Coinbase, the leading U.S. crypto exchange, received permission to provide custody services from New York financial regulator. Coinbase Custody will operate as a Limited Purpose Trust Company chartered by the New York Department of Financial Services (NYDFS), says in the announcement. The company will be engaged in the qualified storage of bitcoin, ethereum, XRP, litecoin, bitcoin cash and ethereum classic.

Today, we’re proud to announce that Coinbase Custody has obtained a license under New York State Banking Law to operate as an independent Qualified Custodian. https://t.co/6uGZG0UzvF

— Coinbase (@coinbase) October 23, 2018

Asiff Hirji, President and Chief Operating Officer of Coinbase, said that the new Coinbase division had the same requirements as the already established financial institutions in the state of New York. He added that the local financial regulator is a supporter of the responsible growth of the cryptocurrency industry.

“The New York State Limited Purpose Trust charter, which now enables Coinbase Custody to act as a Qualified Custodian for crypto assets, builds on our unparalleled success as a crypto custodian while holding the company to the same exacting fiduciary standards and oversight of other, mature financial institutions operating in New York," said Hirji.

It is noteworthy that the Ripple token appeared on the cryptocurrency list. Earlier, there were rumors in the network that the trading platform plans to add this asset, but this information is not officially confirmed. Therefore, while the XRP does not support neither the exchange nor the e-wallet.

Keep in mind that the demand for depository services in the crypto sphere is very high. Recently, more and more exchanges and companies offer similar services to their customers. Also, the crypto community has been waiting for institutional investors for a long time. Holders of big capital should bring the crypto market to a new stage of development. Therefore, traditional and blockchain companies are developing and offering new financial instruments to make investing in digital assets as convenient as possible for institutionalists.

For example, last month, representatives of the Californian cryptocurrency startup BitGo announced NYDFS approval to work in the United States as a digital asset custodian focused on institutional clients. And in the summer, the American financial company Prime Trust also announced its entry into the market for cryptocurrency custodial services.

But not only blockchain companies are developing new financial services. The largest traditional players are also taking serious steps towards the crypto market, as they note the interest of institutional investors in the new class of assets. The impact of institutional capital on the market can be very significant. And in the end, everyone will win.

Last week, one of the world's largest providers of diversified financial services, Fidelity Investments, announced the launch of a new division of Fidelity Digital Asset Services. The company will begin to provide services for the storage of digital assets and the execution of transactions with them to institutional investors, such as hedge funds, family offices and market intermediaries. The company explained that Fidelity seeks to make operations with cryptocurrency and digital derivatives as affordable as traditional assets.

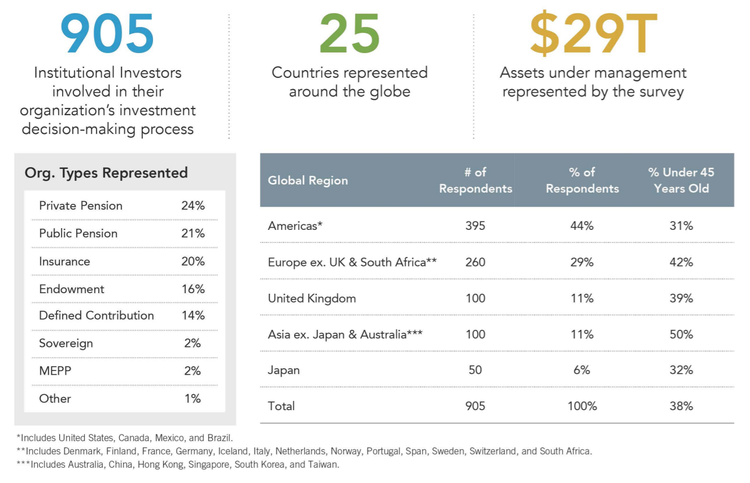

The interest of institutional investors in cryptocurrency was seen by the company based on the results of the study. Thus, the latest survey by Fidelity Global Institutional Investor Survey, responded by 905 investors in 25 countries, including pension, insurance companies and financial institutions, showed that 70% believe in the further development of cryptocurrency and associate it with progressive blockchain technology. Under the management of the surveyed investors is $29 trillion.

In the summer, the media also reported that one of the largest investment banks, Goldman Sachs, was also considering launching custodial services for cryptocurrency funds. Anonymous sources claimed that this issue is being discussed within the company, but the exact dates have not yet been established.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.