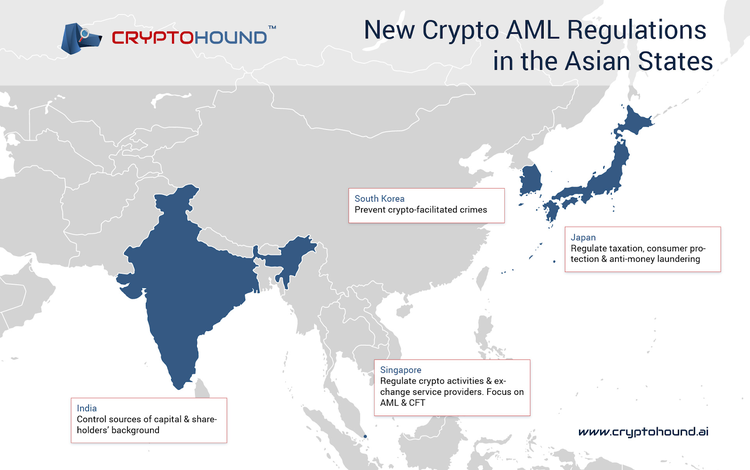

Asia occupies an important share of the global cryptocurrency market. Naturally, this has attracted the attention of hackers and other criminals. Bitcoinist reports that Japan alone witnessed a 900% increase in suspected money laundering in cryptocurrency in 2018. Key Asian states are now experimenting with a number of new policies to combat money-laundering linked to virtual currencies. CryptoHound has prepared this article to provide a brief overview of what those are.

China

China remains one of the countries with the hardest stance on cryptocurrencies. Money-related organizations are prohibited from dealing on crypto exchanges; ICOs and local trading platforms are also forbidden. Nonetheless, China turns a blind eye to mining and the use of remote crypto exchanges.

In 2019, the central bank of the country aims to stiffen anti-money laundering regulations by imposing a new series of restrictions on financial institutions. The China Banking and Insurance Regulatory Commission (CBIRC) recently issued a policy document designed for improving banks’ AML and CFT practices with regards to tracking sources of capital, background verification of the shareholders and executives, and the establishment of respective positions within the company. All the AML/CFT procedures are filed in an internal database so that the government is able to assess their effectiveness at any time.

India

India is still on its way to regulating cryptocurrency operations. As of the date of writing, there is no prohibition on crypto trade, although virtual currencies are not considered legal tender and there is no clarity with regard to their taxation.

Since 2018, local banks and other money-related institutions have been banned from settling or managing digital monetary forms. These measures were undertaken to win time for developing more comprehensive legislation. As of 2019, India is close to issuing new cryptocurrency regulations encompassing areas such as taxation, consumer protection, and anti-money laundering.

Japan

Japan is among the most advanced states in terms of cryptocurrency regulation. Since 2017, virtual currencies have had the status of legal assets and are taxed, as other income, at rates between 15% and 55%. Japan has always been a friendly country for crypto traders; however, a recent series of big cyberattacks have forced authorities to stiffen regulations. As a result, cryptocurrency trading platforms now have to comply with stricter AML and CFT criteria and are under the supervision of Japan’s Financial Services Agency.

March 2019 marked the introduction by the Japanese financial regulators of new regulations tackling margin trading (trading financial assets borrowed from a broker). The news agency Nikkei reports that these regulations limit leverage in cryptocurrency margin trading at two to four times the initial deposit. New regulations will provide closer monitoring of cryptocurrency operations, similar to that of the securities trade. The government’s aim is to implement just the level of supervision required to prevent Ponzi schemes or ICO fraud.

Singapore

Trading and exchanging virtual currencies is legal in Singapore and goes in line with its global positioning of itself as a Smart Nation and a major financial center. For tax purposes, virtual currencies are treated as “goods”. Singapore is currently working on creating a clear regulatory framework for regulating the crypto sector.

The Monetary Authority of Singapore (MAS) is quite friendly with regards to adopting blockchain and cryptocurrencies. Its top priority in 2019 is to regulate crypto payment, trade, and exchange service providers. The upcoming bills will focus on AML and CFT regulations.

South Korea

Digital exchanges in South Korea are legal and required to comply with strict regulations. Digital currency exchanges are subjects to 22% corporate tax and a 2.2% local income tax.

Despite rigorous supervision and advanced security measures, crypto exchanges in South Korea have often become the victim of cyber attacks. In light of this, four major South Korean cryptocurrency trading platforms (Bithumb, Coinone, Corbit, and Upbit) have initiated a joint anti-money laundering initiative aimed at preventing the level of crypto-facilitated crimes. The initiative lets exchanges share important insights about suspicious activities with each other via an internal hotline.

Summary

Asia is a very promising crypto market. Nonetheless, the absence of an advanced legal framework makes local crypto businesses vulnerable to cyber attacks and money laundering schemes. The general trend for 2019 at the governmental level across the region is focused on introducing further AML/CFT regulations to ensure the transparency of the sector. As those regulations are not yet a reality, Asian states tend to either partially ban or strictly supervise the activities of organizations dealing in virtual currencies.