Last week the fall in cryptocurrency capitalization stopped at $120 billion. Altogether the fall since the beginning of this year amounted to a total of 85%. In 11 months, the cryptocurrency market has lost more than $700 billion, which is approximately equal to the capitalization of Google. On November 25, a correction began and the market won back $20 billion.

Tim Draper, a billionaire from Silicon Valley, doesn’t care about the loss of a several hundred billion dollars in the crypto world. Draper believes that cryptocurrency will inevitably replace fiat money. This will happen when you can easily and safely invest in coins, as well as spend them in familiar stores. Investment security is guaranteed by the Bakkt cryptocurrency platform, which will be launched in January 2019. New York Stock Exchange Chairman Jeff Sprecher is also ignoring the current collapse. The launch of bitcoin futures on a regulated exchange will allow you to avoid price manipulation, which is not at all controlled by many exchanges.

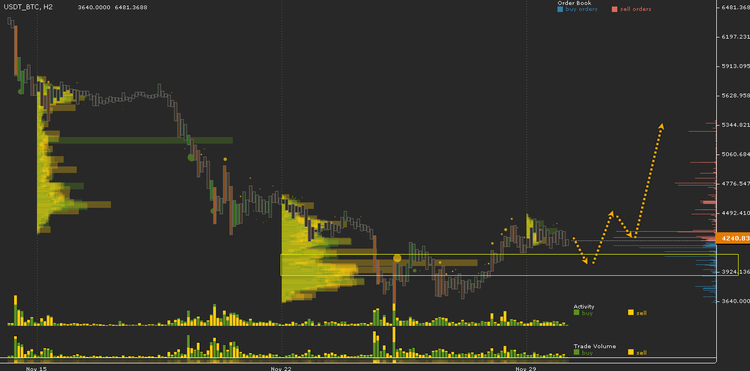

The price of bitcoin fell to the first long-term goal of $3,650. As is usually the case, the price rebounded from the support and overcame $4,000.

Daily FX analyst Nick Cayley expects a new drop to $2,900. At this level, two long-term support intersect the base of the rollback, which formed last fall, and the classical level of momentum on the Fibonacci grid. The price of bitcoin will fall to $2,900, if not kept at the current level. While the support turns into resistance, the rate will continue to drop down to $1,500 and lower.

Growth from $3,600 is limited by the resistance in the $4,500 area. Sellers prevailed at this level. If it is still relevant for them, then they will manifest themselves again. The way the price reacts to this will tell you who will have the advantage. If bitcoin’s price breaks the $4,500 mark, corrects for it and pushes up, then the probability will be in favor of growth. In this case, the scale of growth will increase and it is quite likely that a massive buying of the coin may begin, which will push the price to at least $ 5,300. If there is no fixation on $4,500, then the probability will be in favor of a new fall to $3,600 and below. According to the classical technical analysis, the 4th wave is being formed now and 5th to $3,600 should follow. After the fifth wave, bitcoin is will be waiting for growth.

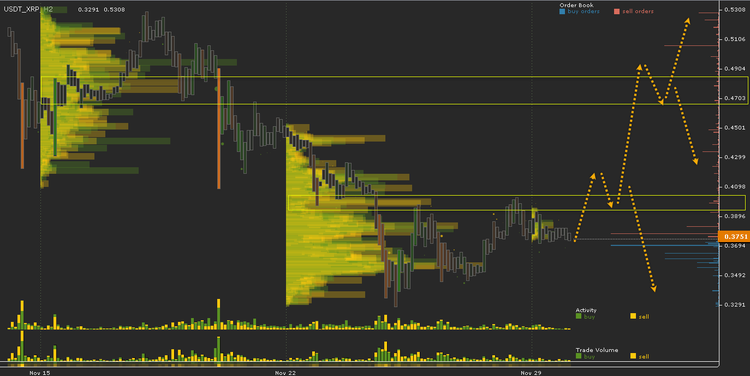

Ripple is releasing the fourth version of the cross-border payment service xCurrent. In the new version, you can connect to xRapid liquidity and use the XRP coin for greater transaction speed and lower commissions. Prior to this update, many RippleNet partners used xCurrent. The rate of the coin is trading at the peak of the correction to growth from September 2018. The price of the cryptocurrency, unlike many, has so far maintained its position.

After reaching a peak of $0.33, demand sharply increased. Buyer volumes pushed the price up to $0.4. The course of the coin just rested on the resistance, from which the previous week collapsed. Ripple has support, but whether it’s more than the sales volume will be clear when the $ 0.4 mark is broken. If the price turns up in this area, it will mean meant that the buyers have a clear advantage. From this, it is expected that the main resistance of the entire rollback to be in the region of $0.5. A turn at the main level may cause a rise to the peak of the upward movement of $0.8. If the fixings and reversals at these marks do not occur, then, most likely, the price of the coin, like the majority, will update its long-term minimum.

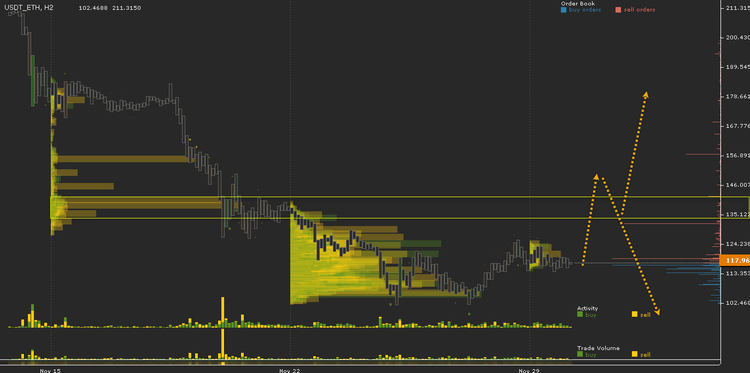

Last week the executive director of the TRON project Justin Sun suggested that the developers of ethereum move their token to the TRON platform. Ether’s price stopped at a psychological level of $100.

The graph has formed a double bottom according to the classical analysis, which is essentially flat. Sideways movement is formed above the resistance of $135, which protects the fall from $220. Therefore, the upper limit of the flat would be better to move from $125 to $135. This structure creates two options for further movement: either a false breakthrough of the $135 level and a return to $100, or a fixation at $135 and a turn-up. In any case, as long as the price of the ETH does not overcome the boundaries of the flat, it will fluctuate in this corridor. The turn at the lower border of the flat can double the rate of the ether. A U-turn may complete a long-term fall. For the second week in a row, there are large orders for buying Bitcoin Cash ABC from $80 to $125. The course of the coin, as well as the price of the air with the general growth, could not overcome the resistance of $220.

Although there is strong support in the $100 area, current purchases slightly prevail over sales. The correction, which began on November 15, may develop into a downward trend. This will happen if the rate of the coin does not unfold to $220. Fixation and reversal at $220 will be the signal for the beginning of the short-term uptrend. The price under such conditions will rise to at least $350.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.