The crypto industry is developing rapidly and is under the scrutiny of analysts. We decided to collect the most interesting studies that came out in the recent weeks so you don’t miss anything.

CryptoCompare – 'Cryptoasset Taxonomy Report 2018'

CryptoCompare, a global data provider for cryptocurrency markets, presented the 'Cryptoasset Taxonomy Report 2018', which classifies cryptoassets using various frameworks. The report is an analysis of more than 200 cryptoassets based on more than 30 attributes covering a number of economic, legal and technological features. According to analysts “the taxonomy offers a framework to help retail and institutional investors, regulators and the industry as a whole gain a holistic understanding of the cryptoasset landscape”.

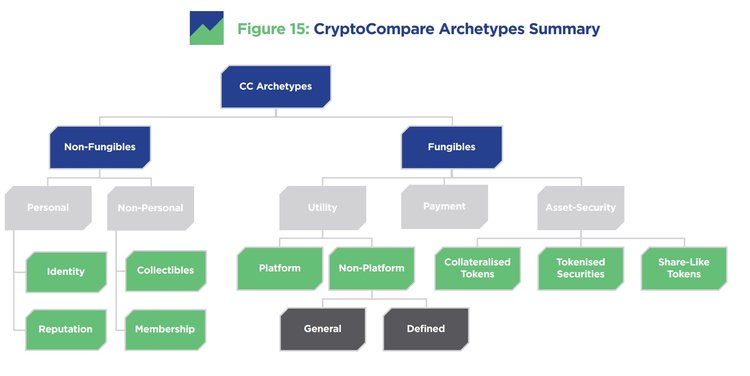

The researchers made a tree with the main archetypes, which seeks to fix in a simple form the most significant grouping of cryptoassets. Analysts expect that with the development of innovations, some types of cryptoassets will become more prevalent while the archetypes above change. Each archetype is described and described in detail in the study.

20% Of Hedge Funds Launched In 2018 Are Crypto Funds

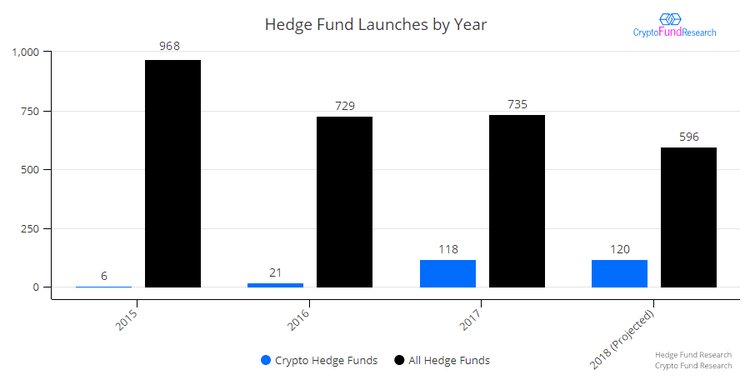

According to a study by Crypto Fund Research, 90 cryptocurrency hedge funds were launched in the first three quarters of this year. Analysts suggest that this year we can see a total of 120 hedge funds associated with crypto. This represents about 20% of the projected 600 major hedge funds in 2018. It is worth noting that this data indicates a positive trend. Last year, only 16% of funds started were associated with cryptocurrencies.

Despite the increase in the number of crypto hedge funds, so far they still occupy a small niche in the overall industry. Now there are only 303 crypto funds, that is only 3% of more than 9,000 hedge funds that exist all over the world. At the same time, they control assets worth just about $4 billion, whereas traditional hedge funds manage over $3 trillion. It should be borne in mind that crypto hedge funds began to appear quite recently and simply could not take a more significant market share so quickly.

