On October 11, YoBit held a previously announced “pump of a randomly selected cryptocurrency”, which turned out to be PutinCoin token. Platform’s controversial marketing strategy to win over investors was realized despite the opinion of many crypto community participants that this is just a bad joke, and critical remarks on social networks.

The story began when the Russian cryptocurrency exchange Yobit announced on October 9 the upcoming "Yobit Pump", scheduled for October 11, 9:00 AM (EDT). Back then the cryptocurrency exchange published on Twitter a counter for the future “pump” they were going to conduct.

YoBit Pump in 22 hrs: https://t.co/RIbW7OhKzM

— Yobit.Net (@YobitExchange) October 10, 2018

We will buy one random coin for 1 btc every 1-2 mins 10 times (total buy amount - 10 btc).

The pump and dump scheme, as the name implies, is characterized by inflating the price of a certain cryptocurrency building to its subsequent sale at inflated prices. As a rule, such schemes are organized to siphon money out of those who want to “get rid of it quickly,” since the organizers enter the transaction first, raise the price of cryptocurrency by creating excitement and investment from other users, and then sell the currency first, gaining profit and bringing down the exchange rate. Such schemes are recognized as fraudulent since the organizers profit from gullible users, in essence, “pumping” their funds for themselves.

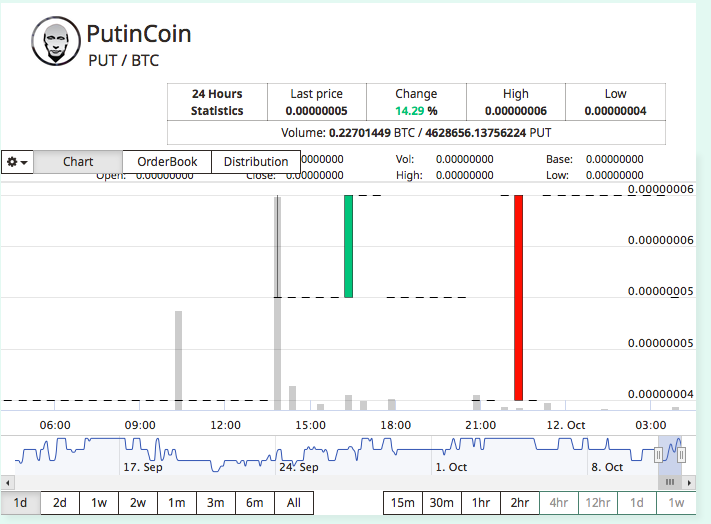

After choosing PutinCoin (PUT) at random, YoBit bought 1 BTC worth of tokens every minute for ten consecutive minutes.

That resulted in the expectable price raise of PUT by 1,400%. By the way, the President of the Russian Federation has no relation to cryptocurrency.

The token’s value increased from 118 satoshi to 1,768 satoshi with a speed that has not been observed on the crypto market since 2017. The trading volume in pair with bitcoin became 130 BTC in just 40 minutes.

As it usually happens after a big pump there has to be a dump. As soon as YoBit stopped buying PUT, the price plummeted.

Currently, according to the CoinMarketCup, PutinCoin is trading at $0.000299 USD, going red by -8.17%.

The pump and dump scheme has also resulted in a rise of the exchanges 24h trading volume. Thus, YoBit managed to get a trading volume of $28 million.

However, despite the damnation from the cryptocurrency community, the exchange didn’t stop at one pump&dump and has already announced a new one.

Next YoBit Pump in 69 hrs! Timer: https://t.co/RIbW7OhKzM

— Yobit.Net (@YobitExchange) October 12, 2018

This is not the first time the exchange has been in the spotlight because of the pump&dump scheme. In November last year, a study of telegram groups identified YoBit as a favorite place for traders to inflate prices for subsequent sales of cryptocurrency, but this time the exchange itself initiated such a scheme.

Recently, The U.S. Securities and Exchange Commission (SEC) announced that it has filed a subpoena enforcing action against St. James Holding and Trust Investment Company and its trustee, Jeffrey James. It is explained that the regulator has initiated an investigation against a potential pump-and-dump scheme “in the stock of Cherubim Interests, Inc., among other penny-stock companies”.