Everything is bad and the market is in the red zone? These three altcoins (spoiler alert — plus one stablecoin) do not think so. If you invested in these digital assets, you could earn in these difficult times. So, here are our fearless leaders

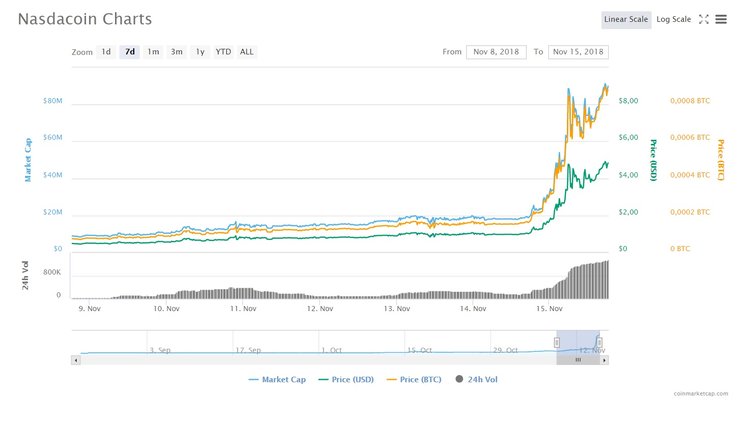

Nasdacoin

The little-known Nasdacoin soared almost 360% amid the general collapse. At the time of this writing, altcoin is still in the green zone and shows a positive trend. Its cost is $4.46.

The gradual appreciation of the coin started a few days ago, and the day before it began to rise sharply with the general fall in the cryptocurrency market. On October 30, the Nasdacoin project launched its own marketplace, whose users can buy and sell services and goods directly to and fro each other. A company token is used for payment.

Cryptocurrency trading is also available on the project website. At the time of the marketplace opening two weeks ago, the coin was at 576th place by capitalization and cost $0.2.In 2019, the company is going to open its own casino, integrating blockchain into the gambling industry. According to the plan, Nasdacoin will become the main currency for buying game chips and receiving rewards. The project team is also developing a payment card that can be used for online purchases.

Etheera

The Etheera (ETA) token launched at the beginning of the year also made a real breakthrough and at some point took off in price by 82,960%. Just a few weeks ago, the token was worth $0.000015 and then rose sharply to $0.012459. The altcoin has now rolled back again along with the crypto market and at the time of this writing, the ETA costs $0.000140.

Etheera is an ethereum-based token that was launched in the first quarter of 2018. It hit the lists of crypto aggregators like CoinMarketCap only in October of this year. Project developers expect to turn Etheera into a global decentralized real estate platform. Based on the documentation, both private individuals and large agencies and brokers will be able to participate.Based on the Bitcointalk project page, the ETA token was added to the BarterDEX and HyperDEX decentralized exchanges. In addition, the token has been listed on several other exchanges, including Bitker, Coinical, and Ethershift.

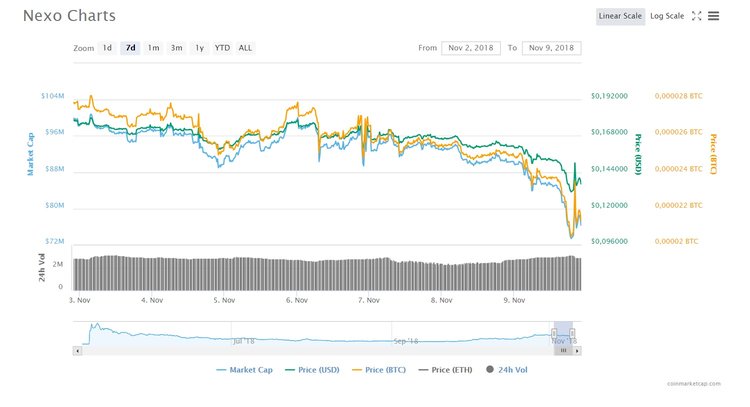

Nexo

It’s the second week in a row that Nexo has shown good results. There is s credit card account under the same name. For now the altcoin has sank in price and is trading at $0.117047, but yesterday it showed good growth.

It should be noted that at the end of October, the provider of cryptocurrency loans Nexo announced that instant loans are now available on the platform, secured by Ripple tokens (XRP). Nexo thus became the first lender to accept XRP as a guarantee for cryptocurrency loans.

At the same time, representatives of the platform state that the project is a success. In less than six months, the platform already has gathered 120,000 people, and Nexo has already processed tens of millions of dollars in 40+ currencies in more than 200 jurisdictions where they currently operate, the company says in a statement.

+ Bonus

USD Coin

Against the background of a falling market, one stablecoin has shown excellent results. Success favors USD Coin (USDC). At the moment, the cost of the coin is $1.04.

USDC was introduced by Circle in September. American crypto exchange Coinbase added the asset to its platform in late October. And the other day Binance announced the listing of USDC, too.In the cryptocurrency market, there are concepts of “Coinbase effect” and “Binance effect”, which can be described as an increase in the value of cryptocurrency after its listing on these exchanges. However, USDC is a stable digital asset, its rate is secured by the American dollar at a ratio of 1:1, so the start of trading should not have affected the value of the token. However, we can observe an increase in prices.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.