It seems that the U.S. Christmas season tradition know as “Black Friday” during which everything goes on sale has touched the world of cryptocurrency too. Over the past week, most of the prices from the first hundred have fallen by an average of 30%. The capitalization of the coins broke through the support over which the courses had been held since February 2018. Now prices are in free fall.

Regardless of the fact that since the beginning of this year, the cost of bitcoin has dropped 4.5 times, financial analyst Tom Lee is still waiting for it to rise to $15,000 by the end of 2018. However, earlier the strategist’s predictions of growth were a lot more optimistic and around $25,000. The current drop occurred due to panic, but the arrival of institutional capital and control by U.S. regulators will change this situation, claimed Lee.

A grain of truth can be found in the words of the Wall Street analyst. Crypto asset prices are subject to such large-scale falls and jumps due to a lack of control over institutional capital. Volatility will change when most large investors start investing in it. In addition, the blockchain industry has not stopped and continues to evolve. Last week, the Swiss Stock Exchange SWX with a capitalization of $1 trillion launched a stock exchange product that includes bitcoin, ripple, ethereum, bitcoin ABC (bitcoin cash) and litecoin. Also, according to research by MarketsandMarkets, the global blockchain market will cost more than $7 billion by 2022 with an 80% increase every year.

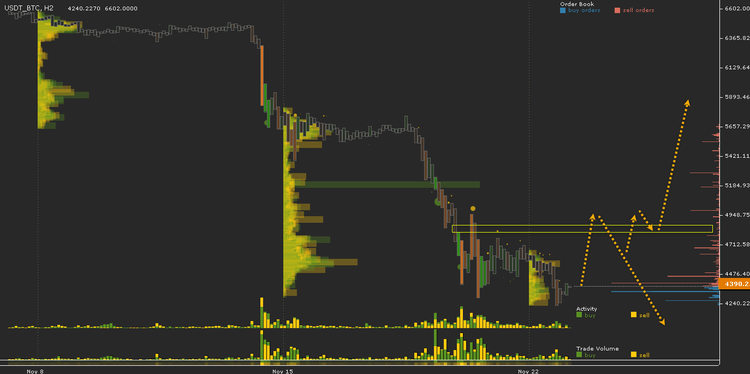

The sharp decline in the price of bitcoin from $6,000 was primarily due to the execution of sale transactions under this mark. For 8 months, the course was repelled 5 times from this support, which allowed many to buy at the proposed day of correction. The latest rise to $7,000 turned out to be false. The course broke through the upper limit of the converging triangle and captured buying orders. This alignment can not bother buyers and it is logical that they will begin to limit their losses by selling bitcoin.

As of December 2017, bitcoin continues its downward movement. Descending channels of medium and long-term periods, as well as the Fibonacci grid, show the following strategic levels: $3,650, $2,900, $2, 000 and $1,500. At the current trend scale, a drop to these marks is possible.

As long as the structure of the downtrend persists, the price will go down level by level. It is clear from the volume that optimism is still preserved. Although the price fell below the annual support, buyers are still continuing to catch the bottom. The largest volume of purchases, relative to the entire fall since November 8, is concentrated at $5,150. It is possible that in the region of $4,500 they were bought again. Therefore, when bitcoin reaches the rate of $ 5,150, traders can close their unsuccessful trades in the breakeven. This creates an opportunity for a large buyer to purchase large volumes at one price. If such a volume is filled and the price stays at that level, then the likelihood of a rise to at least $6,000 is high. To confirm this scenario, the course needs to turn around at roughly $ 4,800.

CIMB is the fifth largest bank in Southeast Asia to join RippleNet. Ripple chief strategist Corey Johnson believes that the blockchain-based company is the most advanced yet. The platform has about 100 customers. The price of cryptocurrency has reached the bottom of the flat, which has been forming since the end of September. This sideways movement is a pullback to an uptrend from $0.25. Ripple, unlike many coins, has kept its growth structure.

After reaching the bottom of the flat, the volume of purchases increased dramatically. There is support for the coin, but the overall picture of the market may affect the mood of the traders. In this case, a bitcoin-like scenario may repeat with ripple. After rolling back up, buyers will place protective orders below $0.39. If after that the rate reaches this mark, then due to the orders it may fall to $0.275. Growth requires fixing and turning at the upper limit of $0.515.

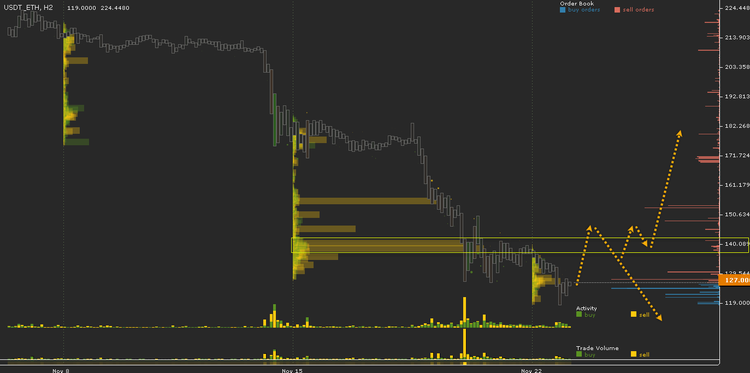

Descending channels of different periods and the Fibonacci grid show two ethereum supports $100 and $23. If in the near future the advantage does not change in favor of the buyers, then the goal of $23 per ETH will become quite real.

Judging by the volume, optimism over the ether is not observed, in contrast to bitcoin and ripple. Apart from the loss of the second position on capitalization, a small amount is now invested in this coin.

This does not mean that this is the end of the cryptocurrency. On the contrary, the first makings for growth appeared at the beginning of the week. November 20-21, the largest volumes were sold for the entire fall of November 8. At the same time, the price continued its sideways movement. It is possible that someone bought on a large scale at these levels, but to confirm the growth, it is necessary to fix and turn at the previous resistance of $140. Otherwise, the probability is in favor of the downward scenario.

The bitcoin cash hardfork has further derailed the coin’s price. After splitting the cryptocurrency into two: Bitcoin ABC and Bitcoin SV, the coin almost immediately lost $100 in price, as Roger Ver supported the ABC network, the price of the currency even before hardfork overcame all support.

Regardless of negative events, investments were made around $200 - $280 into the cryptocurrency. The last selling pressure appeared at $230. If bitcoin ABC’s price turns around at this level, then there will be a chance for the formation of growth of the medium-term scale. If the advantage remains for the sellers, the price will continue to fall to at least $100.