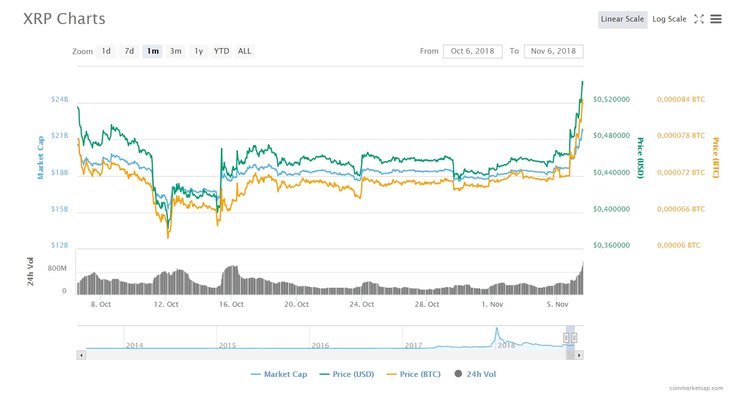

On Tuesday, XRP quotes reached the maximum level of monthly values. Allegedly, there are several reasons for the cryptocurrency rate to grow at once.

Today, the average market value of the XRP token has risen to $0.53. The last time altcoin traded at the this level was exactly a month ago. The market capitalization of cryptocurrency exceeded $21.5 billion.

So, what affects the cost of XRP? Most likely, several events had an impact. On November 2, Canadian platform CoinField Exchange, which uses Ripple's token its base currency, announced launching of operations in 61 countries. For the first time, CoinField announced its intention to use XRP as a base asset in September in its Twitter account. The final decision coincided with the opening of the auction.

The platform is now live in 61 countries! Enjoy trading 20 #XRP based pairs as low as 0.05% commission fee. Sign up at https://t.co/bCReJubCUC@bgarlinghouse @Ripple @Cointelegraph @coindesk @Ripple_XRP1 @xrp_news @XRPtheone @XRPstreetTEAM @KingRippleXRP @XrpCenter @tsuki_ryokou pic.twitter.com/T5MBmdUHWu

— CoinField Exchange (@coinfieldEX) November 2, 2018

Representatives of CoinField explained that in their opinion, in a very short period of time, XRP proved to be one of the most reliable and cost-effective blockchain networks in the industry. By selecting XRP as the underlying asset for 20 trading pairs, the exchange gave its users an ability to deposit and withdraw funds from various exchange sites or different wallets in seconds. Plans for the project, it is worth noting, are ambitious. CoinField has set a low commission, and believes that all this will help make the platform the most popular among traders around the world.

Ripple has one more piece of good news that may affect the price of the token. By the end of 2018, SendFriend, supported by Mastercard and MIT Media Lab, will begin to use xRapid technology. Thanks to the Ripple product, the Philippine-oriented SendFriend platform intends to provide labor migrants with a cheap way to send money home.

“That allows us on the back end to be more efficient with our capital. These are real-time settlements so we don’t have to do pre-funding, we don’t have to park money in the receiving corridor and then manage the foreign exchange risk. We can just do it one by one as the transactions go through,”— said the CEO and founder David Lighton.

It also became known that Ripple continued its expansion to the east. Dilip Rao, Ripple Head of Infrastructure Innovation, spoke at a global Islamic economic summit where he announced that the company would open an office in Dubai before the end of the year. He noted that Ripple was no stranger in the Middle East, and was already cooperating with various financial institutions in the region. The company's focus is on cross-border payments. Rao also noted that Ripple products and solutions were consistent with the Sharia Law.

According to World Bank statistics, several Middle Eastern countries are among the largest sources of remittances in the world due to a huge number of foreign workers, which makes the region a profitable market for payment companies. In 2016, according to some estimates, there were more than 10 million migrants in Saudi Arabia. Earlier Ripple announced a partnership with the largest credit organization in Saudi Arabia – the National Commercial Bank (NCB).

All of these factors combined now allow XRP value to grow. After the launch of xRapid which helped stir up expectations, the XRP quotes showed an impulse growth but then a strong pullback followed by a price decline. Now, the growth of quotes does not look like a one-time impulse, but as a beginning of a long-term trend.

Some experts agree with this. According to Picolo, an independent cryptological research group, XRP is significantly undervalued. Analysts explain that the recent report of the Ripple XRP Markets Report indicates a “further increase” in the price of XRP due to a sharp increase in the volume of institutional investors. Researchers also believe that the commercial launch of xRapid could be a driver for the rise in the price of the XRP token. It seems no surprise that early in October three companies started commercial use of the xRapid payment platform.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.