As the end of 2018 is drawing ever closer, we have decided to start summing up the results of the year which was indeed saturated with many events for the crypto and ICO community. Today we will look at the ICO market, how it has changed, and in what areas token projects were carried out and why. If you are a fan of statistics and graphs, then you are sure to enjoy this article.

Before starting to discus 2018 let’s remind ourselves of the fact that 2017 turned out to be a super profitable year for ICO startups - over $4 billion worldwide. Various reasons made this possible - starting from the innovative form of fund raising itself to the simplicity of the actual procedure of collecting the money.

Here are the most successful projects of 2017

Any fairytale sooner or later comes to an end and breaks against the harsh coldness of reality. In 2018 the ICO market began to move away from the euphoria of 2017 and began to show a natural fall. Many projects turned out to be fraudulent or simply not capable to collect the planned sum and were closed even before the completion of the token sale. Some believe that this is the end of the ICO era.

In their turn regulators of different countries quickly began to invent what to do with the new and completely uncontrollable multi-billion market. Some countries, like Malta and France, tried to regulate it with laws, some, like China, prohibited it, and some of them, like Japan, still haven’t defined their position.

But despite the unfavorable situation, investment outflow and massive distrust in the projects that decided to raise money by ICOs, 2018 became even more profitable for such projects.

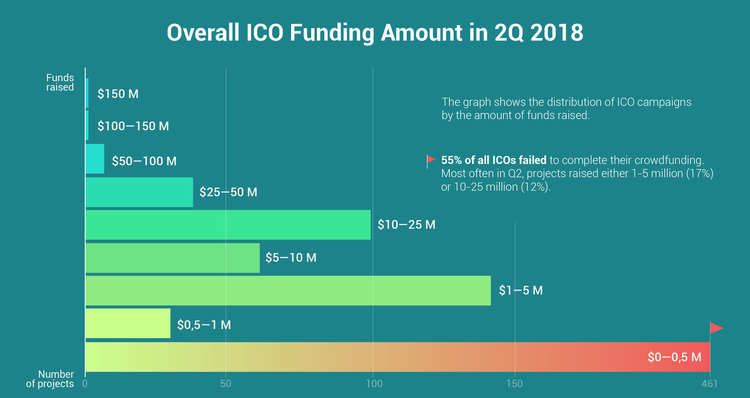

According to the ICORating report only during the second quarter of 2018 investors spent $8.3 billion on ICOs although more than half of these projects turned out to be inviable.

So why, after all the investigations and statements, does the market continue to grow and has more than doubled only in the first half of 2018? Maybe the reason for this is that the IСO market is changing and only the projects, that really have something to offer survive? So, what sectors to investors prefer to invest in?

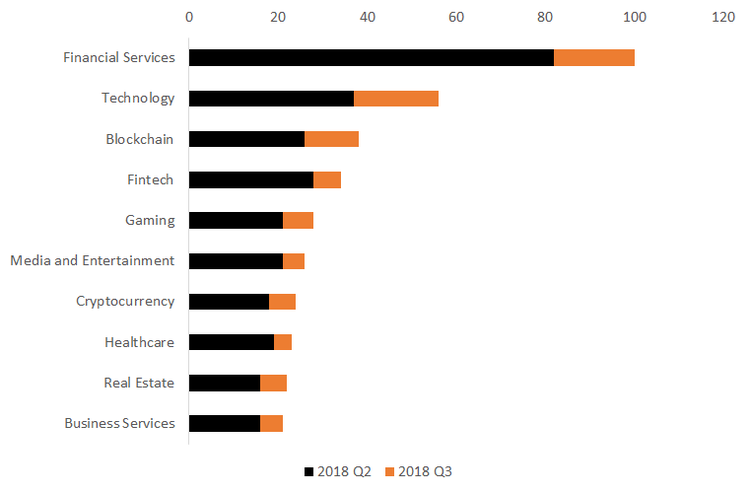

According to Coinmarketcap statistics of the third quarter of 2018 the financial sector remains the leader of ICO industries for the second year in a row. And this is not surprising since blockchain and the financial sector go hand in hand, because of the necessity to quickly and reliably track the transfer of money and information, limiting the possibilities of interception and changes. The most prominent example of a project from the financial sector is Huobi, which managed to raise over $300 million.

During 2018 many businesses appeared with a vision to develop a variety of blockchain solutions. So it’s natural, that projects dealing with software and services based on blockchain can’t be undemanded. Just keep in mind the well-known EOS project with an enormous collected fund of $4 billion.

But from traditions to innovations.

Another actively developing ICO sector is gaming. And here a question arises: why only now? In many respects online gaming platforms, especially gambling, initially face a large number of problems, such as complex relationships with regulators, severe distrust from investors and a small audience.This blockchain and the gaming industry ideal for each other.

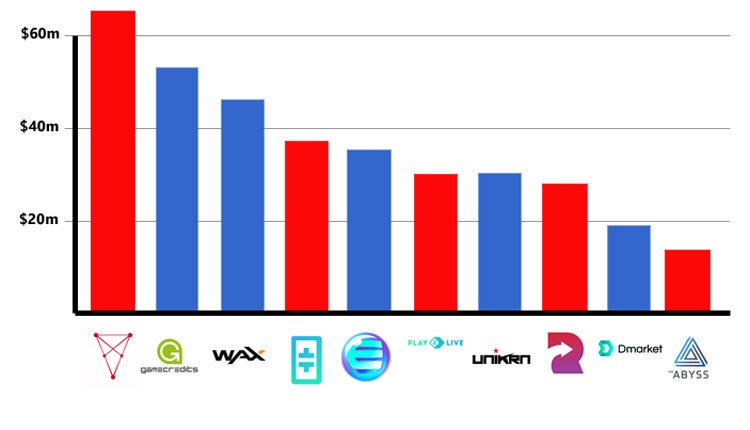

And the statistics show this trend. Here is top 10 blockchain games companies that raised a substantial sum of money.

Blockchaingamer said that the most successful gaming ICOs are ChiliZ collecting $65 million during ICO, video streaming company Theta Labs with $37 million and esports company Play2Live with $30 million.

It's worth paying attention to two other growing industries - media and healthcare.

Media is one of the most dynamic industries for blockchain technology today. The main reason is that the media industry has traditionally been highly centralized and very opaque. Advertising and streaming video are controlled by several large companies that talk little about their internal operations and cost structures.

The same goes for healthcare. A growing number of ICO projects in medicine is logical. Using blockchain Clinics, diagnostic centers and laboratories could acquire new customers, pharmaceutical companies could quickly bringing new drugs to the market and patients could receive qualified medical assistance and control information in their own electronic medical records. And for all these new options and services ICOs are an ideal option.