Bitcoin Cash, the 4th largest crypto by market capitalization, has shown rapid growth due to the upcoming hardfork.

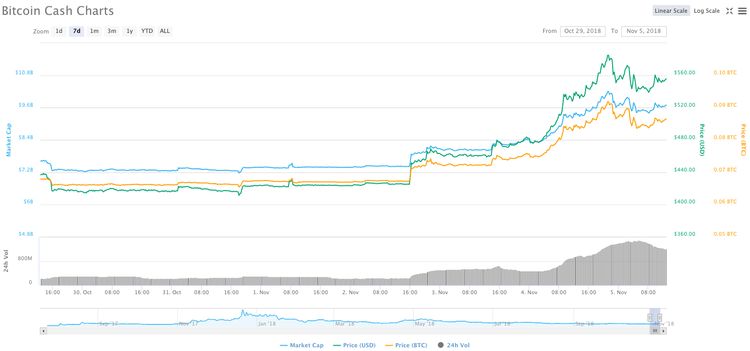

The price of Bitcoin Cash has shown almost 30% growth over the last 7 days. Thus, the price of the digital asset has increased from $437 to $552. This is happening due to the fact that on November 15, BCH is expecting to undergo a hardfork, which gave rise to many contradictions within the cryptocurrency community.

The whole problem started after the Bitcoin ABC was released on August 20. It included a number of updates, along with the function of smart contracts supporting atomic swaps. That divided the team into two. Bitcoin Cash developers couldn't come to a consensus on what path the cryptocurrency should take. For example, Craig Wright, who is the “self-proclaimed Satoshi Nakamoto”, is promoting a Bitcoin SV client. It involves increasing the block from 32 to 128 MB and independently changing the Bitcoin ABC scripts. The description of the technology says that it is intended for miners who support the original vision of bitcoin. Wright, who is a senior researcher at nChain startup, and Calvin Ayre, the developer of Coingeek, the largest mining pool of Bitcoin Cash, are opposed to optional changes in the original code.

But the software from nChain is not so popular for full nodes on the Bitcoin Cash network, unlike Bitcoin ABC promoted by the founder of Bitmain, Jihan Wu. Bitcoin ABC and Bitcoin SV clients are incompatible. As no consensus has been reached, during the hardfork scheduled for 15th of November around 4:40 PM GMT (epoch 1542300000), Bitcoin cash will most likely split into two chains both supported with the mining power. Eventually, one of these chains will become dominant as the majority roots for it.

The confusion doubles since major cryptocurrency exchanges such as Binance, OKEx, and Coinbase have already voiced their support for the upcoming hardfork.

While all three cryptocurrency exchanges promise to freeze the assets and create a snapshot of the accounts prior to the hardfork, Coinbase also states that if the team doesn’t come up with a solid decision and “multiple viable chains persist after the fork”, cryptocurrency exchange “will ensure that customers have access to their funds on each chain.”

On the eve of the hardfork, the daily trading volume of BCH increased from $234 million to $1.197 billion. Such a substantial growth became a result of the fact that most investors plan to increase the share of Bitcoin Cash in their crypto portfolio, to subsequently receive an equivalent number of cryptocurrency if it is split during hardforks.

The upcoming update is compatible with the following clients:

- Bitcoin ABC 0.18.2;

- Bitcoin Unlimited Cash Edition 1.5.0.0;

- bcoin – bcash 1.1.0.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.