The Proof-of-Stake consensus algorithm (PoS) is becoming more and more popular in the cryptocurrency market. Even Ethereum co-founder Vitalik Buterin has long-term plans to switch from Ethereum to PoS. That’s not surprising, given that more than $7 billion are stored in PoS cryptocurrencies. Using PoS, anyone with the right know-how has the potential to earn up to 150% per annum on them.

Currently, two consensus algorithms dominate the cryptocurrency market: Proof-of-Work (PoW) and Proof-of-Stake. PoW supports the most well-known crypto in the world, Bitcoin. Here, miners, using huge computing power, find blocks in the blockchain and confirm transactions. Yet in spite of being used for such a high-brow coin, this mechanism has many flaws. One of the biggest is the amount of electricity it consumes, which not only cuts into the profits of crypto traders but also harms the environment.

The newer Proof-of-Stake consensus algorithm, however, is supporting the most innovative coins, such as EOS.

What are Proof-of-Stake and Staking?

Unlike Proof-of-Work, Proof-of-Stake is a much less energy-intensive mechanism, garnering the nickname the “green consensus”. Here, trust nodes act as miners. They also find blocks and confirm transactions. To become such a “miner,” a node must contribute a huge amount of coins to a deposit account in a process known as staking. The coins are then “locked in, ” meaning that the node cannot take back its money while finding blocks.

This protection is designed to ensure the node will work for the benefit of the entire ecosystem. In this way, the node cannot harm the cryptocurrency without its own money suffering, as well.

Nodes do not work for free. They earn on each extracted block and their coins, which generate a stable return on investments. In fact, the latter mechanism is very similar to a bank’s saving accounts.

Nodes not only earn money and confirm transactions, but also actively participate in the development of the entire cryptocurrency ecosystem, which is incredibly important for the project. “There is no magic pill that makes you rich, and the staking ecosystem is also full of concerning projects,” a representative of P2P Validator stacking service told CryptoHound. “In the case of solid projects, every person who stakes is contributing to the ecosystem security and becomes an active part of the project earning rewards for that kind of service.”

Nodes play a role similar to shareholders, having the ability to vote for key decisions in the system. In addition, they play long, giving up speculative earnings. P2P Validator says that because they are interested in the overall development of the project and its implementation in the real world, this can push the price of the respective coinage up.

With the development of PoS coins, many companies have begun offering customers ‘lazy’ staking. In this model, an investor turns his or her coins over to the company’s management, which handles transaction confirmation and other activities typically carried out by nodes.

In return, the investor benefits from the accrued interest on the coins. Sometimes, this can be up to 150% per annum.

Coinbase launched this type of service for institutional investors at the end of March 2019. The company is offering the opportunity to invest in a PoS cryptocurrency called Tezos with returns up to 6.6% per annum.

Another example is the Coinone Node project. Unlike Coinbase, it allows everyone to participate in staking. As the company told CryptoHound, most often investors prefer only two coins for investments — Tezos and Atom. Its customers invested $9.3 million through the service in the former, and $2.6 million in the latter. The yield ranges from 5% to 20%, depending on the cryptocurrency and other factors.

Moreover, according to Myunghun Cha, CEO of Coinone, the number of investments in 2019 is already three times higher compared to 2018.

According to Cha, Coinone offers investors three primary advantages over other platforms. The first is that anyone can receive passive income. Investment is not restricted to those with particular credentials or a high trading budget.

This model means that Coinone can be an excellent entry point for newcomers to get acquainted with the blockchain and invest in its development. And the openness of the platform involves investors in building a healthy ecosystem around distributed ledger technology.

“Provide opportunities for crypto-investors to exercise their influence on the blockchain ecosystem, and the blockchain ecosystem will be healthier by the participation of more individuals,” says Cha.

$7 billion and 150% per annum

Proof-of-Stake is gaining popularity. According to the PoS List, there are 140 cryptocurrencies in the crypto industry that work on Proof-of-Stake. Nonetheless, this is just 6.22% of the total number of cryptos (2,250) in the global crypto market.

