Stablecoins, a way for crypto to weave itself into the traditional financial market, is lately a very popular phenomenon. However, despite the fact that there are lots of stablecoins already on the market, and without a doubt, many more are yet to come, only one name really stands out as one of the first on the scene. Tether.

Just to recap, a stablecoin is a crypto that is backed by fiat currency. For this to be the case, the company issuing the coin must have a bank account with enough money to pay for all the coins in circulation. 1 tether = $1, so if a million tether coins are circulating on the market, then the company must have a million dollars on their account.

The problem up to date has been verifying that very sum, in order to prove that, in this case, tether is backed up by hard cash. Anyone who has half-following the world of crypto will have at least once heard about the unsuccessful audit that the company went through, and since then the community has been eager to see proof that tether was indeed a “stable” coin.

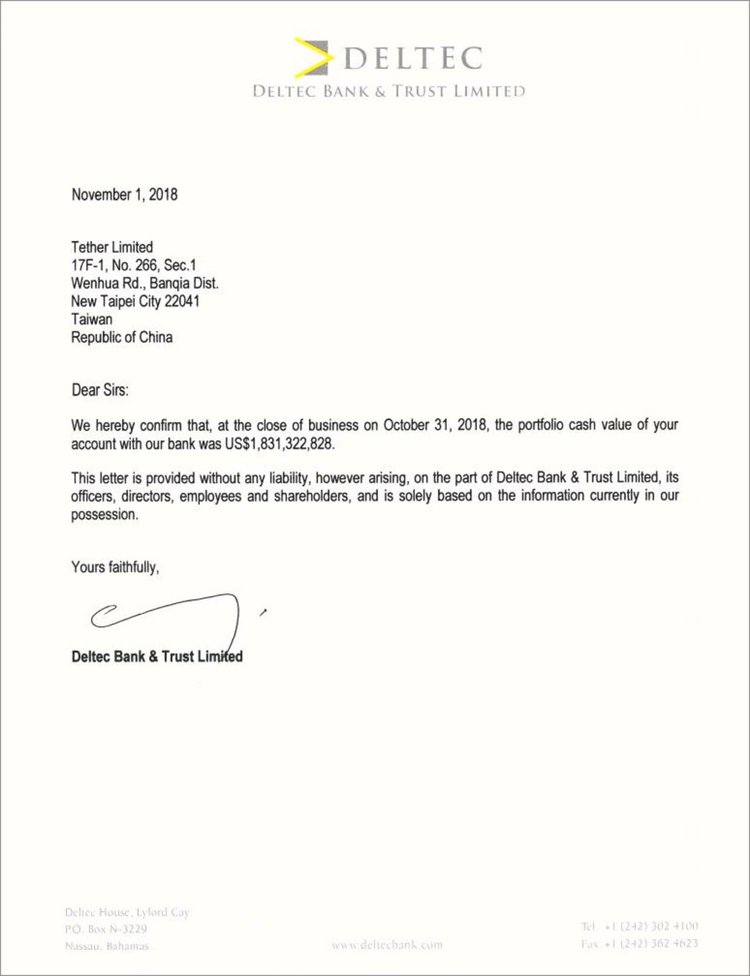

And it appears that finally a statement from tether has been made public:

We are pleased to be able to confirm that Tether has an account with Deltec Bank & Trust Limited https://t.co/LSn64soUsC . Balance confirmation at 2018-10-31 attached.

— Tether (@Tether_to) November 1, 2018

The company claims that they have an account with Bahamas-based Deltec Bank & Trust Ltd, and $1,8 billion on said account. Now, considering that the circulation amount of tether, as according to coinmarketcap.com, is just under 1,8 million all seems dandy and fine, the company has kept its word and most importantly confirmed its status of “stablecoin”. But, and of course, there is a but, the bank in question has not made any comment regarding the matter. And if we are to closely inspect the presented document, apart from the rather simple and slightly childlike signature at the bottom of the document, there is no indication as to whom the signature belongs to, must be the bank’s.

Tether has a notorious bank history having been required to change quite a few over the years. And the recently issued statement hasn’t made it any easier for the community to trust the company. In response to the twitter announcement, tether received quite a backlash with many claiming that this has in no way made it easier to trust the company.

The attitude towards tether is predominantly that of doubt and suspicion, which is both good and bad news for stablecoins. One the one hand, it is impossible to create a perfect product from scratch. The product must be tested by both people and time, and any defects that are uncovered ought to be changed and improved. As we can see, stablecoins are experiencing a similar period. The new fiat-backed coins that are appearing are making an emphasis on the issue of transparency since this has become one of the crucial points of mistrust in the first generation of stablecoins. On the other hand, this seemingly shady attitude that can be seen in tether could mean that while paving the way for new, more modern and transparent coins, it itself could become outdated. To avoid this, the company really needs to up their game, since the stablecoin market is growing and the competition is hot on the heels of the currently dominant dollar-backed coin.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.