Alibaba Group Holding Ltd. will report on financial results for the second quarter tomorrow before the opening of the US market. WSJ believes that the Chinese e-commerce giant will report revenue growth but a decline in profits.

Analysts polled by FactSet expect Alibaba to report $12,5 billion (86.9 billion yuan) in quarterly revenue, up 57.6% from $7,9 billion (55.1 billion yuan) a year earlier, the poll showed.

In recent years, Alibaba's revenue has been growing. Last quarter, the company's revenue rose 61% year on year to $11.8 billion (80.9 billion yuan). This means the company's revenue has been growing more than 50% for the eighth quarter. Investors expect to see if BABA can support this trend during the second quarter of the fiscal year 2019. They will also compare the revenue growth this quarter to the same period last year.

Growth in revenue is also provided by the continuously growing number of users of e-commerce giant service. The Chinese company is constantly increasing the monthly number of customers actively using Alibaba’s mobile services. At the same time, according to Chinese data provider Wind, in September, the retail sales of physical goods in online stores fell to its lowest level in five months, the WSJ says.

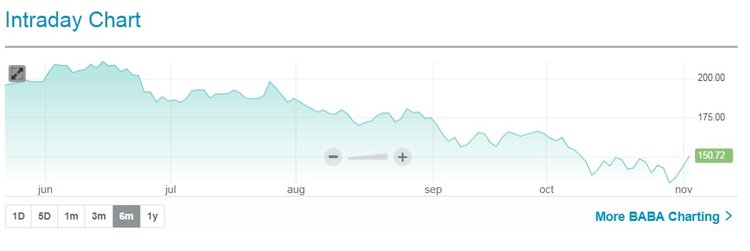

However, revenue growth does not mean that the company’s profit grows. Analysts expect the company to report a 38.4% decline in net income to $1.6 billion (10.9 billion yuan) compared with 17.7 billion yuan from the same period last year. We note that in recent times, a slowdown in the growth of the Chinese economy has been causing concern. Alibaba also makes large investments and incurs one-time expenses, which affected the company's net profit last quarter. Therefore, close attention will be riveted to the quarterly report.

The company's margin has also recently been reduced due to large investments. In March, Alibaba invested $2 billion in Southeast Asia’s Lazada e-commerce platform. In April, Alibaba acquired the largest food delivery company in China, Ele.me. This summer, Alibaba launched a $3 billion marketing campaign on behalf of Ele.me to help it reach more than 50% of its market share in China. The holding company has invested about $1.4 billion in a Chinese logistics company ZTO Express (Cayman) and another $320 million in a Thai e-commerce project.

Alibaba continues to actively invest. The company believes that these investments will bear fruit in the long term. But investors pay close attention to how long it may take for invested funds to start generating revenue, understanding as they are that Alibaba focuses on long-term growth areas.

Last month it became known that Alibaba and the American сorporation IBM are leading in the number of patents related to the blockchain technology. According to the iPR Daily report, Alibaba occupies the first place in the ranking – there are 90 patent applications filed on the company's account. Ant Financial, Alibaba’s billing office, is also actively using distributed ledger technology. In summer, the company launched a blockchain-based cross-border settlement service.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.