Bitpay cryptocurrency payment platform has added an option of converting digital assets into Gemini Dollar (GUSD) and Circle USD Coin (USDC) stablecoins. This will reduce the risks associated with the high level of volatility of Bitcoin (BTC) and Bitcoin cash (BCH) rates.

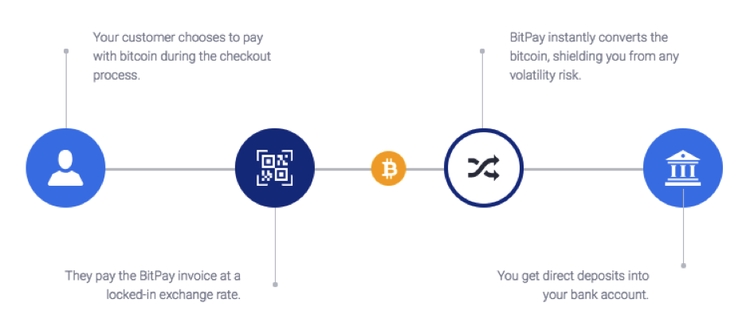

The BitPay platform automatically converts digital Bitcoin and Bitcoin Cash assets into fiat currency from 38 countries of the world, then this money can be transferred to a bank account. Thus, for firms that accept payments for goods or services in cryptocurrencies, the risk of profit loss due to the volatility of the BTC and BCH rate is excluded.

However, the option of automatic conversion is not available for all fiat currencies, as such, many companies from South America and Asia will be counting losses in the event of a sharp fall in the value of digital assets. This problem was solved with the help of a Gemini Dollar and Circle USD Coin.

From October 15, companies are able to exchange Bitcoin or Bitcoin Cash to GUSD or USDC. The rate of both stablecoins is pegged to the U.S. dollar, so the risk of volatility is associated only with a change in the national fiat currency rate against the dollar.

“BitPay was founded to make payments faster, more secure, and less expensive using Bitcoin for organizations around the world,” said Stephen Pair, co-founder, and CEO of BitPay. “The introduction of the USDC and GUSD stablecoin offers BitPay customers a new alternative to holding Bitcoin and Bitcoin Cash by offering a stablecoin option.”

Both GUSD and USDC were issued about a month ago, and now they are preferred over another stable virtual currency - Tether (USDT). This happened primarily due to the doubts regarding the reliability of the token-creator company USDT - Tether. There were rumors that the top cryptocurrency exchanges (including Binance) would soon delist the USDT coins and use alternative stablecoins instead. The basis for such statements was the anomalous trading activity on October 15: as a result of the massive sale of tokens, Tether rate dropped to $0.87 on some platforms. The fluctuations also caused Bitcoin price to skyrocket at the exchanges that were supporting BTC-USDT pairs.

In 2018, six U.S. Dollar-backed cryptocurrencies were released or announced:

- in January the crypto community saw TrueUSD - the only regulated, and exchange-independent stablecoin (the platform is planning to add TrueEuro, TrueYen, and stable baskets of tokenized goods, including precious metals and real estate) in the future,

- Gemini Dollar (Stablecoin was launched with the permission of the New York State Department of Financial Services (NYDFS)) and Circle USD Coin (the reserve of the dollars backing Circle’s stablecoin, are stored at Goldman Sachs. Coin is also launched on an open sourced framework, meaning other companies can issue it).

- Stronghold USD from IBM, Paxos Standard, and MKR from MakerDAO.

- Binance cryptocurrency exchange together with OKEx, Huobi Capital and Dunamu & Partners launched a project called Terra, aimed at developing the same-named stablecoin.

On the eve of the BitPay announcement cryptocurrency exchange OKEx has also added a support for four stablecoins: TrueUSD (TUSD), Gemini Dollar (GUSD), USD Coin (USDC) and Paxos Standard Token (PAX).

Founded in 2011, BitPay is the largest Bitcoin payment processor. Last year, the company announced that it is moving towards a volume of $1 billion. In addition to being a payment provider, the company also has such products as BitPay Wallet and BitPay Prepaid Visa® Card. BitPay was, as well, the first blockchain payment processor that received a virtual currency license from the New York Department of Financial Services.

All stable digital assets have two main purposes: to simplify the cryptocurrency trading process and to reduce business risks. However, not every coin succeeds in accomplishing these tasks, practice shows that not all stablecoins are equally reliable and stable.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.