The Israel Securities Authority (ISA) has integrated distributed ledger technology (DLT) into its internal systems. Representatives of the ISA noted that the blockchain allows more reliable transfer of information because it provides authenticity confirmation and prevents data falsification and removal.

The integration process took place in two stages. The first one involved Yael system, which provides communication with accountable structures. The next one should implement Etsba-on voting system, which allows investors to participate in meetings remotely. This stage has not yet been completed. The agency also plans to implement blockchain into its control system.

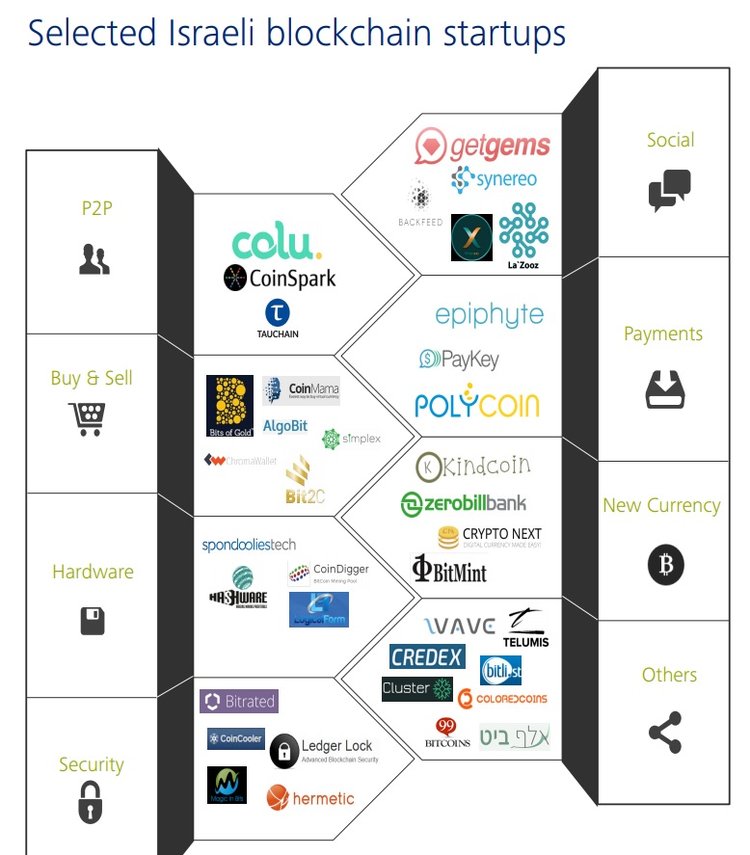

Earlier consulting firm Deloitte published a new report on the development of DLT in Israel. The state of affairs in the industry allowed the authors of the document to designate the country as a full-fledged center of blockchain technologies.

By the way, Deloitte's partner is one of the most famous blockchain startups in Israel, Colu. One of its projects is a single software platform based on blockchain called Rubix. It is designed to help traditional financial institutions launch pilot projects using distributed register technology. The company also developed a blockchain-based engine that is used as an API for many scenarios when creating digital assets. Such assets can be tickets, money, car registration, property documents, and even music.

There is another project in Israel called CoaIiChain. This is an interactive political platform that promotes the idea of transparent elections when all stages of voting will be saved in the blockchain. The platform provides an opportunity for open dialogue and communication between politicians and citizens, conveys sentiments and pressing problems that concern the society, enables the authorities to respond in real time to voter requests. The system uses smart contracts to monitor the fulfillment of policy commitments in terms of budgeting or political promises.

It should be noted that at the same time, the Israeli regulatory environment can hardly be called blockchain-friendly. On June 1 the law on combating money laundering using cryptocurrency came into force in the country, equating the latter to financial assets. A few months earlier, ISA announced the exclusion of cryptocurrency shares from the Tel Aviv Stock Exchange listing.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.