At just 8% of the total market capitalization ($288 billion) as of June 20, 2019, the $23 billion total market capitalization of the PoS cryptocurrencies is still far from shabby.

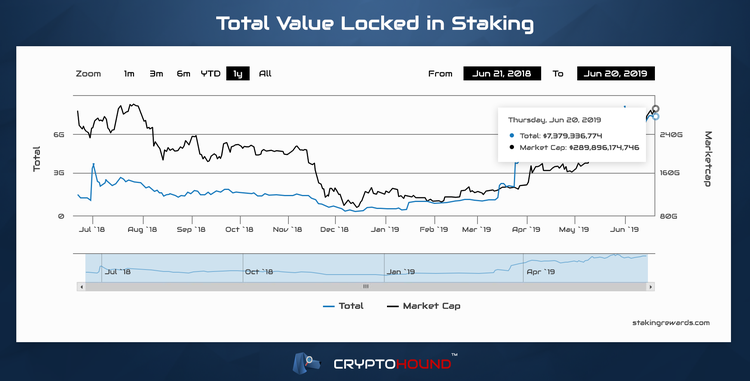

Despite the comparatively small numbers, PoS cryptocurrencies are developing by leaps and bounds. According to Staking Rewards, the total value of coins in staking was just $1.7 billion in June 21, 2018. A year later and this figure was nearly seven times higher, standing at $7.3 billion by June 20 of this year.

Most of those coins are locked up in the EOS blockchain ($3 billion). Among other coins with large stakings are Cosmos, Dash, Tezos, NEM, Tron, V System, and Lisk.

Although these cryptocurrencies have the most coins locked up in staking, they are far from the most profitable ones. According to Staking Rewards, EOS has the potential to bring only 1.84% per annum from crypto. Livepeer, on the other hand, offers more than 150% per annum.

The average yield of coins stands around 11% per annum. It is worth remembering that the higher the yield, the higher the risk of losing money. Therefore, it is worthwhile to carefully study the cryptocurrency and staking platform before investing money.

Where to stake PoS coins

Anyone can participate in the staking of cryptocurrencies, but there are some nuances. Coins set the lower threshold of investment in staking, which not everyone can afford. Another problem is that with direct staking, the user has to become a node and confirm transactions. Not everyone has the necessary equipment, knowledge, capabilities, or desire for it.

In this case, staking services provide a convenient solution. They assume responsibility for the client’s coins and handle the mining and confirmation of transactions. In return, the user just receives a return on the investment.

Staked is one such service. It offers 11 cryptocurrencies, with yields ranging from 0.1% to 158%.

P2P Validator is another, offering a curated collection of four PoS coins: XTZ (Tezos), Atoms (Cosmos), Luna (Terra), and IRIS (Iris network).

“All projects have different economics and annual return on staking varies from 7% to 12%. These values may rise or decline depending on the current parameters of a particular project. We will accept delegations for Solana, Dfinity, NuCypher, and Polkadot when they will launch on mainnet” (sic), P2P Validator told CryptoHound.

There are dozens of staking companies out there, each with different advantages. Here’s how the top 30 stack up against each other.

Pros and cons of staking

Staking, like any other investment, has its pros and cons. Among the advantages are simplicity and profitability. The user needs only to give their coins to a service to start getting profit.

Risks are also present. For example, most staking coins are kept in hot wallets, which are easy targets for hackers. Some services, however, are aware of this threat and have learned to level it.

Blockdaemon is one platform that has tailored its storage to changing security needs. “We offer self-custody and allow the user to select/work with their preference,” CEO and founder Konstantin Richter told CryptoHound. “It depends on the protocol if they require hot wallets and their delegation principles. Nodes with hot wallets are managed in our own DC and aren’t accessible via our platform.”

But perhaps the biggest problem is the lack of investor protection. This applies not only to staking but to the entire crypto industry. The Quadriga case, in which all the wallet keys of the Quadriga crypto platform were supposedly held only by the CEO, showed that poor management can lead to millions in investor losses.

Therefore, when choosing a staking service, it is vital to research the team and reputation of the company along with the PoS coin itself. If there is any doubt about the service’s security or credibility, it is better not to entrust your money to it.