Trading in futures contracts of the current quarter began on July 30. The last day of trading these bitcoin contracts is today, October 26. CME Bitcoin futures trading ends at 4:00 pm London time. This information can be found on the frequently asked questions page on the CME website.

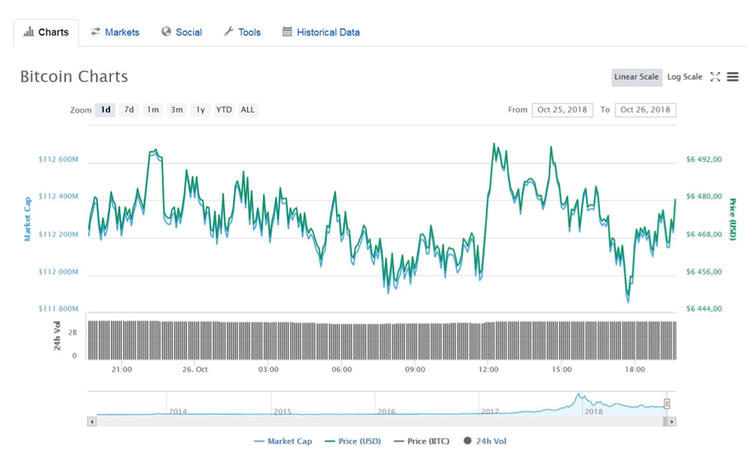

Many crypto experts say that whenever any contracts for bitcoin futures are soon to expire, market volatility usually changes a lot. It is worth noting that in the meantime the market responds calmly, and there are no sharp changes in the cost of the first cryptocurrency.

Bitcoin-based futures allow traders and institutions to bet on whether the price of bitcoin will rise or fall - without the need to buy coins. This means that investors at the expiration of the contract receive fiat currency. In fact, Bitcoin itself is not involved in the operations, so expiration may not have a significant impact on the course of the coin. Often, on the day of the expiration and prior to that, the price usually moves within the framework of the current trend in the cryptocurrency market.

Indeed, there is another way of looking at this process. In June, an analyst from Wall Street and co-founder of Fundstrat Global Advisors Tom Lee claimed that the reason for the rapid fall in the price of bitcoin was just the expiration of bitcoin futures. If traders open long positions on Bitcoin and short on futures, then in an attempt to minimize the tracking error on the threshold of expiration, they can sell large amounts of BTC at a weighted average rate. In addition, Lee explained that by selling a significant number of bitcoins and putting pressure on the price, they maximize the profitability of a short futures position.

There is also an opinion among crypto enthusiasts, that it was the closing of the first futures contracts that caused the global market collapse at the beginning of the year. It was under the influence of news about the release of bitcoin futures, that the cryptocurrency rate began to rise sharply in December and reached a maximum of $20 thousand. Then, CME and CBOE started to trade futures. On the CBOE, the first bitcoin futures contracts expired on January 17, after which traders began to sell them. Non-professional investors panicked and began to dump their assets, too. As a result, the course of Bitcoin collapsed.

At the same time, interest in this tool is growing. The average daily trading volume of bitcoin futures on the CME in the third quarter increased by 41%. The sum of open interests (OI) also showed a positive trend compared to the second quarter and grew by 19%, reaching 2,803 contracts.

In Q3, Bitcoin futures average daily volume rose 41% and open interest was up 19% over Q2 . Learn how market participants are using BTC to manage risk in changing markets. https://t.co/Yt41SzsHku pic.twitter.com/Kw4OX0QaKT

— CMEGroup (@CMEGroup) October 17, 2018

However, some skeptics say that bitcoin futures trading activity still turned out to be lower than the original expectations. Although the trading activity on bitcoin futures at CME is growing, on the whole, their appearance did not have the effect that they expected last year. Investors had expected new contracts to attract huge volumes in a matter of days, but this did not happen.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.