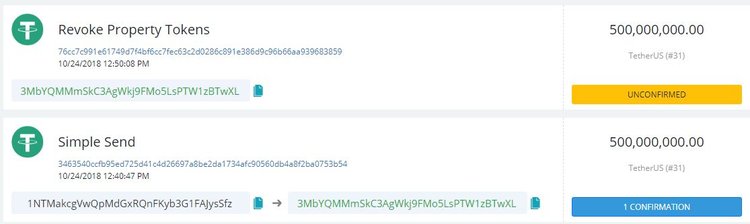

On October 24, Tether, which produces the stablecoin under the same name, announced on Twitter that it had destroyed 500 million USDT tokens.

Tether has just destroyed 500M USDt from the Tether treasury wallet with the following tx: https://t.co/HTG52LaRVh

— Tether (@Tether_to) October 24, 2018

For more information see the announcement here: https://t.co/McLTCGzmJi

Tokens were stored in an account known as the Tether’s treasury. Over the past few weeks, there has been a massive influx of tokens into it, especially after last week the cryptocurrency lost parity with the U.S. dollar.

Since the beginning of September, the balance on cold Bitfinex wallets has decreased by approximately 100,000 bitcoins. This gave food for speculation that the exchange spends bitcoins to buy the USDT - with the goal of returning the exchange rate to $1 or even completely disrupt the stablecoin business. Bitfinex leaves such accusations without a comment.

Since October 14, almost 690 million coins have been sent to the treasury wallet. The transfer was made from accounts controlled by the Bitfinex cryptocurrency exchange. As a result of transfers, the stock of USDT in circulation decreased by 29% in a week and a half to $2 billion. Now, many of these tokens have been destroyed by the company.

On October 24, Tether reported that she had not burned all USDT in the treasury: approximately 466 million coins remain in the account “as a preparatory measure for future USDT issuances.” In the exchange’s statement, USDT transfers to the treasury are characterized as a redemption, the process described in the original Tether whitepaper, published in 2016.

Tether creators claim that their cryptocurrency is pegged to the U.S. dollar, and attribute it to stablecoins. However, the direct binding to the U.S. dollar is often questioned.

Thus, the founder of Galaxy Digital Holdings Mike Novogratz believes that Tether has lost trust among customers and now it needs time to restore it. He also noted that at the same time he would prefer to use the recently announced Gemini Dollar over the Tether because it has the State Street as a U.S.- based correspondent bank.

Some Twitter users think that this procedure might help the coin “to revoke itself”.

Tether just redeemed/burned another $500,000,000.

— Brad Mills (@bradmillscan) October 24, 2018

This is good for the ecosystem. Having 1 stablecoin with so much gray area surrounding it be so dominant among UAD pegged-tokens is unhealthy.

Slow decline of USDT + competition without FUD is healthy. https://t.co/ZPpF6ilbVI

In the meantime, Tether's anonymous opponent, the well-known critic of Tether and Bitfinex, registered on Twitter under the nickname “Bitfinex'ed”, was not impressed with today's announcement. In particular, he stated that transfers of tokens to the treasury can hardly be considered as true redemption.

500M “redeemed”.

— Bitfinex'ed 🐧 (@Bitfinexed) October 24, 2018

Not one person can come forward and say that they converted Tethers to dollars and got wired money from Tether.

Are they simply buying their own tokens for less than a dollar? Did they redeem in dollars or something else? pic.twitter.com/cI9iIfe6Cu

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.