The more I know, the less I sleep — the more I ponder, the less I’m sure.

I think crypto is making me paranoid.

The one thing I hate more than anything else is being left in the dark, as in, not knowing exactly what’s going on. So, a couple of weeks ago I discovered a very interesting piece of research that placed me bang on in the middle of the darkest — dark. The research was about ‘Over The Counter’ (OTC) trading of bitcoin and it concluded that the overall daily volume of OTC trades is 2-3 times higher than the daily volume on all cryptocurrency exchanges combined.

What’s interesting about this is the fact that OTC trading doesn’t affect the actual price of bitcoin the way exchanges do. This makes OTC trading a perfect way of moving large sums of money without disrupting the entire market. It’s where the real whales are swimming. It’s the backstage area where big things are happening and not knowing what’s going on there is genuinely killing me.

So, to get a little perspective on the OTC space I talked to Ilya, who is a tutor at Moscow’s Financial University and a seasoned crypto trader. He is also a CEO of a company that facilitates OTC trades.

For some reason, I was always convinced that cryptocurrency trader is a completely different, new kind of breed of an investor. Turns out I was wrong. According to Ilya, the tech-savvy traditional investors were the first ones to appreciate bitcoin and the possibilities it opened for traders.

Still, back in 2013, it wasn’t easy to attract clients – people were way too conservative at the time and just didn’t want to splash out $150 for one bitcoin. After he told his students about bitcoin, some of them invested $200-$300 doubling and sometimes tripling their money. Apparently, this was very easy to do at the time. It wasn’t just due to the constant fluctuations of the bitcoin’s price. The real money was in arbitrage.

For a long while, one could easily buy bitcoin for, say, $1,000 on one exchange and immediately sell it for $1,100 on another, making it relatively easy to guarantee your clients a return on their investment. As cryptocurrency trading was getting more and more popular, new exchanged were propping up and they became flooded with trading bots, which more or less made premiums obsolete.

Cryptocurrency regulations throughout the years were obviously making OTC traders’ lives more difficult. During the time when withdrawal operations had massive fees attached to them, banks didn’t really care all that much. Apparently, these days most banks will most likely freeze your account if you’ll try to withdraw anything over $2,000.

But in this instance, there’s a thing about Russians – we are really good at finding a way of doing something we’re not technically allowed to do. Ilya told me that after banks began freezing and suspending accounts, a lot of people simply started using 10, 20, 30 and sometimes even 50 different bank cards, all with different names on it. So that’s 50 cards with a soft withdrawal limit of $2,000. You do the math.

Ilya went a different and actually legal way. His company is officially registered in Singapore, they have a license, they pay taxes and sign contracts with their clients. That was his vision from the start: doing everything officially and legally, with all the investors knowing exactly what transactions are being made with their money.

Of course, not everyone does that. There are still a lot of traders who simply create a nice-looking website and invite people to trust them with their funds. Of course, they go out of their way to explain how risky cryptocurrency investments are, promising a drawdown of no more than 15%. Once the drawdown goes beyond 15% there is virtually no way for an investor to get their money back, apart from physical violence, maybe.

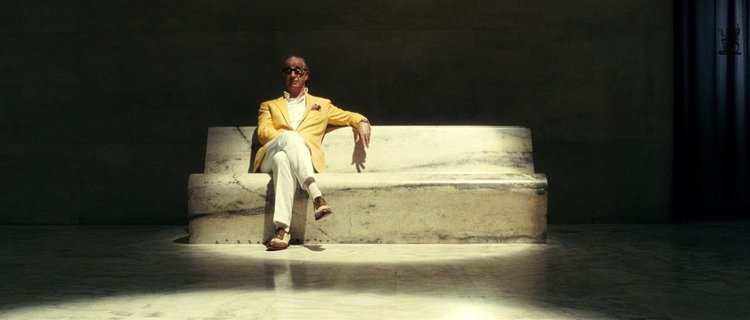

At this point, I have to admit, I’m a little bit disappointed. I was kind of imagining the OTC bitcoin traders to be those shadowy drug lords sitting in grimy basements plotting their illegal venture. While I do believe there are people like that, most who trade ‘Over The Counter’ are just very rich. It’s that simple, they’re just very rich traditional investors who also happened to invest in crypto.

Still, Ilya referred to the cryptocurrency market as ‘wild’. Among the particularities of this wild market are people with suitcases full of money who still expect enormous returns. Some of them take those suitcases to Ilya.

He says that he can’t disclose any names, occupations or anything else about his clients, which is fair enough. He did say that the average amount they exchange is around $15,000. But that’s just an average, as some people need just 1 bitcoin, others buy several hundred at once. There’s no funny business here, everyone is a legitimate investor, as they have to comply with AML and KYC requirements, and work with bank accounts.

Finally, there was one thing that I was always dying to know. What do the rich do with their 100 or so bitcoins? Not trying to pay for a cup of coffee, that’s for sure. According to Ilya, they’re mostly investors, but a lot of people also need it for cross-border transactions. To me, that’s ver interesting, because this fact basically destroys the argument that bitcoin and other cryptocurrencies don’t have any real-life applications. Rich people who are obviously good with money clearly think it’s the best way to send money to another country, what else is there to say.

Ilya and I talked for a while, he told me stories about what was going on with the cryptocurrency market at the time when I had no idea that such a thing even existed. And that’s where my paranoia kicked it. It might seem totally nuts, but hear me out. let me correct that - I am nuts but still, do read on.

Somehow unnoticed, bitcoin has had more or less the same value for over 6 months. It’s just floating around $6,500. It’s now less volatile than Netflix, Amazon, and Nvidia. High volatility and low liquidity were the factors that SEC cited as the reason for not approving any bitcoin ETFs this year.

So, now the market isn’t really that volatile. I don’t remember any high-profile speculations rocking it. It seems that the only reasons for SEC did not approve a Bitcoin ETF are close to not being valid anymore. Unless they change their reasoning once more and screw everyone over.

At the same time, bitcoin seems to have big support at the crucial $6,000 mark, which might mean that the whales are accumulating, waiting for the imminent rally, definitely entering positions Over The Counter to keep the market calm. For now. Do they know something about SEC’s next big decision? Is the market maturing or was this entire year nothing but a big fat speculative movement? Anyway, to my main point here: someone has any idea of how to deal with paranoia?

—

According to Ilya, in the last 6 months of Bitcoin’s stability, he’s had fewer clients, but their average transaction value was a lot bigger. Think of that what you wish.