Deribit cryptocurrency exchange decided to analyze the speed of closing orders as it is one of the most important indicators for traders. The value of assets is changing so rapidly that time really matters in this case. Apart from Deribit, Bitfinex, Binance, Coinbase, Bitmex, and Okex exchanges also participated in the analysis. And here are the results.

Spoiler -– Deribit showed the best results and therefore actively publishes the analysis.

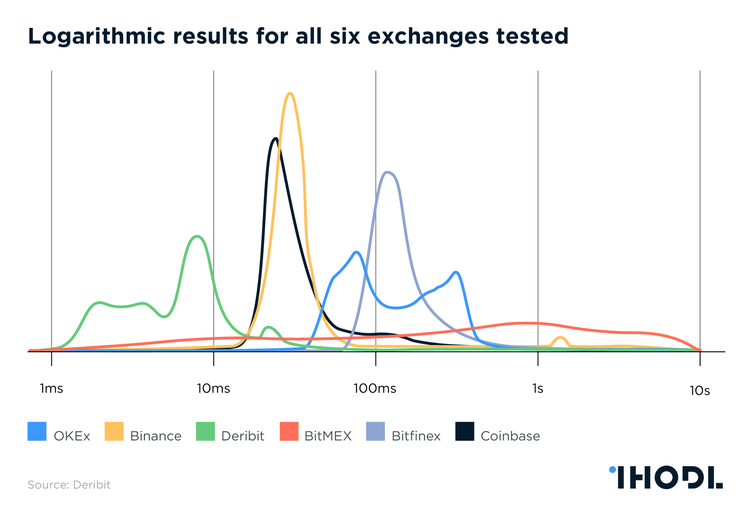

On each exchange, the most liquid pair was checked to determine the time required to add a limit order and execute a market order. Most of the sites from the list could not perform any task in less than 10 milliseconds. Okex in this test proved to be the worst. Some exchanges recorded a significant number of cases where the transaction took more than one second, Bitmex showed the largest percentage of such orders.

Why is the speed so important?

Suppose traders have received new information that allows you to make a profit. For example, a press release came out with a hint that the value of a digital asset will go up. If the high-frequency trader (scalper) is even a millisecond late, he might miss a significant profit. That’s why sites spend efforts to reduce the system response times. After all, professional players eventually choose the most optimal platform.

Methodology

Deribit measured the time from the original order to confirm that the order had been placed. To compensate for delays that do not depend on the exchange, company representatives have determined the delay for the API request. The duration of these requests was deducted from the duration of the order requests, and the remaining time was the time it took for the order to be executed. Deribit claims that it conducted all tests on machines that were located as close as possible to the relevant exchanges.

The results were as follows:

- The delay in the execution of the average Binance order was 37.2 milliseconds, while 0.1% of orders were executed within 10 milliseconds;

- • The average execution speed of Bitfinex was 156 milliseconds, while 0% of orders were executed within 10 milliseconds;

- • The average execution speed of Bitmex was 1.11 seconds, while 13.4% of orders were executed within 10 milliseconds;

- • The average execution time for a Coinbase order was 33.0 milliseconds, while 0.2% of orders were executed within 10 milliseconds;

- • Deribit’s average order execution delay was 6.1 milliseconds, with 89.6% of orders being executed within 10 milliseconds;

- • The average lead time for an Okex order was 127 milliseconds, with 0% of orders being fulfilled within 10 milliseconds.

A few words about scalping

The strategy of scalping in cryptocurrency trading has been spreading on crypto exchanges for a long time. This method is used on all markets. But on crypto platforms, it gained particular popularity due to the fact that digital assets seem to be some of the most appropriate assets for traders.

A trader opens and closes positions very often – at intervals from 1 to 15 minutes. Each transaction ideally brings him a small profit. When summed up, small profits from each transaction result in significant numbers. For example, a trader who trades in large time periods calculates a good moment to enter the market for a long time and is waiting for this moment. If he is experienced and his prediction is correct, he gets a good profit as a result of a single successful deal. A scalper trader takes positions when the cryptocurrency rate has adjusted at least a little and receives a small profit from each successful transaction. As a result, it takes him as much time to make a profit as a regular trader, because all the time during which the first trader has been predicting, the scalper has been making deals.

Although volatility is important for a scalper, too much volatility can also be dangerous. If the asset fluctuates strongly and unpredictably, the losses may be prohibitively high so that the profit covers them with interest. But time also plays against crypto scalpers. Still, cryptocurrency exchanges operate not so smoothly, and scalpers, who literally treasure every second, suffer losses because of this. Therefore, the results of a new study may be curious for them.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.