Cryptocurrencies cannot be ignored, but institutionalization, elimination of volatility and transparent regulations will realize the full potential of virtual assets. This conclusion was made by the international audit company from the “Big Four” KPMG.

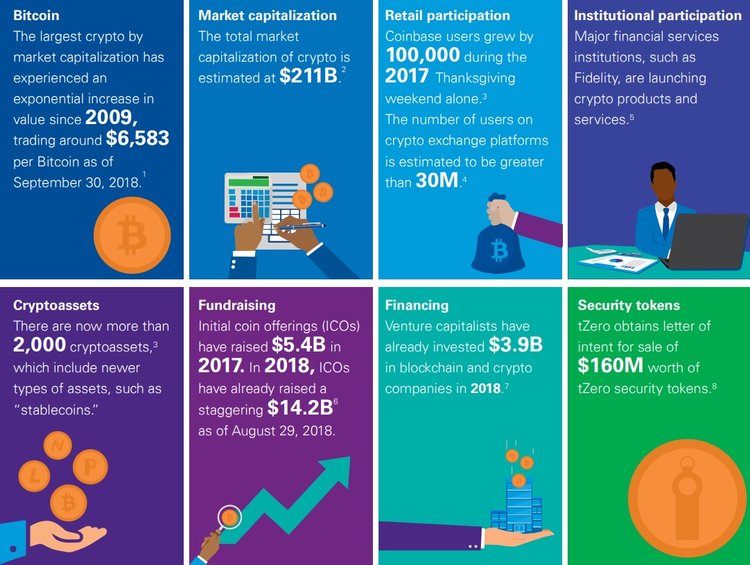

The company produced a report with the assistance of Coinbase, Fundstrat Globe Advisors and Morgan Creek Digital, which addresses the key problems of digital money and ways to overcome them. KPMG analysts have concluded that since 2017, cryptocurrency has been competing with traditional asset classes in terms of investment. In 2018, the competitiveness of digital currencies has strengthened new financial mechanisms, such as security tokens, stablecoins. Major companies also launch their own products and services associated with virtual money.

However, so far, cryptocurrencies still stand in the shadow of the traditional assets market, the cumulative capitalization of which exceeds $300 trillion, the report says. Experts believe that there’s a number of aspects that interfere with digital assets.

First, the market for virtual currencies is subject to volatility, but over time its importance will gradually decrease. Analysts believe the emergence of stablecoins is the solution to this problem. According to Coinbase representatives, digital money is suitable for people who do not have access to banking services to conduct transactions more efficiently, a counterpart to unstable national currencies and create a system that is not controlled by anyone.

Experts added that on the way to the widespread adoption of a new class of assets is a gap between their use and existing developments. According to KPMG, many of the existing crypto assets do not have functional solutions. Analysts point out that the additional obstacles that need to be addressed are the lack of a reliable clearing settlement system and problems during the forks of cryptocurrencies.

At the same time, KPMG researchers noted that the use of cryptocurrencies will become the norm in the future. However, this will happen only when financial institutions can engage in crypto activities without the fear of risk, and the regulation of the sphere will become clear and transparent. KPMG has developed standards for the cryptocurrency. Digital assets should perform the basic functions of money, that is, be considered a unit of account, a means of accumulation and exchange. Developers must also realize the possibilities of acquiring, transferring and redeeming digital money.

Analysts also noted that cryptocurrencies should eradicate their speculative nature in order to become a medium of exchange. However, many creators of virtual assets are quite satisfied with the rapid growth of their coins, according to KPMG. As long as at least one cryptocurrency will not meet all three criteria, they cannot be considered fully currencies, the report says.

The cryptocurrency market makes it unsafe not only due to the speculation but also due to the lack of an understandable regulation. Researchers at KPMG point out that reaching an agreement with regulators is indeed a daunting task, which the crypto community must nevertheless have to solve. A cryptocurrency business must clearly define what it proposes in order to designate its place in the regulatory system. As soon as the legal aspect of this business becomes clear and unambiguous, it will become much easier for large financial organizations to enter the industry, the researchers emphasize.

In general, analysts conclude that the cryptocurrency industry needs to go through a stage of institutionalization. The participation of a wider range of financial companies will help the tokenized economy to earn the necessary level of confidence and scalability, and also contributes to the growth and maturation of the cryptocurrency market, representatives of KPMG said. Institutionalization of the researchers called the large-scale involvement in the cryptocurrency business of financial and technological companies, banks, payment organizations, exchanges, and broker-dealers. The participation of such players will ensure broad acceptance of digital assets.

Institutional investors have a different set of requirements than those of retail consumers. For them, transparency, legal compliance, and government regulations are important in order to comfortably carry out transactions with cryptocurrencies. At the same time, many steps towards the institutional have already been taken. Crypto and traditional companies are creating new tools that will make it easier for such players to enter the crypto market.

For example, Coinbase has already received permission to create a custodial service for cryptocurrency in the territory of the State of New York. In December, the Bakkt platform will be launched. The crypto community often sees this event as one of the most anticipated events of the year, which will potentially contribute to a wider spread of cryptocurrency and the entry of investors into the market for digital assets of crypto.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.