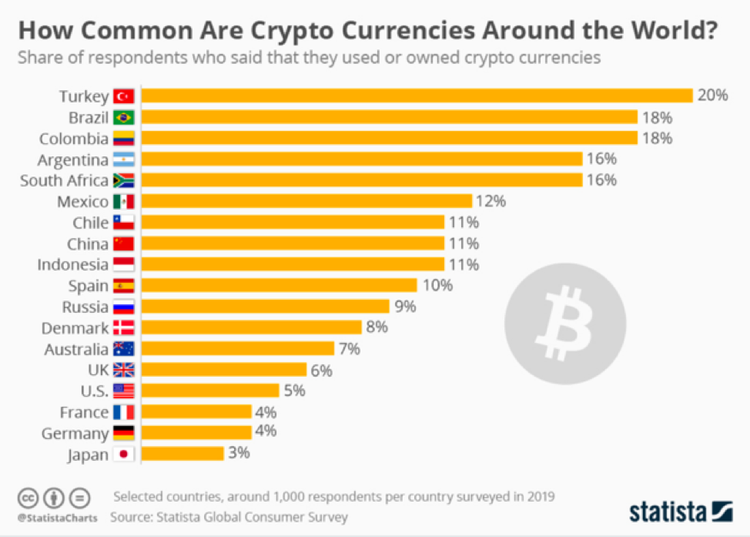

One cannot lose sight of the fact that the cryptocurrency market is insignificant compared to the fiduciary currency market. In late 2018, the world's monetary supplies were assessed at $90.7 trillion, with stock markets eating up an outsized portion at $73 trillion, followed by gold at $7.6 trillion, and $1.67 trillion in circulation. At the time, the total value of cryptocurrencies was merely $250 billion. As a young market, crypto has a long way to go before it gains widespread adoption. Consider that the daily volumes of Forex trading are estimated at $5 trillion +/-, while the equivalent volume of daily cryptocurrency trading hovers around $10 billion – $13 billion.

Given all these factors, it is clear that pricing is impacted by many opposing elements. Breakthrough technologies and cryptocurrency integration into the mainstream financial market will only serve to strengthen crypto’s appeal to the masses.