On November 15 the hard fork took place in the Bitcoin Cash network accompanied by large-scale disputes and ‘hash war’. Two development teams that promoted incompatible Bitcoin ABC and Bitcoin SV clients successfully launched their new cryptocurrencies.

Trading platforms have already ceased to support BCH, now users can only work with coins that appeared as a result of the update. Probably, now the speed of recovery of the fallen cryptocurrency market will depend on the victory of ABC or SV (whichever chain of blocks is longer).

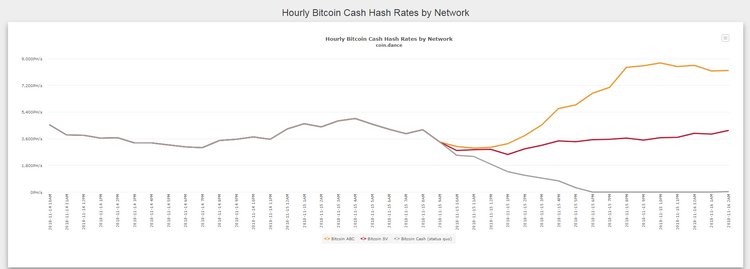

So far, all the advantages have been on the side of Bitcoin ABC. At the moment, ABC has managed to create a longer chain after the fork of Bitcoin Cash and significantly increase the hashrate of its network:

Before hardfork, the head of Bitcoin.com, Roger Ver, said in his Twitter account that his mining pool had sent more computing power to the Bitcoin ABC chain than the entire Bitcoin Cash blockchain had in the morning of that day. As a result, Bitcoin SV developers are far behind in this indicator. The main share of mining is being done by Roger Ver, so it’s probably his entry into the game that decided Craig Wright’s current failure.

The https://t.co/6EeRmpfaH7 pool now has more hash rate on it than the entire BCH network had earlier today.

— Roger Ver (@rogerkver) November 15, 2018

Bitcoin is cash for the world! #BitcoinCash #bitcoincashfork pic.twitter.com/n2MqQ5mlfK

Initially, many crypto experts believed that after the hard fork, Bitcoin SV supporters would remain in the minority. Craig Wright coined the term ‘hash war’, but analysts say this is just a loud name to attract supporters. At the same time, hash will never be the main criterion for users to choose an asset. And there is still an economic battle ahead.

Poloniex crypto exchange has already converted all BCH into digital assets BCHABC and BCHSV. At the same time, the BCH market was no longer available to users of the exchange. Later, the following trading pairs were identified: BCHABC / BTC, BCHSV / BTC, BCHABC / USDC and BCHSV / USDC.

I / O assets BCHABC and BCHSV is not yet available, but will open when the situation with the hard fork stabilizes. At the same time, the BCHABC asset is traded on the Poloniex exchange much more expensive than the BCHSV:

However, Craig Wright, the head of the company nChain and self-proclaimed Satoshi Nakamoto, is in no hurry to raise the white flag. Initially, he said that he was ready for a long war that would bring him victory.

“If ABC stays on SHA256d and does not add replay protection, we will hound it. Not until it is weak, not until it is unlisted on every miner and major and home level exchange globally, but until the last CPU running it anywhere globally burns out. If this means chasing a lone dev with a CPU to burn that last vestige of hope, and you think I will not, then, you do not know me! But, you will learn. This is not vengeance. It is a lesson. And I intend to burn it into the hearts and souls of all the socialists in ABC so their great grand children do not forget it!” he said.

Now Wright reminds his supporters that “hash competitions are a marathon, not a sprint.”

In our hash competition, we have seen the ABC team bring on their strongest sprinters. We are just at the trials and not yet on the finals to Marathon and they have made a remarkable burst to do a 9.9 second 100m (unfortunately in the wrong direction)

— Dr Craig S Wright (@ProfFaustus) November 16, 2018

Meanwhile... pic.twitter.com/ezbppbrY3W

Bitcoin SV fulfilled its threat by arranging a hacker attack on the competitor, although it was necessary to abandon the originally promised option. The attackers did not have the hashrate capacity for ‘selfish mining’. Therefore, pool blocks are ‘clogged’ with spam transactions (multitude of payments with a negligible face value). This planned attack reveals the same identical addresses, which transfer these sums of money back and forth. However, 32 MB of Bitcoin Cash blocks are quite roomy and do not experience problems at the current level of spam transactions. But some experts point out that the power of CoinGeek will be enough to cause substantial damage to ABC.

In any case, cryptocurrencies are developing, which means the inevitable fact of disagreement between major communities will lead to a split. And while it happens you shouldn’t take anyone's side, but see what choice the market will make. The main thing is that competition should benefit and not to detriment the entire ecosystem.

Experts believe that the war could have become the main cause of the collapse of the crypto market. Competitors were looking for money for their ‘battles’, which means they were selling BTC assets. Also, the general hype and panic does not add confidence to investors. But so far Bitcoin ABC is significantly ahead of Bitcoin SV, which means this particular asset can get the right to be called the successor to Bitcoin Cash. Given this news and the increased trading volume, current price levels can provide a rebound to falling cryptocurrency quotes.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.