Binance crypto exchange will add a stablecoin developed by the Circle blockchain startup to its listing. USDC will be available for the exchange from November 17 in pairs with Bitcoin (Bitcoin) and Binance Coin (BNB). The largest cryptocurrency exchange has announced it in the official blog.

#Binance Will List USD Coin (USDC) on 2018/11/17https://t.co/Ws4GhH7otf pic.twitter.com/6t6CCz0wRc

— Binance (@binance) November 15, 2018

What can be even better for users who are constantly questioning the work of the other 1:1 fiat backed stablecoins, is the promise of Binance to audit the newly listed coin every month?

“Additionally, for increased transparency, USDC has engaged a top-ranking auditing firm to release monthly balance attestations of the corresponding USDC and USD balances held/issued,” stated the exchange.

The trading platform shows an interest in stablecoins, as these digital currencies are collateralized in the form of fiat money or other reliable assets.

Circle announced the launch of its stablecoin USD Coin in September this year. It joined the list of digital currencies secured by real assets. Stablecoin became one more crypto analogue of the American dollar.

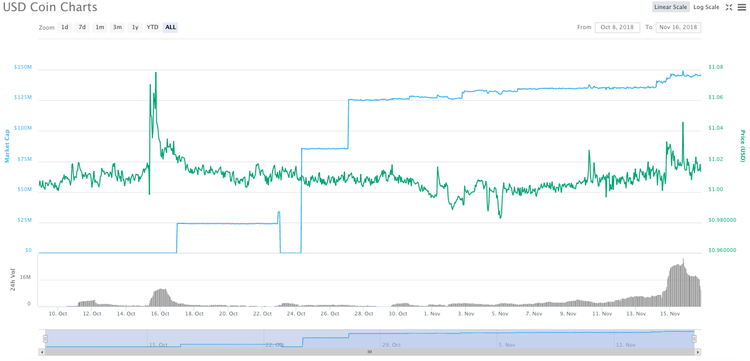

Currently, USD Coin ranked 49th on the Coinmarketcap. Its daily turnover is exceeding $9.8 million market cap; $144,441,378 USD and the total amount of backed by U.S. dollar coins currently issued by the team is around 143.3 USDC.

Circle's stablecoin is already trading on the Coinbase and Poloniex exchanges. In October, the USDC trading became available on BitPay bitcoin service payments. Adding a stablecoin to the Binance listing can increase trading volume and its total capitalization.

Right after the announcement, the price of the coin surged up to $1.05 but as the practice shows, it went back the next day. Currently, the coin is trading at $1.02 (-1.21%) mark.

Stable cryptocurrencies are common in the market. The most striking example is Tether. It ranks eighth in total capitalization among cryptocurrencies.

However, Tether is famous for its shady reputation. USDT token has been received by the crypto enthusiasts with suspicion from the very beginning, and even the results of the audit could not convince them. Cryptocurrency is constantly blamed for the lack of transparency, incomplete security, and excessive centralization. Studies have also been repeatedly published confirming the link between the USDT issue and the manipulation of the quotes of other coins.

With the fading confidence in one of the oldest stablecoins, investors started to choose other alternatives. And this year they really have something from what to choose.

Earlier, its own stablecoins were launched by Carbon (Carbon USD), Tiberius Group AG (Tiberius Coin backed by seven metals) and the London Block Exchange (LBXPeg backed by the British pound sterling). The Japanese company GMO Internet plans to create a stablecoin tied to the yen. And the People's Bank of China wants to launch stablecoin backed by the yuan.

Today it became known that eToro, the UK-based crypto and fiat exchange platform is planning to launch its own stablecoin in 2019. Answering the question “will eToro issue its own stablecoin in 2019?” at Finance Magnates London Summit, Yoni Assia the CEO of the platform said: “absolutely yes!”

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.