Since November 14, the top five cryptocurrencies continued their long-term decline. The market capitalization of the coins returned to the values of November 2017. This brings us closer to the denouement in the long run, because that is where influential investors manifest themselves, in the long-term discussion, and it is they who have the power to influence prices.

Regardless of the total capitalization that is 4 times lower than it was at the beginning of the year, the head of Binance, the largest cryptocurrency exchange, Changpeng Zhao said in a recent interview with CNBC Crypto Trader, that he is still expecting growth. He appeals to the company’s trading volumes and bitcoin deposits as an argument in favor of this. Compared to the previous year, the volumes are still high, and the number of active bitcoin deposit users has increased. The exchange is waiting for institutional capital, which will be distributed across the cryptocurrencies.

The executive director of the ShapeShift cryptocurrency exchange, Erik Voorhees, is also expecting growth. In his opinion, the next global financial crisis will serve as a catalyst. The U.S. national debt has exceeded $20 trillion. The inability to repay it will affect people's opinions about fiat currencies. After the financial crisis in 2008, the U.S. interest rate fell to 0.25% and remained at that point until 2015. For the last 3 years, the committee has been raising rates. Now they have reached the mark they were at before the 2008 crisis.

The price of bitcoin has fallen from the respectable $7,700 level it reached in October. When support turns into resistance, the trends change. The level coincides because it was from this level that the previous trend began and purchases started, which influenced the price. After the peak of the reversed wave that had formed by the beginning of November, most of the buyers placed protective orders under it.

The price of bitcoin stopped at $5,400, but because of a sharp fall under this peak, buyers that invested in the $6,000 area at the beginning of this year can now place protective orders. In this case, the course will collapse below $4,000. To change the downward trend from $7,600 a similar scenario in the opposite direction is needed at around $6,300. Given the formation of the scale of the long-term wave, when going up at this level, the movement will be of a similar scale. If the resistance of $6,300 turns into support, then the price of bitcoin is likely to double. There is a possibility of a hidden reversal at this point when the correction to the uptrend is minimal.

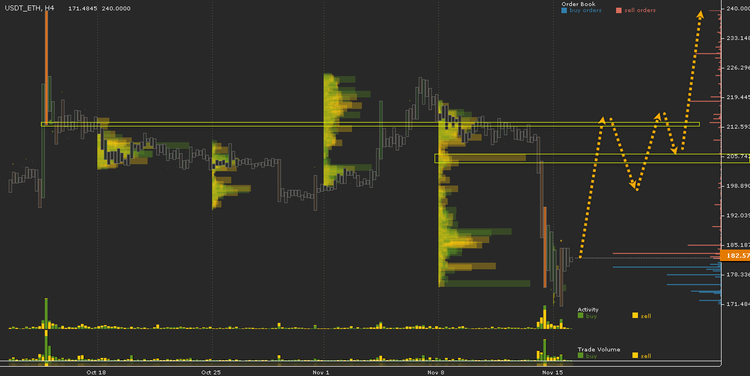

The graph of the ether shows an unsuccessful fixation on the resistance of $218-$219. At this level, the price stopped after a sharp rise in October, and later sales followed. If resistance does not give way to support, then the previous trend will continue. As well as with bitcoin, the course of ether formed a reverse wave at the beginning of November. The upward movement after this was a correction. The failed fixation and reversal at the key level is the end of the correction and a down impulse wave.

Constantinople is the largest and most anticipated ethereum update, which is scheduled for mid-January 2019. It will implement a technology for conducting transactions outside the network, which will significantly reduce commissions. On January 16, the devs plan to hold a hardfork on the test network, and on February 12, already on the main one. Perhaps by this date, the course will return to the level of $218. If the price of ether manages to consolidate and turn up this time, then the course will have a chance to grow to $500. Otherwise, a long-term decline can see ETH fall to $100 or less. Ripple’s price failed to consolidate at $0.51. A sharp impulse up on October 15 stopped at this level. Nevertheless, the long-term fall didn’t happen, but a rollback to the entire uptrend from $0.25 was formed. It seems that the desire of the Ripple’s director Brad Garlinghouse to surpass SWIFT so far is encouraging for the investors.

The short-term trend of the coin is not in favor of growth. The price has broken the starting point of the previous upward trend. If the rate consolidates below $0.51 and forms a reversal down to $0.43, then the price may fall to $0.27. Now there are two options: either ripple will start to grow and become a catalyst for other cryptocurrencies, or ripple’s course will follow the majority. But in order to talk about an uptrend, first, the resistance of $0.51 should become a support.

The hardfork took place, and the price of bitcoin cash is forming the third long-term scale wave of the downward trend. All significant support has already been overcome and now those who are hoping either for good luck or are confident in its future will buy this cryptocurrency.

Short-term resistance appeared in the $450 area. At this mark are visible large sales. Above is the long-term scale resistance. From his price and collapsed. Therefore, in order to change the downward movement, the course must turn upward at these levels.

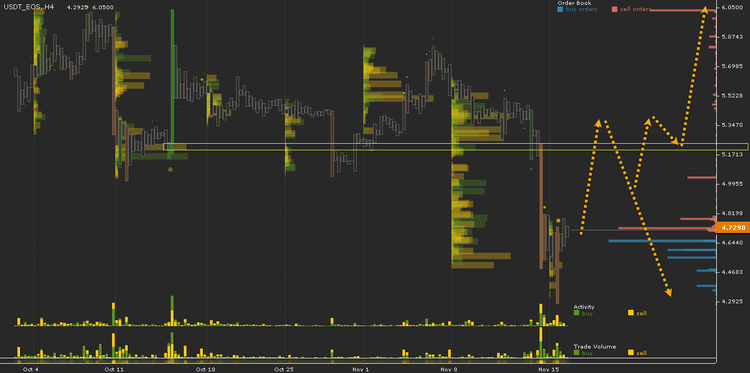

The change of support for resistance can be seen with EOS. Synchronous change of support for cryptocurrencies is confirmed by simultaneous big capital speculations on these coins. A large participant moving prices holds these top currencies in their portfolio.

If in the future there will be an upward reversal, then, most likely, it will happen just as synchronously. At the same time, the price of EOS will reach $5.3 and be fixed and will grow together with the other top cryptos.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.