The central bank of Germany, Deutsche Bundesbank (BBk), and securities marketplace organizer Deutsche Boerse (DB) have successfully completed the trial of a blockchain solution in the settlements area. According to the test results, they described all the pros and cons of using the distributed register technology. At the same time, both sides were satisfied with the test results and pinned certain hopes on blockchain in the financial sector.

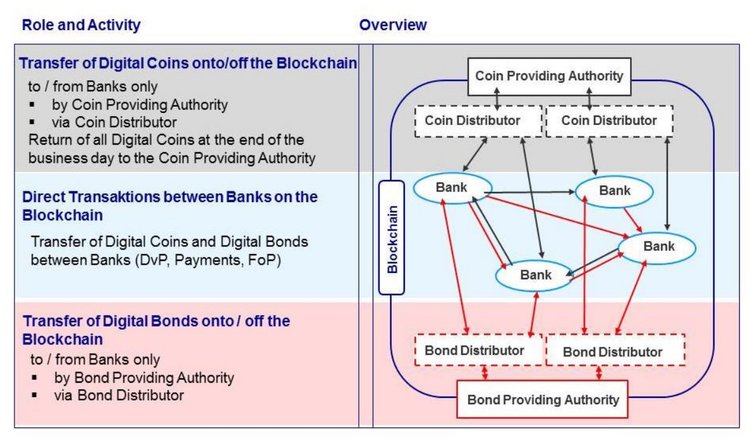

The distributed ledger technology (DLT) was used in the project to improve back-office services. The prototype supports the calculation of operations with securities, payments, interest payments, and repayment of the maturity of the bond. The tests took place immediately on the Hyperledger Fabric (version 1.0) and on the Digital Asset Platform platform. Representatives of the companies came to the conclusion that both prototypes are suitable for work within the financial market. Accordingly, both of these solutions can form the basis for the further development of this industry, including improving productivity.

“During this project, Deutsche Bundesbank and Deutsche Börse learned a lot about the usage of this technology and its concrete implementation. We expect the rapid development to continue, and also see the potential in using it for high-volume applications. The approach of a permissioned architecture, which takes into account the requirements of the financial sector from the outset, has proven to be right”, said Burkhard Balz, Member of the Executive Board of Deutsche Bundesbank.

Representatives of the Deutsche Börse Group also expressed satisfaction with the results. They believe that the blockchain can be a suitable basis for applications in the field of calculations and other financial infrastructures, and products based on DLT can be adapted to the needs of the industry.

The goal of the joint project of the Deutsche Börse Group and Deutsche Bundesbank was to create a prototype for the transfer and settlement of securities and cash based on the blockchain. Therefore, the two institutions have undertaken a joint experiment to analyze the potential use of DLT. The prototype fulfilled all the main regulatory functions for financial transactions: anonymity (KYC), confidentiality of transfers, participation of only registered peers (allowed network). At the same time, the parties emphasize that this project was intended only for familiarization and gives purely analytical results.

It is worth noting that Deutsche Bundesbank and Deutsche Börse are open to new technologies and try to use the blockchain opportunities to develop the financial sector. They are very thorough in studying the DLT, which they have been testing since 2016. Both sides are trying to better understand the technology in order to minimize risks when using it further.

In particular, recently Deutsche Börse announced creating a special unit that would deal with the blockchain technology and cryptocurrency assets. Previously, all DLT initiatives were disconnected within a company. It is the task of linking them all together that the new division will solve. Representatives of Deutsche Börse believe that the blockchain may be involved in areas such as trading, clearing, pre-IPO, securities settlements, and data analytics.

“From Deutsche Börse’s point of view, blockchain technology is a key opportunity for the creation of new market structures, adding new products onto our present structures and enhancing our existing offerings”, — said Jens Hachmeister.

The central bank of Germany also previously voiced its thoughts on the blockchain. Researchers from Deutsche Bundesbank wrote in a report that the technology offers a number of advantages due to distributed data storage. At the same time, the bank noted that it does not see a large role for this technology in consumer payments. The researchers then concluded that the wider use of DLT is possible in cases where users would need to send their funds through several intermediaries.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.