This week we consider the 4ArtTechnologies project, which claims to solve the biggest problem in the world of art.

What is the project about?

4ARTechnologies Group is a Swiss company working on creating a blockchain-based cataloging and transaction platform to provide greater transparency, security, and efficiency of the processes in the world of art. According to the team, the platform is based on patented “extended authentication” technology of “augmented authentication" developed by the German company, which will allow users to register a "final print" on a notebook along with all important information about the piece of art.

That having been said, the offered solution fights the problem of art fraud and provides highly relevant use cases for the global player.

Do we need this project?

According to the whitepaper, the project studied the published by Art Basel and UBS report “The Art Market 2018” and TEFAF's Art Report of 2017 and concluded that the biggest problem of the art industry is that from 30% to 50% of artworks may be forged or can’t be declared as verified originals due to an incomplete evidence. As a result, artworks’ owners lose a lot of money on the evaluation of these works and in case of detecting fakes, the purchased work loses its value.

To solve this identified problem, the project offers seven services on their platform, such as:

- creating a “biometric passport” of a piece of art with a fingerprint of its creator;

- issuing of certificates for each performed transaction;

- storing art data in the cloud;

- 4ART platform for any actions - crediting, restoration, transportation, insurance using 4ART tokens;

- transaction verification service;

- crypto wallet for 4ART tokens;

- сatalog of artworks.

It’s worth noting that the base of two reports for 2017 and 2018 is not enough to identify the market demand for the offered service - in a word, market research and analysis were not conducted, which means that it’s completely unclear who and why should use the project’s services.

What about the technology?

The project involves the use of an identifier of an artwork, fully developed by the German company Atlantic Zeiser. After the artwork is identified, the data about it will be recorded and stored in the Ethereum blockchain, which is also used to conduct transactions on the platform.

Platform participants will be able to use cloud storage and catalog - 4ART Digital Artwork,

which will be accessible via a desktop web app. All apps will allow transferring fiat money to 4ART tokens from a credit card.

The 4ART tokens are an ERC-20 utility token that will represent the core of the project's ecosystem and payment instrument for any service and sale.

The demo version of the app on iOS has been developed since March 2018, the MVP should have seen the light in September, and the listing in crypto exchanges is scheduled for December. However, now (end of October) the public still hasn’t seen any mobile app or other developments. That is, for a year and a half of its existence, the project didn’t follow its own roadmap and didn’t tell what is going on at all.

Token sale and financing

There is 26.23% of the total number of 6,5 billion 4ART tokens that will be available for sale in three stages of the ICO:

- closed stage (minimum investment €500);

- pre-ICO (2 phases, minimum investment €100);

- pubic ICO (minimum investment €100).

The price of a 4ART token will be €0.08 for closed sale, from €0,1 to €0,2 for pre-ICO and €0,3 for public ICO stage. For investors in a closed stage, the blocking period will last for 6 months after ICO. Soft cap is €150,000,000, hard cap is €250,000,000.

The 0.6% of 4ART tokens (39 million) will be allocated to the core team, except the founders. The 40.75% (2.648 billion tokens) of all tokens will be kept by the company as a reserve for future needs. The company can also issue tokens when market demand rises for the 4ART token.

With such a distribution of tokens after the listing on crypto exchanges (which is scheduled for December this year), the team could theoretically keep a large sum. For example, with a minimum token price of €0.1, this amount can compose almost €270 million and no one will know where this money will go to.

However, don’t worry too much about these concerns, because it’s unlikely that tokens will be able to attract such a sum. But if we turn on the fantasy and assume this probable amount of money, then it will be one of the loudest scandal companies of the year.

It’s necessary to pay the attention to the fact that the project website says that during the early stage of an ICO (apparently closed) the project raised over €21 million. Where these investments came from is not explained, perhaps from the first investor Rolf Maier, who is named as a member of the team.

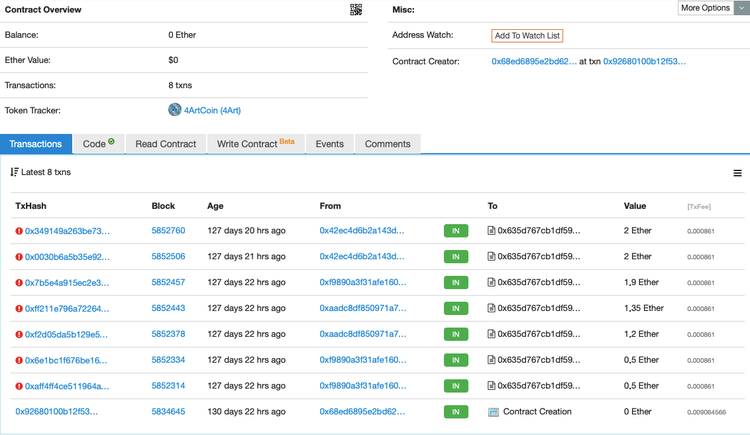

Not to be lazy and to check every website service for viewing Ethereum network statistics, such as Etherscan, it can be easily found out that only a few of the project’s transactions were completed more than 127 days ago and the amount of these transactions is far from the named sum of money.

The official website of the project is replete with bright colors so that sometimes it is even difficult to read (perhaps that’s the point?). But tastes differ. The informative part of the site is poor and doesn’t describe the project at all.

The social media activity of the project isn’t good. It seems like the project has created profiles on social media in order to be in the mainstream, and not to attract the audience, as the project doesn’t need it. Here are its pages on Facebook, Twitter, Reddit, Medium, Youtube, Instagram and Telegram.

To sum up, we should warn that before investing in this project, you must carefully analyze the whitepaper, the description of the idea, development stages and how tokens will be distributed after the ICO. Read, learn, don’t let anyone make you confused.

Click here to visit 4ArtTechnologies page in the list of our ongoing ICOs.