Stablecoin USDC, which was launched by the bitcoin startup Circle, is gaining popularity, Bloomberg reports.

The stablecoin has been brought to the crypto market just about a month ago. Since then, tokens have been sold for more than $127 million. The USDC market capitalization has grown from $24 million to $126 million in just 2 weeks.

Last week, the American cryptocurrency exchange Coinbase announced the listing of USDC, which also added points to the popularity of the digital asset. Note that this was the first time that Coinbase has added a stablecoin listing. Coinbase Wallet's Product Lead Sid Coelho-Prabhu explained that stablecoin helps cryptocurrency to reach millions of users, bringing us one step closer to an open financial system. Also, supporting USDC has been added by BitPay processing bitcoin payments and OKEx crypto exchange.

In late September a cryptocurrency startup Circle, which owns the bitcoin exchange Poloniex, announced launching the tokenized dollar USD Coin (USDC). Representatives of the project explained that stablecoin was developed using CENTER consortium affiliated with the company and was intended to be a way to easily move tokenized dollars in public blockchains.

#USDC 30+ supporting companies span the entire #crypto industry, including wallets, platforms, protocols, and exchanges. https://t.co/iIFbAeXOM3

— Circle (@circlepay) September 26, 2018

“Exchanges, where USDC will be listed for trading soon, include DigiFinex, CoinEx, Poloniex, KuCoin, OKCoin, Coinplug, and XDAEX, thus allowing millions of retail and institutional investors around the world to use a transparent, price-stable cryptocurrency to trade against hundreds of different crypto assets,” said the Circle blog.

CENTER announced its commitment to making every effort to ensure the safety of using USDC, as well as partnership with blockchain-oriented organizations, compliance with AML rules, and risk management companies, including Chainalysis, Elliptic, Coinfirm, and Coral.

The consortium will also serve as a platform for users, allowing them to make deposits in traditional bank accounts, convert fiat into tokens issued by CENTER members.

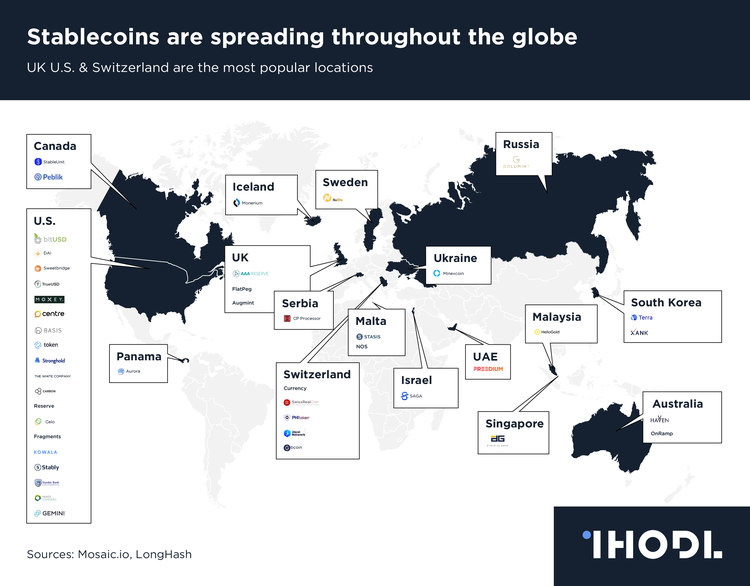

It’s worth noting that stablecoins are now a buzz-word and are often the centerpieces of the news agenda. These are digital currencies that are secured by one or another valuable asset, be it gold or the American dollar. In theory, such a cryptocurrency is characterized by a steady rate and low volatility. At the same time, the most famous stablecoin Tether (USDT), tied to the dollar, is now going through hard times. The token raises a lot of questions and doubts in the crypto community.

At the beginning of September, Gemini released its own stablecoin. The token issued by a subsidiary of the Gemini Trust is named GUSD and operates on the basis of the ERC-20 standard. The company claims that GUSD is pegged to the dollar at a 1:1 ratio and the funds to maintain it are stored in Gemini Trust accounts in the American State Street Bank. So far the asset is doing very well.

This is not surprising since stablecoins have their undeniable advantages. Many experts note that such coins are useful for the entire cryptocurrency community, as they help to get rid of fiat dependence as a base for trading. They are also designed to solve the problem of high volatility, which for some potential market participants is becoming one of the main obstacles to using cryptocurrencies. Those players who wish to cash out or have short-term liability assets, and at the same time expose themselves to a possibility of assets value rapidly changing in a matter of hours, can rely on stablecoins.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.