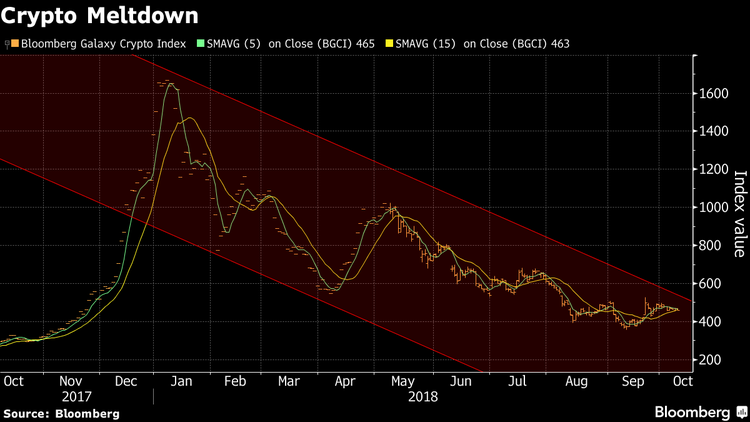

The price of Bitcoin continues its fall. On Wednesday, October 10, Bitcoin (Bitcoin) dropped below the $6,600 mark. At 10:00 (GMT+1), the first cryptocurrency is trading at $6,555 (-1.21%).

Bitcoin has been trading at $6,400- $6,600 marks for the last two weeks. Analysts point out that at these levels bears face support, and bulls — resistance.

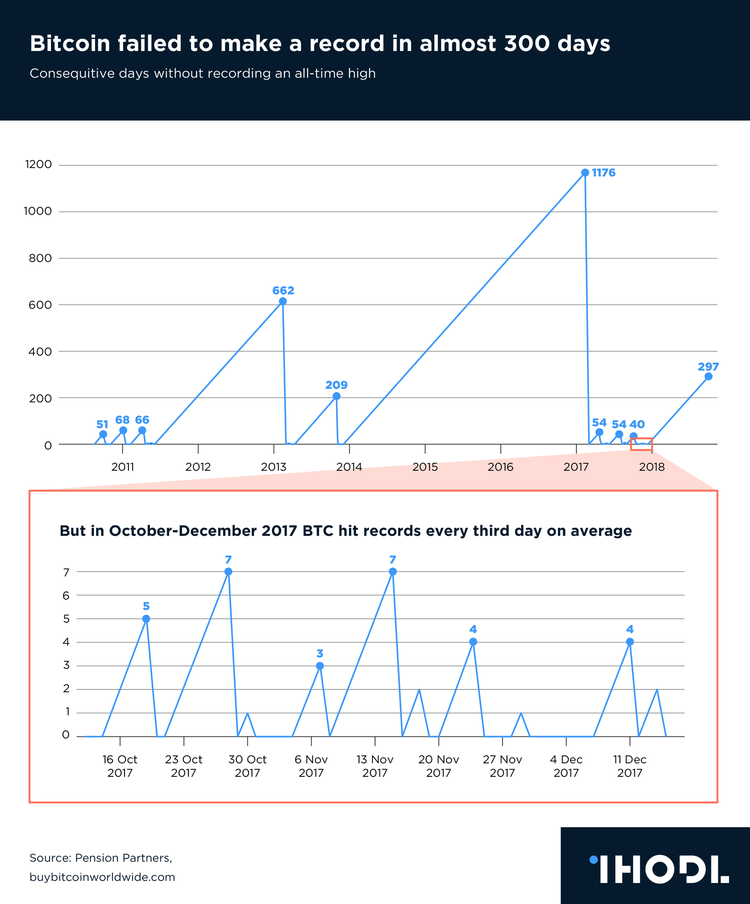

The first cryptocurrency has failed to reach a new record in nearly 300 days. However, this is not the longest time without beating a historic maximum. The situation was far worse between 2013 and 2017, when the stagnation lasted for 1176 days. Interestingly enough, it’s the past three months of the previous year, October to December, that were the luckiest. Back then, bitcoin topped the record every other day.

Blockchain Capital's venture capitalist crypto expert Spencer Bogart believes that we are facing the other side of the coin now. No bad news affects the market, but the same goes for the good one. Bogart believes that this is a sign that more institutional investors are coming to the market. According to the expert, bitcoin is close to signaling the reach of a reliable minimum.

"We are down from about 70% to our highs. I think that bitcoin is close to bottoming, and so is the rest of the crypto market," Bogart said in a conversation with CNBC, adding that the positive news that accompanies the development of cryptocurrency industries “is a piece of a kindle we are going to throw to the future bonfire when we will have the next bull market".

The next month is vital for the market as it awaits the decision on a Bitcoin-ETF and the launch of a “regulated ecosystem” for institutional investors from Bakkt. According to some experts, in such conditions, the cryptocurrency market is able to spend the whole of October without pronounced movements.

Reverberating suppositions of a market financial experts, Juniper research cautions that a significant number of measurements in the crypto world indicates market implosion.

Industry bellwether bitcoin had seen its 24h exchange volumes tumble from a normal of around 360,000 per day in late 2017 to only 230,000 in September 2018. In the interim, day by day exchange esteems were down from more than $3.7 billion to under $670 million in a similar period, Juniper reminded in their research dubbed “The Future of Cryptocurrency: Bitcoin & Altcoin Trends & Challenges 2018-2023”.

"Based on activity during the first half of Q3, Juniper estimates a further 47 percent quarter-on-quarter drop in transaction values in that quarter," — the paper says.

The market neglected to rally even in the midst of stressed China-U.S. trade relations and Brexit-related inconveniences, the analysts noted — prime conditions for demonstrating crypto leeway as an option in contrast to the customary budgetary framework.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.