The Not-So-Killer Whales of Bitcoin

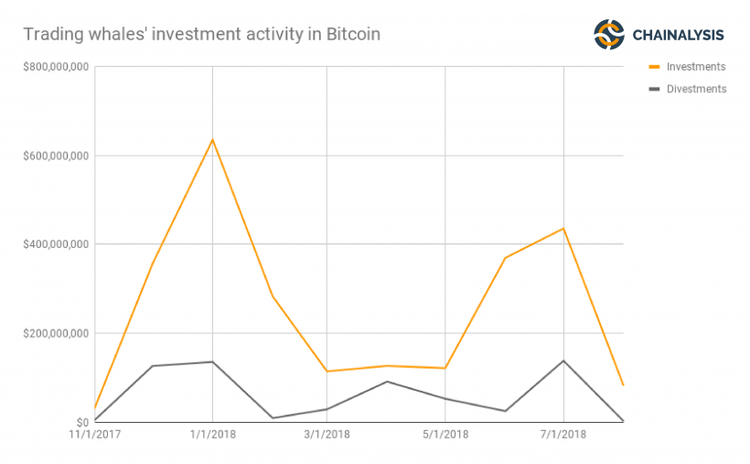

Analysts from the blockchain-startup Chainalysis presented their research on the crypto market. They studied the 32 largest bitcoin wallet worth $ 6.3 billion and concluded that bitcoin whales are not the cause of volatility in the crypto market. Chainalysis divided the owners of these wallets into four categories: traders, miners and early hodlers, lost, criminals.

Analysts explained that during 2017-2018, bitcoin whales from the “traders” group preferred to buy cryptocurrency when the price fell, and not vice versa. At the same time, experts believe that they have not such a strong influence on the rate of crypto, as some representatives of the market believe. In their opinion, trading whales were rather a stabilizing than a destabilizing factor in the market. By the way, Diar recently conducted another study that showed that more than 55% of all bitcoins are on wallets with a balance of over 200 BTC. This means that whales store more than half of all bitcoins.

ISSA's Reports On Infrastructure For Crypto-Assets

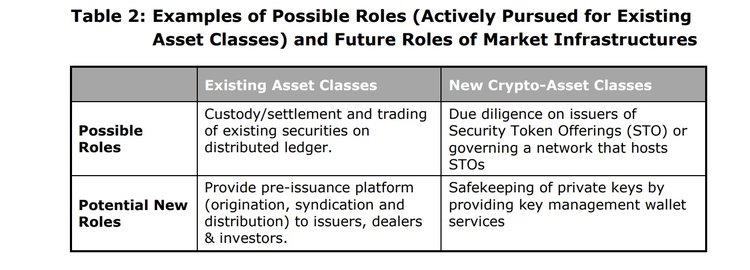

The Working Group on DLT, under the auspices of the International Securities Services Association (ISSA), released a report stating that in the future, the cryptocurrency market services will become an integral part of the infrastructure of central securities depositories (CSDs) and stock exchanges. Researchers believe that tokens and cryptocurrencies are gradually becoming the basis of a new class of assets.

Analysts also see potential in the blockchain. According to the report, the list of services provided by CSDs based on the distributed ledger technology will only grow. Central securities depositories can support financial organizations in the transition period, using the experience of applying subject and technical standards, as well as messaging. Thus, CSDs can ensure compatibility with existing business, which will make the securities market more efficient.

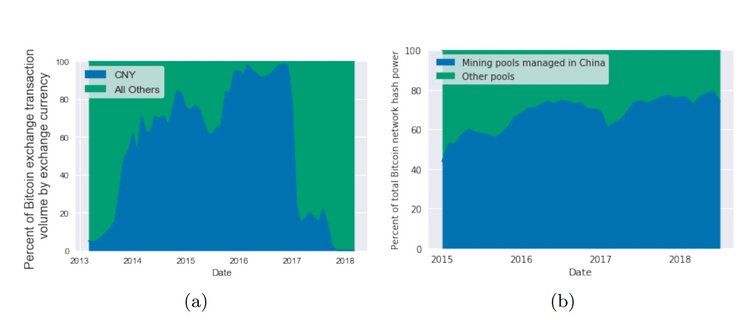

The Looming Threat of China: An Analysis of Chinese Influence on Bitcoin

A group of scientists from Princeton University and Florida International University has published a study that states that the Chinese government currently has sufficient tools and resources to significantly change or even destroy bitcoin. The researchers explain that the government has the opportunity to significantly affect the cryptocurrency due to the high concentration of miners and computing power in China.

Bitcoin mining has become extremely centralized due to the development of specialized devices. As a result, miners began to merge into large pools – consortia working together and distributing profits. As of June 2018, more than 80% of mining capacity is in six pools, five of which are managed by individuals or organizations located in China. In this case, the fear is that such a concentration of resources occurs in a country with an opaque policy. The government of the People’s Republic of China has powerful tools that can make people obey state dictates, analysts explain.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.