The reserve banks of Canada, Singapore and the United Kingdom believe that the central bank digital currencies (CBDC) will help in overcoming problems in making international payments. The joint report entitled “Cross-border interbank payments and settlements” notes that this type of assets has many advantages, including a 24-hour availability, anonymity and the absence of double-credit risks for participants.

Based on the report, financial institutions point out the main shortcomings of the current model of interbank payments. Banks, in particular, speak about temporary delays for inter-contractual payments, during which counterparties are exposed to credit and settlement risk on the part of their correspondents.

Other major problems include the lack of transparency regarding payment status for end users and banks, high operational costs and the growing vulnerability of RTGS systems to cyber attacks and other threats.

The report by the Monetary Authority of Singapore, the Bank of England and the Bank of Canada notes that CBDC can be either retail CBDC or wholesale CBDC (W-CBDC). The joint report also presents three CBDC models, which are separated by geography and accessibility.

The first model is a specialized currency that can be sent and exchanged within the country, but not in other jurisdictions. In this case, central banks will offer wallets for CBDC in local currency, and commercial banks, in turn, will have to open the wallets of various central banks that issue currencies that they want to keep.

In the second model, central banks offer CBDC, which can be sent and exchanged outside the issuer's jurisdiction. In this case, each central bank will have to have wallets supporting multiple tokens.

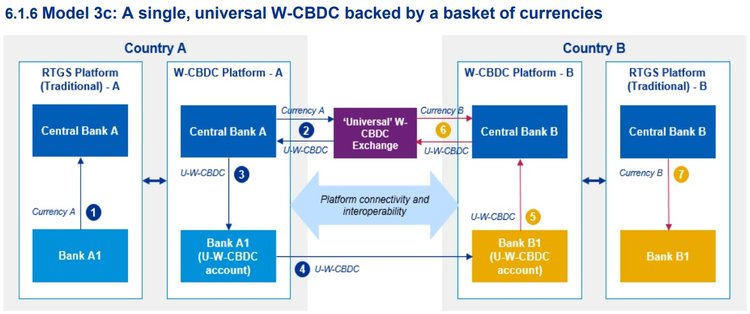

The third model proposes to introduce a single universal CBDC, which is supported by multiple currencies and can be sent and exchanged in all participating jurisdictions. However, CBDC in this model can become objects of volatility, manipulation and investment activity due to the fact that this currency must be supported by a number of other currencies, the report says.

According to experts, the annual number of individual and corporate international payments will increase by 5.5% and by 2022 will reach $30 trillion, while in 2016 this amount was $22 trillion. Switching from existing banking channels for making international payments to new rails will help to cope with a number of emerging issues.

It is worth noting that the other day, the head of the International Monetary Fund (IMF), Christine Lagarde, said that the international community should consider introducing digital currencies issued by the central bank (CBDC). Speaking at the FINTECH conference in Singapore on November 14, she noted that despite the fact that the foundation is not fully confident in the concept of cryptocurrency, CBDC can play an important role in the digital economy era.

Also in a report published this week, the International Monetary Fund concluded that when considering the benefits of CBDC, central banks should pay attention to the particularities of a country, the attendant risks, and the merits of alternative solutions. According to the document, the introduction of CBDC can help expand access to financial services for the public, as well as enhance the benefits and reduce the risks of payment systems, but organizers will have to take into account operational risks from hacker attacks.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.